Instructions For Banking Corporation Mta Surcharge Return Form Ct-32-M - 2004

ADVERTISEMENT

New York State Department of Taxation and Finance

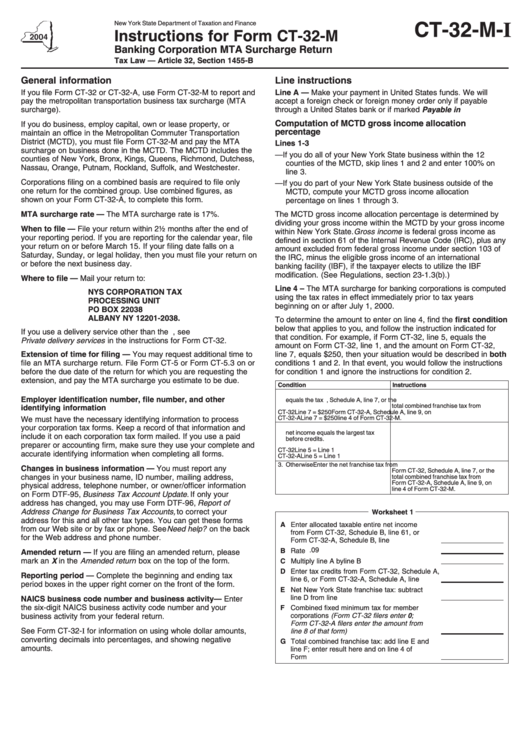

CT-32-M-I

Instructions for Form CT-32-M

Banking Corporation MTA Surcharge Return

Tax Law — Article 32, Section 1455-B

General information

Line instructions

If you file Form CT-32 or CT-32-A, use Form CT-32-M to report and

Line A — Make your payment in United States funds. We will

pay the metropolitan transportation business tax surcharge (MTA

accept a foreign check or foreign money order only if payable

surcharge).

through a United States bank or if marked Payable in U.S. funds.

Computation of MCTD gross income allocation

If you do business, employ capital, own or lease property, or

percentage

maintain an office in the Metropolitan Commuter Transportation

District (MCTD), you must file Form CT-32-M and pay the MTA

Lines 1-3

surcharge on business done in the MCTD. The MCTD includes the

— If you do all of your New York State business within the 12

counties of New York, Bronx, Kings, Queens, Richmond, Dutchess,

counties of the MCTD, skip lines 1 and 2 and enter 100% on

Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester.

line 3.

Corporations filing on a combined basis are required to file only

— If you do part of your New York State business outside of the

one return for the combined group. Use combined figures, as

MCTD, compute your MCTD gross income allocation

shown on your Form CT-32-A, to complete this form.

percentage on lines 1 through 3.

MTA surcharge rate — The MTA surcharge rate is 17%.

The MCTD gross income allocation percentage is determined by

dividing your gross income within the MCTD by your gross income

When to file — File your return within 2½ months after the end of

within New York State. Gross income is federal gross income as

your reporting period. If you are reporting for the calendar year, file

defined in section 61 of the Internal Revenue Code (IRC), plus any

your return on or before March 15. If your filing date falls on a

amount excluded from federal gross income under section 103 of

Saturday, Sunday, or legal holiday, then you must file your return on

the IRC, minus the eligible gross income of an international

or before the next business day.

banking facility (IBF), if the taxpayer elects to utilize the IBF

modification. (See Regulations, section 23-1.3(b).)

Where to file — Mail your return to:

Line 4 – The MTA surcharge for banking corporations is computed

NYS CORPORATION TAX

using the tax rates in effect immediately prior to tax years

PROCESSING UNIT

beginning on or after July 1, 2000.

PO BOX 22038

ALBANY NY 12201-2038.

To determine the amount to enter on line 4, find the first condition

below that applies to you, and follow the instruction indicated for

If you use a delivery service other than the U.S. Postal Service, see

that condition. For example, if Form CT-32, line 5, equals the

Private delivery services in the instructions for Form CT-32.

amount on Form CT-32, line 1, and the amount on Form CT-32,

Extension of time for filing — You may request additional time to

line 7, equals $250, then your situation would be described in both

file an MTA surcharge return. File Form CT-5 or Form CT-5.3 on or

conditions 1 and 2. In that event, you would follow the instructions

before the due date of the return for which you are requesting the

for condition 1 and ignore the instructions for condition 2.

extension, and pay the MTA surcharge you estimate to be due.

Condition

Instructions

1. The fixed dollar minimum tax

Enter the net franchise tax from

Employer identification number, file number, and other

equals the tax due.

Form CT-32, Schedule A, line 7, or the

total combined franchise tax from

identifying information

CT-32

Line 7 = $250

Form CT-32-A, Schedule A, line 9, on

CT-32-A

Line 7 = $250

line 4 of Form CT-32-M.

We must have the necessary identifying information to process

2. The tax on allocated taxable entire

Complete Worksheet 1.

your corporation tax forms. Keep a record of that information and

net income equals the largest tax

include it on each corporation tax form mailed. If you use a paid

before credits.

preparer or accounting firm, make sure they use your complete and

CT-32

Line 5 = Line 1

accurate identifying information when completing all forms.

CT-32-A

Line 5 = Line 1

3. Otherwise

Enter the net franchise tax from

Changes in business information — You must report any

Form CT-32, Schedule A, line 7, or the

changes in your business name, ID number, mailing address,

total combined franchise tax from

Form CT-32-A, Schedule A, line 9, on

physical address, telephone number, or owner/officer information

line 4 of Form CT-32-M.

on Form DTF-95, Business Tax Account Update. If only your

address has changed, you may use Form DTF-96, Report of

Address Change for Business Tax Accounts, to correct your

Worksheet 1

address for this and all other tax types. You can get these forms

A Enter allocated taxable entire net income

from our Web site or by fax or phone. See Need help? on the back

from Form CT-32, Schedule B, line 61, or

for the Web address and phone number.

Form CT-32-A, Schedule B, line 59 ...................

.09

B Rate ....................................................................

Amended return — If you are filing an amended return, please

mark an X in the Amended return box on the top of the form.

C Multiply line A by line B ......................................

D Enter tax credits from Form CT-32, Schedule A,

Reporting period — Complete the beginning and ending tax

line 6, or Form CT-32-A, Schedule A, line 6 ......

period boxes in the upper right corner on the front of the form.

E Net New York State franchise tax: subtract

line D from line C ................................................

NAICS business code number and business activity — Enter

the six-digit NAICS business activity code number and your

F Combined fixed minimum tax for member

corporations (Form CT-32 filers enter 0;

business activity from your federal return.

Form CT-32-A filers enter the amount from

See Form CT-32-I for information on using whole dollar amounts,

line 8 of that form) .............................................

converting decimals into percentages, and showing negative

G Total combined franchise tax: add line E and

amounts.

line F; enter result here and on line 4 of

Form CT-32-M ....................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2