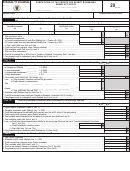

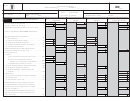

Schedule X1 Incentives - Computation Of Tax Credits For Exempt Businesses Under Act 73-2008 Page 2

ADVERTISEMENT

Schedule X1 Incentives – Page 2

Rev. 06.12

Credit to Reduce the Cost of Electric Power

Part V

Did you include with the return the certification from the Electric Power Authority?

Yes

No

00

1.

Payments made to the AEE for net electric power consumption (See instructions) ............................................................................

(1)

Allowable credit:

2.

00

a) Basis credit (Multiply line 1 x 3%) ………..............................................................................................................................

(2a)

00

b) Did you keep an average of 25 employees or more during the taxable year?

Yes

No (If you checked “Yes”, multiply line 1 x 3.5%) ..........

(2b)

00

c) Did you keep an average payroll of $500,000 or more during the taxable year?

Yes

No (If you checked “Yes”, multiply line 1 x 3.5%) ............

(2c)

00

Allowable credit to reduce the cost of electric power for the current year (Add lines 2(a) through 2(c)) ..................................................

3.

(3)

00

Credit carried from previous years (Submit schedule) ..................................................................................................................

4.

(4)

00

Total available credit (Add lines 3 and 4) ….................................................................................................................................

5.

(5)

00

Credit to be claimed (Transfer to the corresponding schedule of the return, as applicable) ...................................................................

6.

(6)

00

Carryforward credit to subsequent years (Subtract line 6 from line 5. See instructions) ......................................................................

7.

(7)

Credit for the Transfer of Intellectual Property

Part VI

00

1.

Total royalty payments ………........................................................................….......................................................................

(1)

Allowable royalty credit:

2.

00

a) Exempt businesses subject to fixed rate (Multiply line 1 x 12%) .................................................

(2a)

00

b) Exempt businesses subject to alternate imposition (Multiply line 1 x 2%) .....................................

(2b)

00

Credit carried from previous years (Submit schedule) ...................................................................

3.

(3)

Total available credit (Add line 2(a) or 2(b), as applicable, and line 3) ..............................................................................................

4.

00

(4)

Credit to be claimed (Transfer to Schedule X Incentives, Part V, line 5(f)) …………….......................................................................

5.

00

(5)

Carryforward credit to subsequent years (Subtract line 5 from line 4) .............................................................................................

6.

00

(6)

Credit for Investment in Strategic Projects

Part VII

1.

00

Total credit as per Administrative Determination ............................................................................................................................

(1)

00

2.

Credit carried from previous years (Submit schedule) ..................................................................................................................

(2)

3.

Total available credit (Add lines 1 and 2) ………...........................................................................................................................

00

(3)

4.

00

Total tax (See instructions) .......................................................................................................................................................

(4)

5.

Credit to be claimed in the current year:

00

a) Against the tax liability (Up to 50% of line 4. Transfer to the corresponding schedule of the return, as applicable) .....

(5a)

00

b) Against AEE and AAA expenses (Submit detail) .......................................................................

(5b)

00

c) Credit transferred to another person ……..................................................................................

(5c)

d) Total credit claimed in the current year (Add lines 5(a) through 5(c)) ............................................................................................

(5d)

00

6.

(6)

Carryforward credit to subsequent years (Subtract line 5(d) from line 3) .........................................................................................

00

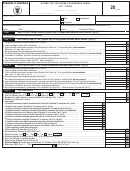

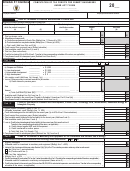

Industrial Investment Credit

Part

VIIII

1.

Total credit as per Administrative Determination .............................................................................................................................

00

(1)

2.

00

Credit attributed against the tax liability for the current year as per Administrative Determination ............................................................

(2)

3.

00

Credit carried from previous years (Submit schedule) ....................................................………..................................................…

(3)

4.

00

Total available credit attributed against the tax liability for the current year (Add lines 2 and 3) ...............................................................

(4)

5.

00

Total available credit (Add lines 1 and 3) .………………………………………................................................................………………

(5)

6.

Less:

a) Credit to be claimed against the tax liability for the current year (Not more than line 4.

00

Transfer to the corresponding schedule of the return, as applicable) …......................……….………

(6a)

00

b) Credit transferred to another person ………..…………….............................................................

(6b)

00

c) Total (Add lines 6(a) and 6(b)) ................................................................................................................................................

(6c)

7.

00

Carryforward credit to subsequent years (Subtract line 6(c) from line 5) …...…..................................................................................

(7)

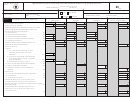

Part

IXI

Detail of Expenses that Qualify as Special Eligible Investment

Complete this part to detail the expenses of line 1, Part III of this Schedule.

Column B

Column A

Column C

Expenses incurred after

the close of the taxable

Expenses incurred during

year and until the filing date

Total

the taxable year for which

of this return, including

this return is filed.

extension of time.

00

1.

Salaries, commissions and bonuses to employees ........................................

00

00

(1)

00

2.

00

00

Payroll expenses ………………………………………...…………….........….…

(2)

3.

00

00

00

Professional services ……………………………………………………............…

(3)

4.

00

00

00

Insurance ………………………………………………………………….........…..

(4)

5.

00

00

00

Property taxes .…………………………………….........................................

(5)

6.

00

00

00

Other taxes, patents and licenses ………………………………………..........…

(6)

00

7.

Rent ......................................................................................................

00

00

(7)

8.

00

00

00

Repairs and maintenance ………………………………………………........….…

(8)

9.

00

00

00

Utilities …………………………………………………………………….......….…

(9)

10.

00

00

00

Materials and supplies ……………………………………….............................

(10)

11.

00

00

00

Other expenses (Submit detail) …………………………………………...........…

(11)

12.

00

00

00

Total (Transfer to line 1, Part III of this schedule) …………………...........….…

(12)

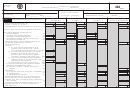

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2