Business Tax Return - Instructions

ADVERTISEMENT

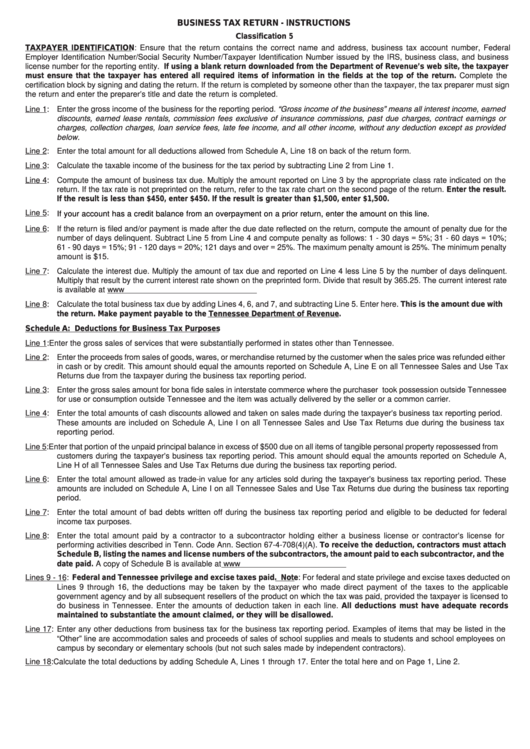

BUSINESS TAX RETURN - INSTRUCTIONS

Classification 5

TAXPAYER IDENTIFICATION: Ensure that the return contains the correct name and address, business tax account number, Federal

Employer Identification Number/Social Security Number/Taxpayer Identification Number issued by the IRS, business class, and business

license number for the reporting entity. If using a blank return downloaded from the Department of Revenue’s web site, the taxpayer

must ensure that the taxpayer has entered all required items of information in the fields at the top of the return. Complete the

certification block by signing and dating the return. If the return is completed by someone other than the taxpayer, the tax preparer must sign

the return and enter the preparer’s title and date the return is completed.

Line 1:

Enter the gross income of the business for the reporting period. “Gross income of the business” means all interest income, earned

discounts, earned lease rentals, commission fees exclusive of insurance commissions, past due charges, contract earnings or

charges, collection charges, loan service fees, late fee income, and all other income, without any deduction except as provided

below.

Line 2:

Enter the total amount for all deductions allowed from Schedule A, Line 18 on back of the return form.

Line 3:

Calculate the taxable income of the business for the tax period by subtracting Line 2 from Line 1.

Line 4:

Compute the amount of business tax due. Multiply the amount reported on Line 3 by the appropriate class rate indicated on the

return. If the tax rate is not preprinted on the return, refer to the tax rate chart on the second page of the return. Enter the result.

If the result is less than $450, enter $450. If the result is greater than $1,500, enter $1,500.

Line 5:

If your account has a credit balance from an overpayment on a prior return, enter the amount on this line.

Line 6:

If the return is filed and/or payment is made after the due date reflected on the return, compute the amount of penalty due for the

number of days delinquent. Subtract Line 5 from Line 4 and compute penalty as follows: 1 - 30 days = 5%; 31 - 60 days = 10%;

61 - 90 days = 15%; 91 - 120 days = 20%; 121 days and over = 25%. The maximum penalty amount is 25%. The minimum penalty

amount is $15.

Line 7:

Calculate the interest due. Multiply the amount of tax due and reported on Line 4 less Line 5 by the number of days delinquent.

Multiply that result by the current interest rate shown on the preprinted form. Divide that result by 365.25. The current interest rate

is available at

Line 8:

Calculate the total business tax due by adding Lines 4, 6, and 7, and subtracting Line 5. Enter here. This is the amount due with

the return. Make payment payable to the Tennessee Department of Revenue.

Schedule A: Deductions for Business Tax Purposes

Line 1:

Enter the gross sales of services that were substantially performed in states other than Tennessee.

Line 2:

Enter the proceeds from sales of goods, wares, or merchandise returned by the customer when the sales price was refunded either

in cash or by credit. This amount should equal the amounts reported on Schedule A, Line E on all Tennessee Sales and Use Tax

Returns due from the taxpayer during the business tax reporting period.

Line 3:

Enter the gross sales amount for bona fide sales in interstate commerce where the purchaser took possession outside Tennessee

for use or consumption outside Tennessee and the item was actually delivered by the seller or a common carrier.

Line 4:

Enter the total amounts of cash discounts allowed and taken on sales made during the taxpayer’s business tax reporting period.

These amounts are included on Schedule A, Line I on all Tennessee Sales and Use Tax Returns due during the business tax

reporting period.

Line 5:

Enter that portion of the unpaid principal balance in excess of $500 due on all items of tangible personal property repossessed from

customers during the taxpayer’s business tax reporting period. This amount should equal the amounts reported on Schedule A,

Line H of all Tennessee Sales and Use Tax Returns due during the business tax reporting period.

Line 6:

Enter the total amount allowed as trade-in value for any articles sold during the taxpayer’s business tax reporting period. These

amounts are included on Schedule A, Line I on all Tennessee Sales and Use Tax Returns due during the business tax reporting

period.

Line 7:

Enter the total amount of bad debts written off during the business tax reporting period and eligible to be deducted for federal

income tax purposes.

Line 8:

Enter the total amount paid by a contractor to a subcontractor holding either a business license or contractor’s license for

performing activities described in Tenn. Code Ann. Section 67-4-708(4)(A). To receive the deduction, contractors must attach

Schedule B, listing the names and license numbers of the subcontractors, the amount paid to each subcontractor, and the

date paid. A copy of Schedule B is available at

Lines 9 - 16:

Federal and Tennessee privilege and excise taxes paid. Note: For federal and state privilege and excise taxes deducted on

Lines 9 through 16, the deductions may be taken by the taxpayer who made direct payment of the taxes to the applicable

government agency and by all subsequent resellers of the product on which the tax was paid, provided the taxpayer is licensed to

do business in Tennessee. Enter the amounts of deduction taken in each line. All deductions must have adequate records

maintained to substantiate the amount claimed, or they will be disallowed.

Line 17:

Enter any other deductions from business tax for the business tax reporting period. Examples of items that may be listed in the

“Other” line are accommodation sales and proceeds of sales of school supplies and meals to students and school employees on

campus by secondary or elementary schools (but not such sales made by independent contractors).

Line 18: Calculate the total deductions by adding Schedule A, Lines 1 through 17. Enter the total here and on Page 1, Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1