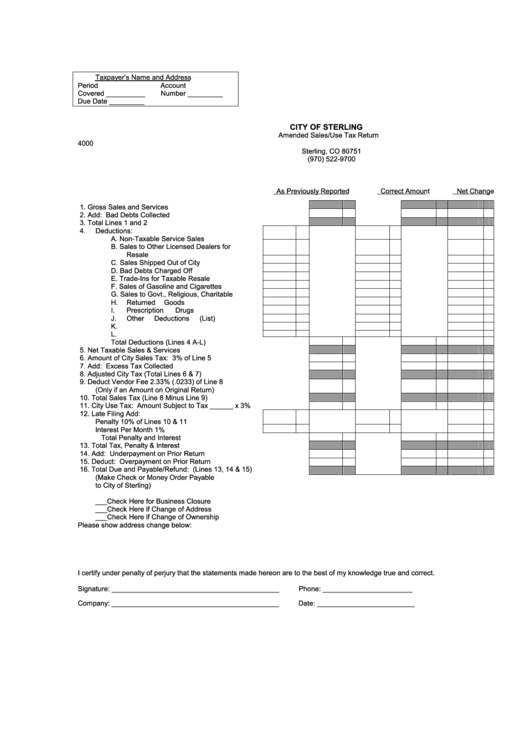

Amended Sales/use Tax Return - City Of Sterling

ADVERTISEMENT

Taxpayer’s Name and Address

Period

Account

Covered __________

Number _________

Due Date _________

CITY OF STERLING

Amended Sales/Use Tax Return

P.O. Box 4000

Sterling, CO 80751

(970) 522-9700

As Previously Reported

Correct Amount

Net Change

1.

Gross Sales and Services

2.

Add: Bad Debts Collected

3.

Total Lines 1 and 2

4.

Deductions:

A.

Non-Taxable Service Sales

B.

Sales to Other Licensed Dealers for

Resale

C.

Sales Shipped Out of City

D.

Bad Debts Charged Off

E.

Trade-Ins for Taxable Resale

F.

Sales of Gasoline and Cigarettes

G.

Sales to Govt., Religious, Charitable

H.

Returned Goods

I.

Prescription Drugs

J.

Other Deductions (List)

K.

L.

Total Deductions (Lines 4 A-L)

5.

Net Taxable Sales & Services

6.

Amount of City Sales Tax: 3% of Line 5

7.

Add: Excess Tax Collected

8.

Adjusted City Tax (Total Lines 6 & 7)

9.

Deduct Vendor Fee 2.33% (.0233) of Line 8

(Only if an Amount on Original Return)

10. Total Sales Tax (Line 8 Minus Line 9)

11. City Use Tax: Amount Subject to Tax ______ x 3%

12. Late Filing Add:

Penalty 10% of Lines 10 & 11

Interest Per Month 1%

Total Penalty and Interest

13. Total Tax, Penalty & Interest

14. Add: Underpayment on Prior Return

15. Deduct: Overpayment on Prior Return

16. Total Due and Payable/Refund: (Lines 13, 14 & 15)

(Make Check or Money Order Payable

to City of Sterling)

___Check Here for Business Closure

___Check Here if Change of Address

___Check Here if Change of Ownership

Please show address change below:

I certify under penalty of perjury that the statements made hereon are to the best of my knowledge true and correct.

Signature: ___________________________________________

Phone: _______________________

Company: ___________________________________________

Date: _________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1