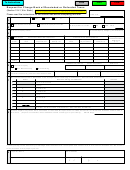

To Form

INSTRUCTIONS

COMPLETE ONE FORM FOR EACH INQUIRY AND YEAR. The amount of the rescinded/refunded tax must have

been $500 or more OR your tax district must have accumulated a total of at least $5,000 of rescinded/refunded taxes

which were levied for the same year. Your request must be filed by October 1. The Department of Revenue (DOR) will

evaluate your request. DOR will notify you and each taxing jurisdiction you have listed on the form of our determination

by November 15.

Section 1 – Enter assessment year, check Town, Village, or City, enter the name of your tax district, county name, and

your 5-digit county/municipal code.

Section 2 – Check either real estate (RE) or personal property (PP) to indicate type of property the request is for. Only

one type, RE or PP, may be filed on a single form. Enter the parcel number or personal property account

number. Check the appropriate box to indicate if this parcel or personal property account is within the legal

boundaries of a Tax Increment Finance District (TID). If yes, enter TID number.

Section 3 – Enter the name of the property owner. Enter the personal property category from the PP codes below if

your inquiry involves personal property.

Section 4 – If the request is for a real estate adjustment, check the real estate box. Enter the RE class(es) from the

table below (one class per line). Enter assessment values on the line for the applicable class of property

for which taxes were refunded or rescinded.

RE Classes:

PP Codes:

1 – Residential

1 – Boats and other Watercraft

2 – Commercial

2 – Machinery Tools and Patterns

3 – Manufacturing

3 – Furniture Fixtures and Equipment

4 – Agricultural

4 – All other Personal Property not Exempt

5 – Undeveloped

4B – Improvements on Leased lands

5m – Agricultural Forest

4C – Manufactured/Mobile Homes, and assessed value

information as required

6 – Productive Forest

7 – Other

Section 5 – If the request is for personal property, check the personal property box and enter the total assessment

value for that account before adjustment, after adjustment, and the total adjustment difference and check

non-manufacturing or manufacturing, as applicable.

Section 6 – Enter TOTAL amount of manufacturing interest refunded to property owner in box a, 80% in b, and 20% in c.

Only 80% of the total amount may be charged back, if approved by DOR. Write the Department of Adminis-

tration at: Manufacturing Tax Refund Program, Department of Administration, Division of Intergovernmental

Relations, PO Box 8944, Madison, WI 53708, by July 1, per sec. 70.511(2)(b), Wis. Stats., to request a

refund of the remaining 20%. Copy DEBF Tax, Department of Administration, PO Box 7864, Madison, WI

53707. Also include a copy of the letter with your charge back request form to DOR.

Section 7 – Enter the proper code and name of each taxing jurisdiction (for Technical College, enter 2-digit code). Enter

the total net tax rescinded or refunded. This is the difference between the incorrect Net Property Tax amount

and the corrected Net Property Tax amount from the property tax bill. DOR will calculate each taxing juris-

diction's share of the rescinded or refunded tax. DO NOT INCLUDE ANY INTEREST PAID BY YOUR TAX

DISTRICT TO THE PROPERTY OWNER.

Section 8 – Explain why these taxes were rescinded or refunded. BE SURE TO ENTER THE STATUTE UNDER WHICH

THESE TAXES WERE RESCINDED OR REFUNDED.

Section 9 – Enter your name, e-mail address, and daytime telephone number, sign and date the form once completed.

Send your request to:

WISCONSIN DEPARTMENT OF REVENUE

LOCAL GOVERNMENT SERVICES SECTION 6-97

PO BOX 8971

MADISON WI 53708-8971

LGS FAX:

608-264-6887

Assistance: 608-264-6892

NOTE: A copy of the original tax bill must be attached to each inquiry.

1

1 2

2