Business Tax Return - Instructions - Classifications 1, 2, And 3

ADVERTISEMENT

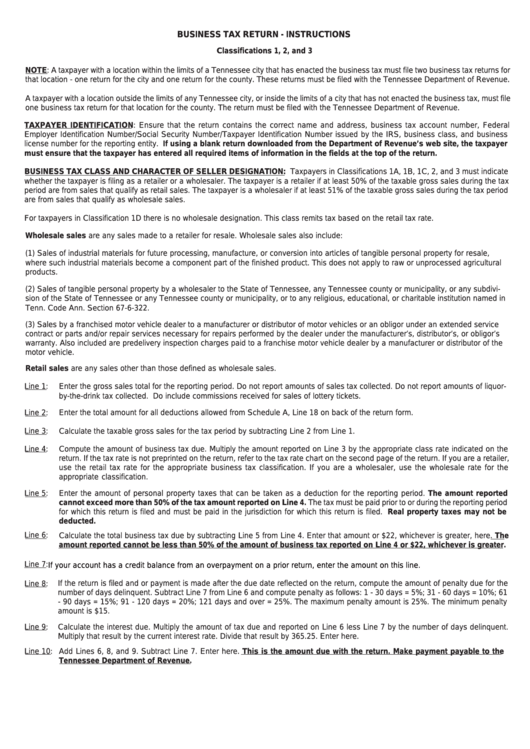

BUSINESS TAX RETURN - INSTRUCTIONS

Classifications 1, 2, and 3

NOTE: A taxpayer with a location within the limits of a Tennessee city that has enacted the business tax must file two business tax returns for

that location - one return for the city and one return for the county. These returns must be filed with the Tennessee Department of Revenue.

A taxpayer with a location outside the limits of any Tennessee city, or inside the limits of a city that has not enacted the business tax, must file

one business tax return for that location for the county. The return must be filed with the Tennessee Department of Revenue.

TAXPAYER IDENTIFICATION: Ensure that the return contains the correct name and address, business tax account number, Federal

Employer Identification Number/Social Security Number/Taxpayer Identification Number issued by the IRS, business class, and business

license number for the reporting entity. If using a blank return downloaded from the Department of Revenue’s web site, the taxpayer

must ensure that the taxpayer has entered all required items of information in the fields at the top of the return.

BUSINESS TAX CLASS AND CHARACTER OF SELLER DESIGNATION: Taxpayers in Classifications 1A, 1B, 1C, 2, and 3 must indicate

whether the taxpayer is filing as a retailer or a wholesaler. The taxpayer is a retailer if at least 50% of the taxable gross sales during the tax

period are from sales that qualify as retail sales. The taxpayer is a wholesaler if at least 51% of the taxable gross sales during the tax period

are from sales that qualify as wholesale sales.

For taxpayers in Classification 1D there is no wholesale designation. This class remits tax based on the retail tax rate.

Wholesale sales are any sales made to a retailer for resale. Wholesale sales also include:

(1) Sales of industrial materials for future processing, manufacture, or conversion into articles of tangible personal property for resale,

where such industrial materials become a component part of the finished product. This does not apply to raw or unprocessed agricultural

products.

(2) Sales of tangible personal property by a wholesaler to the State of Tennessee, any Tennessee county or municipality, or any subdivi-

sion of the State of Tennessee or any Tennessee county or municipality, or to any religious, educational, or charitable institution named in

Tenn. Code Ann. Section 67-6-322.

(3) Sales by a franchised motor vehicle dealer to a manufacturer or distributor of motor vehicles or an obligor under an extended service

contract or parts and/or repair services necessary for repairs performed by the dealer under the manufacturer’s, distributor’s, or obligor’s

warranty. Also included are predelivery inspection charges paid to a franchise motor vehicle dealer by a manufacturer or distributor of the

motor vehicle.

Retail sales are any sales other than those defined as wholesale sales.

Line 1:

Enter the gross sales total for the reporting period. Do not report amounts of sales tax collected. Do not report amounts of liquor-

by-the-drink tax collected. Do include commissions received for sales of lottery tickets.

Line 2:

Enter the total amount for all deductions allowed from Schedule A, Line 18 on back of the return form.

Line 3:

Calculate the taxable gross sales for the tax period by subtracting Line 2 from Line 1.

Line 4:

Compute the amount of business tax due. Multiply the amount reported on Line 3 by the appropriate class rate indicated on the

return. If the tax rate is not preprinted on the return, refer to the tax rate chart on the second page of the return. If you are a retailer,

use the retail tax rate for the appropriate business tax classification. If you are a wholesaler, use the wholesale rate for the

appropriate classification.

Line 5:

Enter the amount of personal property taxes that can be taken as a deduction for the reporting period. The amount reported

cannot exceed more than 50% of the tax amount reported on Line 4. The tax must be paid prior to or during the reporting period

for which this return is filed and must be paid in the jurisdiction for which this return is filed. Real property taxes may not be

deducted.

Line 6:

Calculate the total business tax due by subtracting Line 5 from Line 4. Enter that amount or $22, whichever is greater, here. The

amount reported cannot be less than 50% of the amount of business tax reported on Line 4 or $22, whichever is greater.

Line 7:

If your account has a credit balance from an overpayment on a prior return, enter the amount on this line.

If the return is filed and or payment is made after the due date reflected on the return, compute the amount of penalty due for the

Line 8:

number of days delinquent. Subtract Line 7 from Line 6 and compute penalty as follows: 1 - 30 days = 5%; 31 - 60 days = 10%; 61

- 90 days = 15%; 91 - 120 days = 20%; 121 days and over = 25%. The maximum penalty amount is 25%. The minimum penalty

amount is $15.

Line 9:

Calculate the interest due. Multiply the amount of tax due and reported on Line 6 less Line 7 by the number of days delinquent.

Multiply that result by the current interest rate. Divide that result by 365.25. Enter here.

Line 10:

Add Lines 6, 8, and 9. Subtract Line 7. Enter here. This is the amount due with the return. Make payment payable to the

Tennessee Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2