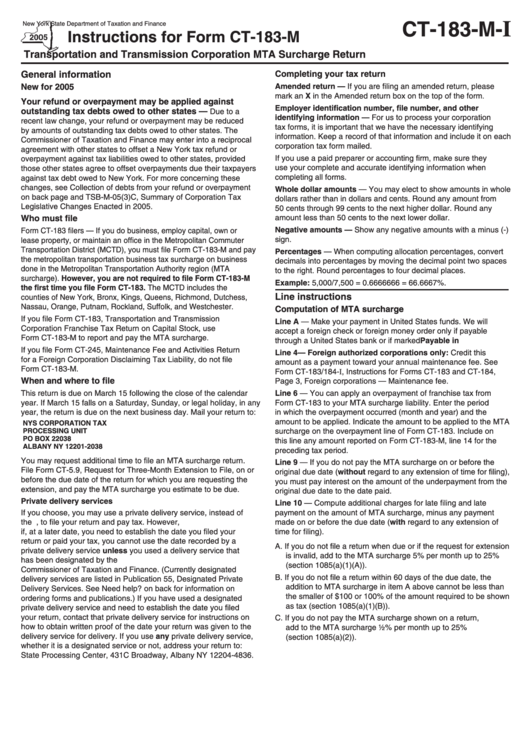

Instructions For Form Ct-183-M - Transportation And Transmission Corporation Mta Surcharge Return - New York State Department Of Taxation And Finance - 2005

ADVERTISEMENT

I

CT-183-M-

New York State Department of Taxation and Finance

Instructions for Form CT-183-M

Transportation and Transmission Corporation MTA Surcharge Return

General information

Completing your tax return

New for 2005

Amended return — If you are filing an amended return, please

mark an X in the Amended return box on the top of the form.

Your refund or overpayment may be applied against

Employer identification number, file number, and other

outstanding tax debts owed to other states —

Due to a

identifying information — For us to process your corporation

recent law change, your refund or overpayment may be reduced

tax forms, it is important that we have the necessary identifying

by amounts of outstanding tax debts owed to other states. The

information. Keep a record of that information and include it on each

Commissioner of Taxation and Finance may enter into a reciprocal

corporation tax form mailed.

agreement with other states to offset a New York tax refund or

If you use a paid preparer or accounting firm, make sure they

overpayment against tax liabilities owed to other states, provided

use your complete and accurate identifying information when

those other states agree to offset overpayments due their taxpayers

completing all forms.

against tax debt owed to New York. For more concerning these

changes, see Collection of debts from your refund or overpayment

Whole dollar amounts — You may elect to show amounts in whole

on back page and TSB-M-05(3)C, Summary of Corporation Tax

dollars rather than in dollars and cents. Round any amount from

Legislative Changes Enacted in 2005.

50 cents through 99 cents to the next higher dollar. Round any

Who must file

amount less than 50 cents to the next lower dollar.

Negative amounts — Show any negative amounts with a minus (-)

Form CT-183 filers — If you do business, employ capital, own or

sign.

lease property, or maintain an office in the Metropolitan Commuter

Transportation District (MCTD), you must file Form CT-183-M and pay

Percentages — When computing allocation percentages, convert

the metropolitan transportation business tax surcharge on business

decimals into percentages by moving the decimal point two spaces

done in the Metropolitan Transportation Authority region (MTA

to the right. Round percentages to four decimal places.

surcharge). However, you are not required to file Form CT-183-M

Example: 5,000/7,500 = 0.6666666 = 66.6667%.

the first time you file Form CT-183. The MCTD includes the

Line instructions

counties of New York, Bronx, Kings, Queens, Richmond, Dutchess,

Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester.

Computation of MTA surcharge

If you file Form CT-183, Transportation and Transmission

Line A — Make your payment in United States funds. We will

Corporation Franchise Tax Return on Capital Stock, use

accept a foreign check or foreign money order only if payable

Form CT-183-M to report and pay the MTA surcharge.

through a United States bank or if marked Payable in U.S. funds.

If you file Form CT-245, Maintenance Fee and Activities Return

Line 4 — Foreign authorized corporations only: Credit this

for a Foreign Corporation Disclaiming Tax Liability, do not file

amount as a payment toward your annual maintenance fee. See

Form CT-183-M.

Form CT-183/184-I, Instructions for Forms CT-183 and CT-184,

When and where to file

Page 3, Foreign corporations — Maintenance fee.

This return is due on March 15 following the close of the calendar

Line 6 — You can apply an overpayment of franchise tax from

year. If March 15 falls on a Saturday, Sunday, or legal holiday, in any

Form CT-183 to your MTA surcharge liability. Enter the period

year, the return is due on the next business day. Mail your return to:

in which the overpayment occurred (month and year) and the

amount to be applied. Indicate the amount to be applied to the MTA

NYS CORPORATION TAX

PROCESSING UNIT

surcharge on the overpayment line of Form CT-183. Include on

PO BOX 22038

this line any amount reported on Form CT-183-M, line 14 for the

ALBANY NY 12201-2038

preceding tax period.

You may request additional time to file an MTA surcharge return.

Line 9 — If you do not pay the MTA surcharge on or before the

File Form CT-5.9, Request for Three-Month Extension to File, on or

original due date (without regard to any extension of time for filing),

before the due date of the return for which you are requesting the

you must pay interest on the amount of the underpayment from the

extension, and pay the MTA surcharge you estimate to be due.

original due date to the date paid.

Private delivery services

Line 10 — Compute additional charges for late filing and late

If you choose, you may use a private delivery service, instead of

payment on the amount of MTA surcharge, minus any payment

the U.S. Postal Service, to file your return and pay tax. However,

made on or before the due date (with regard to any extension of

if, at a later date, you need to establish the date you filed your

time for filing).

return or paid your tax, you cannot use the date recorded by a

A. If you do not file a return when due or if the request for extension

private delivery service unless you used a delivery service that

is invalid, add to the MTA surcharge 5% per month up to 25%

has been designated by the U.S. Secretary of the Treasury or the

(section 1085(a)(1)(A)).

Commissioner of Taxation and Finance. (Currently designated

B. If you do not file a return within 60 days of the due date, the

delivery services are listed in Publication 55, Designated Private

addition to MTA surcharge in item A above cannot be less than

Delivery Services. See Need help? on back for information on

the smaller of $100 or 100% of the amount required to be shown

ordering forms and publications.) If you have used a designated

as tax (section 1085(a)(1)(B)).

private delivery service and need to establish the date you filed

your return, contact that private delivery service for instructions on

C. If you do not pay the MTA surcharge shown on a return,

how to obtain written proof of the date your return was given to the

add to the MTA surcharge ½% per month up to 25%

delivery service for delivery. If you use any private delivery service,

(section 1085(a)(2)).

whether it is a designated service or not, address your return to:

State Processing Center, 431C Broadway, Albany NY 12204-4836.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2