General Instructions Election Not To Be Taxed As A Pennsylvania S Corporation - Department Of Revenue

ADVERTISEMENT

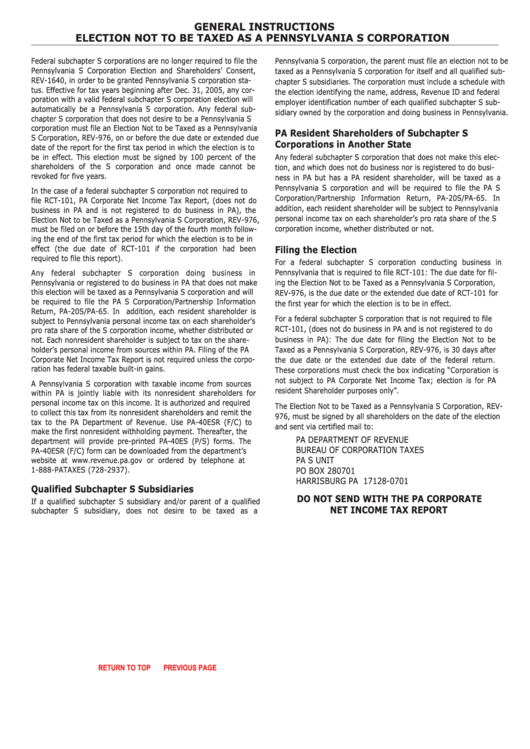

GENERAL INSTRUCTIONS

ELECTION NOT TO BE TAXED AS A PENNSYLVANIA S CORPORATION

Federal subchapter S corporations are no longer required to file the

Pennsylvania S corporation, the parent must file an election not to be

Pennsylvania S Corporation Election and Shareholders’ Consent,

taxed as a Pennsylvania S corporation for itself and all qualified sub-

REV-1640, in order to be granted Pennsylvania S corporation sta-

chapter S subsidiaries. the corporation must include a schedule with

tus. Effective for tax years beginning after dec. 31, 2005, any cor-

the election identifying the name, address, Revenue Id and federal

poration with a valid federal subchapter S corporation election will

employer identification number of each qualified subchapter S sub-

automatically be a Pennsylvania S corporation. Any federal sub-

sidiary owned by the corporation and doing business in Pennsylvania.

chapter S corporation that does not desire to be a Pennsylvania S

corporation must file an Election Not to be taxed as a Pennsylvania

PA Resident Shareholders of Subchapter S

S Corporation, REV-976, on or before the due date or extended due

Corporations in Another State

date of the report for the first tax period in which the election is to

be in effect. this election must be signed by 100 percent of the

Any federal subchapter S corporation that does not make this elec-

shareholders of the S corporation and once made cannot be

tion, and which does not do business nor is registered to do busi-

revoked for five years.

ness in PA but has a PA resident shareholder, will be taxed as a

Pennsylvania S corporation and will be required to file the PA S

In the case of a federal subchapter S corporation not required to

Corporation/Partnership Information Return, PA-20S/PA-65. In

file RCt-101, PA Corporate Net Income tax Report, (does not do

addition, each resident shareholder will be subject to Pennsylvania

business in PA and is not registered to do business in PA), the

personal income tax on each shareholder’s pro rata share of the S

Election Not to be taxed as a Pennsylvania S Corporation, REV-976,

corporation income, whether distributed or not.

must be filed on or before the 15th day of the fourth month follow-

ing the end of the first tax period for which the election is to be in

effect (the due date of RCt-101 if the corporation had been

Filing the Election

required to file this report).

For a federal subchapter S corporation conducting business in

Any federal subchapter S corporation doing business in

Pennsylvania that is required to file RCt-101: the due date for fil-

Pennsylvania or registered to do business in PA that does not make

ing the Election Not to be taxed as a Pennsylvania S Corporation,

this election will be taxed as a Pennsylvania S corporation and will

REV-976, is the due date or the extended due date of RCt-101 for

be required to file the PA S Corporation/Partnership Information

the first year for which the election is to be in effect.

Return, PA-20S/PA-65. In addition, each resident shareholder is

For a federal subchapter S corporation that is not required to file

subject to Pennsylvania personal income tax on each shareholder’s

RCt-101, (does not do business in PA and is not registered to do

pro rata share of the S corporation income, whether distributed or

business in PA): the due date for filing the Election Not to be

not. Each nonresident shareholder is subject to tax on the share-

holder’s personal income from sources within PA. Filing of the PA

taxed as a Pennsylvania S Corporation, REV-976, is 30 days after

Corporate Net Income tax Report is not required unless the corpo-

the due date or the extended due date of the federal return.

ration has federal taxable built-in gains.

these corporations must check the box indicating “Corporation is

not subject to PA Corporate Net Income tax; election is for PA

A Pennsylvania S corporation with taxable income from sources

resident Shareholder purposes only”.

within PA is jointly liable with its nonresident shareholders for

personal income tax on this income. It is authorized and required

the Election Not to be taxed as a Pennsylvania S Corporation, REV-

to collect this tax from its nonresident shareholders and remit the

976, must be signed by all shareholders on the date of the election

tax to the PA department of Revenue. Use PA-40ESR (F/C) to

and sent via certified mail to:

make the first nonresident withholding payment. thereafter, the

PA dEPARtMENt OF REVENUE

department will provide pre-printed PA-40ES (P/S) forms. the

BUREAU OF CORPORAtION tAxES

PA-40ESR (F/C) form can be downloaded from the department’s

PA S UNIt

website at or ordered by telephone at

1-888-PAtAxES (728-2937).

PO BOx 280701

HARRISBURG PA 17128-0701

Qualified Subchapter S Subsidiaries

DO NOT SEND WITH THE PA CORPORATE

If a qualified subchapter S subsidiary and/or parent of a qualified

NET INCOME TAX REPORT

subchapter S subsidiary, does not desire to be taxed as a

Reset Entire Form

RETURN TO TOP

PREVIOUS PAGE

PRINT FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1