Form It-644 - Workers With Disabilities Tax Credit - 2015

ADVERTISEMENT

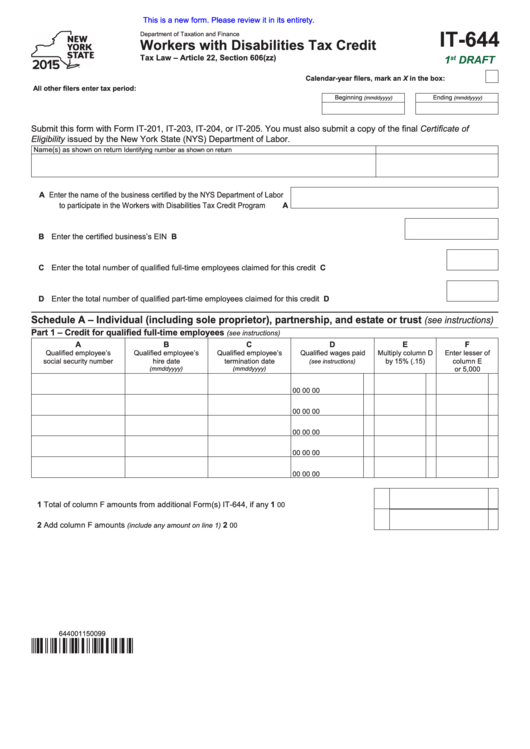

This is a new form. Please review it in its entirety.

IT-644

Department of Taxation and Finance

Workers with Disabilities Tax Credit

Tax Law – Article 22, Section 606(zz)

1

DRAFT

st

Calendar-year filers, mark an X in the box:

All other filers enter tax period:

Beginning

Ending

(mmddyyyy)

(mmddyyyy)

Submit this form with Form IT-201, IT-203, IT-204, or IT-205. You must also submit a copy of the final Certificate of

Eligibility issued by the New York State (NYS) Department of Labor.

Name(s) as shown on return

Identifying number as shown on return

A Enter the name of the business certified by the NYS Department of Labor

to participate in the Workers with Disabilities Tax Credit Program ........... A

B Enter the certified business’s EIN ......................................................................................................... B

C Enter the total number of qualified full-time employees claimed for this credit ........................................................ C

D Enter the total number of qualified part-time employees claimed for this credit ....................................................... D

Schedule A – Individual (including sole proprietor), partnership, and estate or trust

(see instructions)

Part 1 – Credit for qualified full-time employees

(see instructions)

A

B

C

D

E

F

Qualified employee’s

Qualified employee’s

Qualified employee’s

Qualified wages paid

Multiply column D

Enter lesser of

social security number

hire date

termination date

by 15% (.15)

column E

(see instructions)

(mmddyyyy)

(mmddyyyy)

or 5,000

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

1 Total of column F amounts from additional Form(s) IT-644, if any ..............................................

1

00

2 Add column F amounts

...................................................................

2

(include any amount on line 1)

00

644001150099

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3