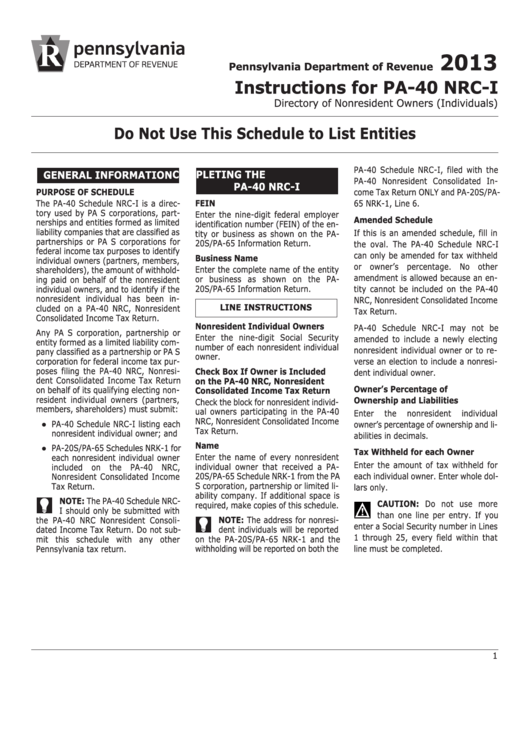

Instructions For Pa-40 Nrc-I - Directory Of Nonresident Owners (Individuals) - 2013

ADVERTISEMENT

2013

Pennsylvania Department of Revenue

Instructions for PA-40 NRC-I

Directory of Nonresident Owners (Individuals)

Do Not Use This Schedule to List Entities

PA-40 Schedule NRC-I, filed with the

COMPLETING THE

GENERAL INFORMATION

PA-40 Nonresident Consolidated In-

PA-40 NRC-I

PURPOSE OF SCHEDULE

come Tax Return ONLY and PA-20S/PA-

The PA-40 Schedule NRC-I is a direc-

FEIN

65 NRK-1, Line 6.

tory used by PA S corporations, part-

Enter the nine-digit federal employer

Amended Schedule

nerships and entities formed as limited

identification number (FEIN) of the en-

liability companies that are classified as

If this is an amended schedule, fill in

tity or business as shown on the PA-

partnerships or PA S corporations for

20S/PA-65 Information Return.

the oval. The PA-40 Schedule NRC-I

federal income tax purposes to identify

can only be amended for tax withheld

Business Name

individual owners (partners, members,

or owner’s percentage. No other

Enter the complete name of the entity

shareholders), the amount of withhold-

amendment is allowed because an en-

or business as shown on the PA-

ing paid on behalf of the nonresident

20S/PA-65 Information Return.

tity cannot be included on the PA-40

individual owners, and to identify if the

nonresident individual has been in-

NRC, Nonresident Consolidated Income

LINE INSTRUCTIONS

cluded on a PA-40 NRC, Nonresident

Tax Return.

Consolidated Income Tax Return.

Nonresident Individual Owners

PA-40 Schedule NRC-I may not be

Any PA S corporation, partnership or

Enter the nine-digit Social Security

amended to include a newly electing

entity formed as a limited liability com-

number of each nonresident individual

nonresident individual owner or to re-

pany classified as a partnership or PA S

owner.

corporation for federal income tax pur-

verse an election to include a nonresi-

poses filing the PA-40 NRC, Nonresi-

Check Box If Owner is Included

dent individual owner.

dent Consolidated Income Tax Return

on the PA-40 NRC, Nonresident

Owner’s Percentage of

on behalf of its qualifying electing non-

Consolidated Income Tax Return

resident individual owners (partners,

Ownership and Liabilities

Check the block for nonresident individ-

members, shareholders) must submit:

ual owners participating in the PA-40

Enter

the

nonresident

individual

NRC, Nonresident Consolidated Income

● PA-40 Schedule NRC-I listing each

owner’s percentage of ownership and li-

Tax Return.

nonresident individual owner; and

abilities in decimals.

Name

● PA-20S/PA-65 Schedules NRK-1 for

Tax Withheld for each Owner

Enter the name of every nonresident

each nonresident individual owner

Enter the amount of tax withheld for

individual owner that received a PA-

included on the PA-40 NRC,

20S/PA-65 Schedule NRK-1 from the PA

each individual owner. Enter whole dol-

Nonresident Consolidated Income

Tax Return.

S corporation, partnership or limited li-

lars only.

ability company. If additional space is

NOTE: The PA-40 Schedule NRC-

CAUTION: Do not use more

required, make copies of this schedule.

I should only be submitted with

than one line per entry. If you

NOTE: The address for nonresi-

the PA-40 NRC Nonresident Consoli-

enter a Social Security number in Lines

dated Income Tax Return. Do not sub-

dent individuals will be reported

1 through 25, every field within that

on the PA-20S/PA-65 NRK-1 and the

mit this schedule with any other

Pennsylvania tax return.

withholding will be reported on both the

line must be completed.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1