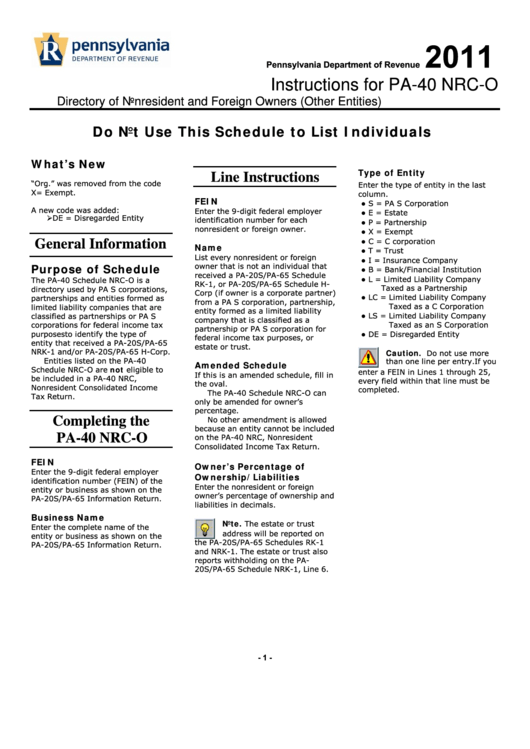

Instructions For Pa-40 Nrc-O - Directory Of Nonresident And Foreign Owners (Other Entities) - 2011

ADVERTISEMENT

2011

Pennsylvania Department of Revenue

Instructions for PA-40 NRC-O

Directory of Nonresident and Foreign Owners (Other Entities)

Do Not Use This Schedule to List Individuals

What’s New

Type of Entity

Line Instructions

“Org.” was removed from the code

Enter the type of entity in the last

X= Exempt.

column.

FEIN

●

S = PA S Corporation

A new code was added:

Enter the 9-digit federal employer

●

E = Estate

DE = Disregarded Entity

identification number for each

●

P = Partnership

nonresident or foreign owner.

●

X = Exempt

●

C = C corporation

General Information

Name

●

T = Trust

List every nonresident or foreign

●

I = Insurance Company

owner that is not an individual that

Purpose of Schedule

●

B = Bank/Financial Institution

received a PA-20S/PA-65 Schedule

●

L = Limited Liability Company

The PA-40 Schedule NRC-O is a

RK-1, or PA-20S/PA-65 Schedule H-

Taxed as a Partnership

directory used by PA S corporations,

Corp (if owner is a corporate partner)

●

LC = Limited Liability Company

partnerships and entities formed as

from a PA S corporation, partnership,

Taxed as a C Corporation

limited liability companies that are

entity formed as a limited liability

●

LS = Limited Liability Company

classified as partnerships or PA S

company that is classified as a

Taxed as an S Corporation

corporations for federal income tax

partnership or PA S corporation for

●

purposes to identify the type of

DE = Disregarded Entity

federal income tax purposes, or

entity that received a PA-20S/PA-65

estate or trust.

NRK-1 and/or PA-20S/PA-65 H-Corp.

Caution.

Do not use more

Entities listed on the PA-40

than one line per entry. If you

Amended Schedule

Schedule NRC-O are not eligible to

enter a FEIN in Lines 1 through 25,

If this is an amended schedule, fill in

be included in a PA-40 NRC,

every field within that line must be

the oval.

Nonresident Consolidated Income

completed.

The PA-40 Schedule NRC-O can

Tax Return.

only be amended for owner’s

percentage.

No other amendment is allowed

Completing the

because an entity cannot be included

PA-40 NRC-O

on the PA-40 NRC, Nonresident

Consolidated Income Tax Return.

FEIN

Owner’s Percentage of

Enter the 9-digit federal employer

Ownership/Liabilities

identification number (FEIN) of the

Enter the nonresident or foreign

entity or business as shown on the

owner’s percentage of ownership and

PA-20S/PA-65 Information Return.

liabilities in decimals.

Business Name

Note.

The estate or trust

Enter the complete name of the

address will be reported on

entity or business as shown on the

the PA-20S/PA-65 Schedules RK-1

PA-20S/PA-65 Information Return.

and NRK-1. The estate or trust also

reports withholding on the PA-

20S/PA-65 Schedule NRK-1, Line 6.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1