Business Tax Return Instructions

ADVERTISEMENT

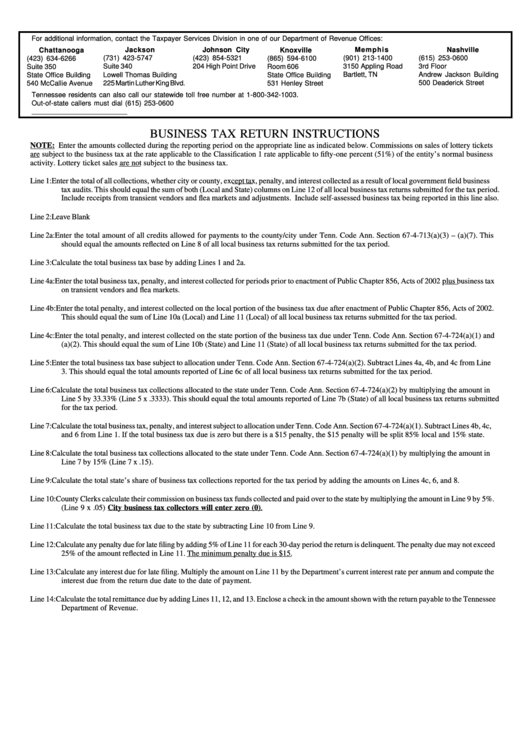

For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Memphis

Chattanooga

Jackson

Johnson City

Knoxville

Nashville

(901) 213-1400

(615) 253-0600

(423) 634-6266

(731) 423-5747

(423) 854-5321

(865) 594-6100

Suite 340

204 High Point Drive

3150 Appling Road

3rd Floor

Suite 350

Room 606

Lowell Thomas Building

State Office Building

Bartlett, TN

Andrew Jackson Building

State Office Building

225 Martin Luther King Blvd.

531 Henley Street

500 Deaderick Street

540 McCallie Avenue

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600

BUSINESS TAX RETURN INSTRUCTIONS

NOTE: Enter the amounts collected during the reporting period on the appropriate line as indicated below. Commissions on sales of lottery tickets

are subject to the business tax at the rate applicable to the Classification 1 rate applicable to fifty-one percent (51%) of the entity’s normal business

activity. Lottery ticket sales are not subject to the business tax.

Line 1:

Enter the total of all collections, whether city or county, except tax, penalty, and interest collected as a result of local government field business

tax audits. This should equal the sum of both (Local and State) columns on Line 12 of all local business tax returns submitted for the tax period.

Include receipts from transient vendors and flea markets and adjustments. Include self-assessed business tax being reported in this line also.

Line 2:

Leave Blank

Line 2a: Enter the total amount of all credits allowed for payments to the county/city under Tenn. Code Ann. Section 67-4-713(a)(3) – (a)(7). This

should equal the amounts reflected on Line 8 of all local business tax returns submitted for the tax period.

Line 3:

Calculate the total business tax base by adding Lines 1 and 2a.

Line 4a: Enter the total business tax, penalty, and interest collected for periods prior to enactment of Public Chapter 856, Acts of 2002 plus business tax

on transient vendors and flea markets.

Line 4b: Enter the total penalty, and interest collected on the local portion of the business tax due after enactment of Public Chapter 856, Acts of 2002.

This should equal the sum of Line 10a (Local) and Line 11 (Local) of all local business tax returns submitted for the tax period.

Line 4c: Enter the total penalty, and interest collected on the state portion of the business tax due under Tenn. Code Ann. Section 67-4-724(a)(1) and

(a)(2). This should equal the sum of Line 10b (State) and Line 11 (State) of all local business tax returns submitted for the tax period.

Line 5:

Enter the total business tax base subject to allocation under Tenn. Code Ann. Section 67-4-724(a)(2). Subtract Lines 4a, 4b, and 4c from Line

3. This should equal the total amounts reported of Line 6c of all local business tax returns submitted for the tax period.

Line 6:

Calculate the total business tax collections allocated to the state under Tenn. Code Ann. Section 67-4-724(a)(2) by multiplying the amount in

Line 5 by 33.33% (Line 5 x .3333). This should equal the total amounts reported of Line 7b (State) of all local business tax returns submitted

for the tax period.

Line 7:

Calculate the total business tax, penalty, and interest subject to allocation under Tenn. Code Ann. Section 67-4-724(a)(1). Subtract Lines 4b, 4c,

and 6 from Line 1. If the total business tax due is zero but there is a $15 penalty, the $15 penalty will be split 85% local and 15% state.

Line 8:

Calculate the total business tax collections allocated to the state under Tenn. Code Ann. Section 67-4-724(a)(1) by multiplying the amount in

Line 7 by 15% (Line 7 x .15).

Line 9:

Calculate the total state’s share of business tax collections reported for the tax period by adding the amounts on Lines 4c, 6, and 8.

Line 10: County Clerks calculate their commission on business tax funds collected and paid over to the state by multiplying the amount in Line 9 by 5%.

(Line 9 x .05) City business tax collectors will enter zero (0).

Line 11: Calculate the total business tax due to the state by subtracting Line 10 from Line 9.

Line 12: Calculate any penalty due for late filing by adding 5% of Line 11 for each 30-day period the return is delinquent. The penalty due may not exceed

25% of the amount reflected in Line 11. The minimum penalty due is $15.

Line 13: Calculate any interest due for late filing. Multiply the amount on Line 11 by the Department’s current interest rate per annum and compute the

interest due from the return due date to the date of payment.

Line 14: Calculate the total remittance due by adding Lines 11, 12, and 13. Enclose a check in the amount shown with the return payable to the Tennessee

Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1