Form 8835 Instructions - Renewable Electricity, Refined Coal, And Indian Coal Production Credit

ADVERTISEMENT

3

Form 8835 (2004)

Page

● Geothermal energy facility placed in service

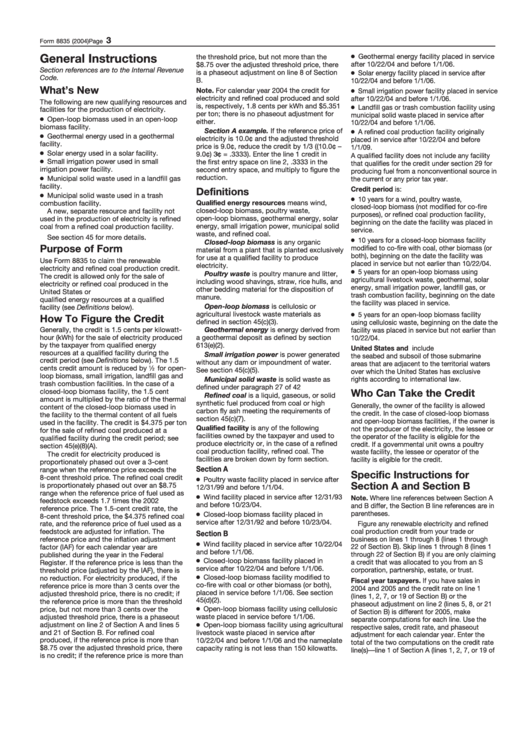

General Instructions

the threshold price, but not more than the

after 10/22/04 and before 1/1/06.

$8.75 over the adjusted threshold price, there

Section references are to the Internal Revenue

● Solar energy facility placed in service after

is a phaseout adjustment on line 8 of Section

Code.

B.

10/22/04 and before 1/1/06.

What’s New

● Small irrigation power facility placed in service

Note. For calendar year 2004 the credit for

electricity and refined coal produced and sold

after 10/22/04 and before 1/1/06.

The following are new qualifying resources and

● Landfill gas or trash combustion facility using

is, respectively, 1.8 cents per kWh and $5.351

facilities for the production of electricity.

per ton; there is no phaseout adjustment for

municipal solid waste placed in service after

● Open-loop biomass used in an open-loop

either.

10/22/04 and before 1/1/06.

biomass facility.

● A refined coal production facility originally

Section A example. If the reference price of

● Geothermal energy used in a geothermal

electricity is 10.0¢ and the adjusted threshold

placed in service after 10/22/04 and before

facility.

price is 9.0¢, reduce the credit by 1/3 ((10.0¢ –

1/1/09.

● Solar energy used in a solar facility.

9.0¢)

3¢ = .3333). Enter the line 1 credit in

A qualified facility does not include any facility

● Small irrigation power used in small

the first entry space on line 2, .3333 in the

that qualifies for the credit under section 29 for

irrigation power facility.

second entry space, and multiply to figure the

producing fuel from a nonconventional source in

● Municipal solid waste used in a landfill gas

reduction.

the current or any prior tax year.

facility.

Credit period is:

Definitions

● Municipal solid waste used in a trash

● 10 years for a wind, poultry waste,

Qualified energy resources means wind,

combustion facility.

closed-loop biomass (not modified for co-fire

closed-loop biomass, poultry waste,

A new, separate resource and facility not

purposes), or refined coal production facility,

open-loop biomass, geothermal energy, solar

used in the production of electricity is refined

beginning on the date the facility was placed in

energy, small irrigation power, municipal solid

coal from a refined coal production facility.

service.

waste, and refined coal.

See section 45 for more details.

● 10 years for a closed-loop biomass facility

Closed-loop biomass is any organic

Purpose of Form

modified to co-fire with coal, other biomass (or

material from a plant that is planted exclusively

both), beginning on the date the facility was

for use at a qualified facility to produce

Use Form 8835 to claim the renewable

placed in service but not earlier than 10/22/04.

electricity.

electricity and refined coal production credit.

● 5 years for an open-loop biomass using

Poultry waste is poultry manure and litter,

The credit is allowed only for the sale of

agricultural livestock waste, geothermal, solar

including wood shavings, straw, rice hulls, and

electricity or refined coal produced in the

energy, small irrigation power, landfill gas, or

other bedding material for the disposition of

United States or U.S. possessions from

trash combustion facility, beginning on the date

manure.

qualified energy resources at a qualified

the facility was placed in service.

Open-loop biomass is cellulosic or

facility (see Definitions below).

● 5 years for an open-loop biomass facility

agricultural livestock waste materials as

How To Figure the Credit

defined in section 45(c)(3).

using cellulosic waste, beginning on the date the

Generally, the credit is 1.5 cents per kilowatt-

Geothermal energy is energy derived from

facility was placed in service but not earlier than

hour (kWh) for the sale of electricity produced

a geothermal deposit as defined by section

10/22/04.

by the taxpayer from qualified energy

613(e)(2).

United States and U.S. possessions include

resources at a qualified facility during the

Small irrigation power is power generated

the seabed and subsoil of those submarine

credit period (see Definitions below). The 1.5

without any dam or impoundment of water.

areas that are adjacent to the territorial waters

cents credit amount is reduced by

⁄

for open-

1

See section 45(c)(5).

2

over which the United States has exclusive

loop biomass, small irrigation, landfill gas and

Municipal solid waste is solid waste as

rights according to international law.

trash combustion facilities. In the case of a

defined under paragraph 27 of 42 U.S.C. 6903.

closed-loop biomass facility, the 1.5 cent

Who Can Take the Credit

Refined coal is a liquid, gaseous, or solid

amount is multiplied by the ratio of the thermal

synthetic fuel produced from coal or high

Generally, the owner of the facility is allowed

content of the closed-loop biomass used in

carbon fly ash meeting the requirements of

the credit. In the case of closed-loop biomass

the facility to the thermal content of all fuels

section 45(c)(7).

and open-loop biomass facilities, if the owner is

used in the facility. The credit is $4.375 per ton

Qualified facility is any of the following

not the producer of the electricity, the lessee or

for the sale of refined coal produced at a

facilities owned by the taxpayer and used to

the operator of the facility is eligible for the

qualified facility during the credit period; see

produce electricity or, in the case of a refined

credit. If a governmental unit owns a poultry

section 45(e)(8)(A).

coal production facility, refined coal. The

waste facility, the lessee or operator of the

The credit for electricity produced is

facilities are broken down by form section.

facility is eligible for the credit.

proportionately phased out over a 3-cent

Section A

range when the reference price exceeds the

Specific Instructions for

8-cent threshold price. The refined coal credit

● Poultry waste facility placed in service after

Section A and Section B

is proportionately phased out over an $8.75

12/31/99 and before 1/1/04.

range when the reference price of fuel used as

● Wind facility placed in service after 12/31/93

Note. Where line references between Section A

feedstock exceeds 1.7 times the 2002

and before 10/23/04.

and B differ, the Section B line references are in

reference price. The 1.5-cent credit rate, the

● Closed-loop biomass facility placed in

parentheses.

8-cent threshold price, the $4.375 refined coal

service after 12/31/92 and before 10/23/04.

Figure any renewable electricity and refined

rate, and the reference price of fuel used as a

feedstock are adjusted for inflation. The

coal production credit from your trade or

Section B

reference price and the inflation adjustment

business on lines 1 through 8 (lines 1 through

● Wind facility placed in service after 10/22/04

22 of Section B). Skip lines 1 through 8 (lines 1

factor (IAF) for each calendar year are

and before 1/1/06.

through 22 of Section B) if you are only claiming

published during the year in the Federal

● Closed-loop biomass facility placed in

a credit that was allocated to you from an S

Register. If the reference price is less than the

service after 10/22/04 and before 1/1/06.

corporation, partnership, estate, or trust.

threshold price (adjusted by the IAF), there is

● Closed-loop biomass facility modified to

no reduction. For electricity produced, if the

Fiscal year taxpayers. If you have sales in

co-fire with coal or other biomass (or both),

reference price is more than 3 cents over the

2004 and 2005 and the credit rate on line 1

placed in service before 1/1/06. See section

adjusted threshold price, there is no credit; if

(lines 1, 2, 7, or 19 of Section B) or the

45(d)(2).

the reference price is more than the threshold

phaseout adjustment on line 2 (lines 5, 8, or 21

● Open-loop biomass facility using cellulosic

price, but not more than 3 cents over the

of Section B) is different for 2005, make

waste placed in service before 1/1/06.

adjusted threshold price, there is a phaseout

separate computations for each line. Use the

● Open-loop biomass facility using agricultural

adjustment on line 2 of Section A and lines 5

respective sales, credit rate, and phaseout

and 21 of Section B. For refined coal

livestock waste placed in service after

adjustment for each calendar year. Enter the

produced, if the reference price is more than

10/22/04 and before 1/1/06 and the nameplate

total of the two computations on the credit rate

$8.75 over the adjusted threshold price, there

capacity rating is not less than 150 kilowatts.

line(s)—line 1 of Section A (lines 1, 2, 7, or 19 of

is no credit; if the reference price is more than

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2