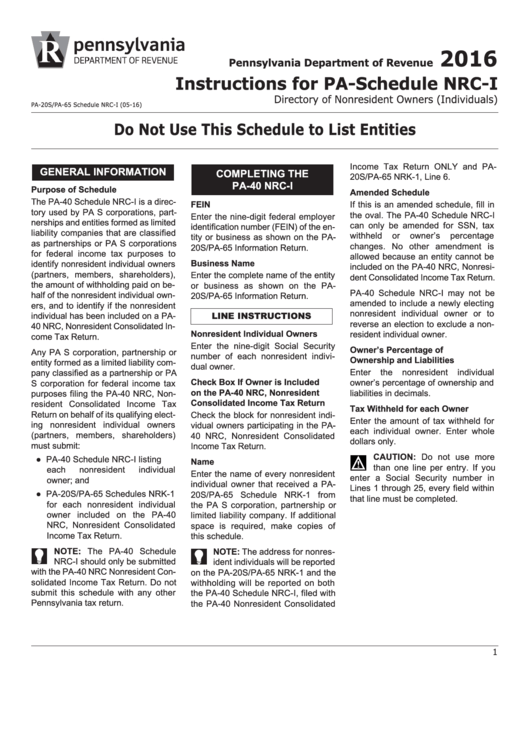

Instructions For Pa-Schedule Nrc-I - Directory Of Nonresident Owners - 2016

ADVERTISEMENT

2016

Pennsylvania Department of Revenue

Instructions for PA-Schedule NRC-I

Directory of Nonresident Owners (Individuals)

PA-20S/PA-65 Schedule NRC-I (05-16)

Do Not Use This Schedule to List Entities

Income Tax Return ONLY and PA-

GENERAL INFORMATION

COMPLETING THE

20S/PA-65 NRK-1, Line 6.

PA-40 NRC-I

Purpose of Schedule

Amended Schedule

The PA-40 Schedule NRC-I is a direc-

FEIN

If this is an amended schedule, fill in

tory used by PA S corporations, part-

the oval. The PA-40 Schedule NRC-I

Enter the nine-digit federal employer

nerships and entities formed as limited

can only be amended for SSN, tax

identification number (FEIN) of the en-

liability companies that are classified

withheld

or

owner’s

percentage

tity or business as shown on the PA-

as partnerships or PA S corporations

changes. No other amendment is

20S/PA-65 Information Return.

for federal income tax purposes to

allowed because an entity cannot be

Business Name

identify nonresident individual owners

included on the PA-40 NRC, Nonresi-

(partners, members, shareholders),

Enter the complete name of the entity

dent Consolidated Income Tax Return.

the amount of withholding paid on be-

or business as shown on the PA-

PA-40 Schedule NRC-I may not be

half of the nonresident individual own-

20S/PA-65 Information Return.

amended to include a newly electing

ers, and to identify if the nonresident

nonresident individual owner or to

LINE INSTRUCTIONS

individual has been included on a PA-

reverse an election to exclude a non-

40 NRC, Nonresident Consolidated In-

Nonresident Individual Owners

resident individual owner.

come Tax Return.

Enter the nine-digit Social Security

Owner’s Percentage of

Any PA S corporation, partnership or

number of each nonresident indivi-

Ownership and Liabilities

entity formed as a limited liability com-

dual owner.

Enter

the

nonresident

individual

pany classified as a partnership or PA

Check Box If Owner is Included

owner’s percentage of ownership and

S corporation for federal income tax

on the PA-40 NRC, Nonresident

liabilities in decimals.

purposes filing the PA-40 NRC, Non-

Consolidated Income Tax Return

resident Consolidated Income Tax

Tax Withheld for each Owner

Return on behalf of its qualifying elect-

Check the block for nonresident indi-

Enter the amount of tax withheld for

ing nonresident individual owners

vidual owners participating in the PA-

each individual owner. Enter whole

(partners, members, shareholders)

40 NRC, Nonresident Consolidated

dollars only.

must submit:

Income Tax Return.

CAUTION: Do not use more

● PA-40 Schedule NRC-I listing

Name

than one line per entry. If you

each

nonresident

individual

Enter the name of every nonresident

enter a Social Security number in

owner; and

individual owner that received a PA-

Lines 1 through 25, every field within

● PA-20S/PA-65 Schedules NRK-1

20S/PA-65 Schedule NRK-1 from

that line must be completed.

for each nonresident individual

the PA S corporation, partnership or

owner included on the PA-40

limited liability company. If additional

NRC, Nonresident Consolidated

space is required, make copies of

Income Tax Return.

this schedule.

NOTE: The PA-40 Schedule

NOTE: The address for nonres-

NRC-I should only be submitted

ident individuals will be reported

with the PA-40 NRC Nonresident Con-

on the PA-20S/PA-65 NRK-1 and the

solidated Income Tax Return. Do not

withholding will be reported on both

submit this schedule with any other

the PA-40 Schedule NRC-I, filed with

Pennsylvania tax return.

the PA-40 Nonresident Consolidated

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1