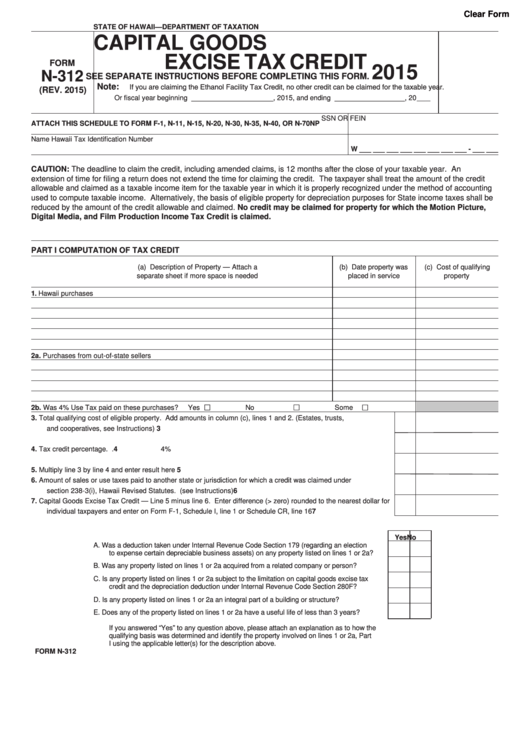

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

CAPITAL GOODS

EXCISE TAX CREDIT

FORM

2015

N-312

SEE SEPARATE INSTRUCTIONS BEFORE COMPLETING THIS FORM.

Note: If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed for the taxable year.

(REV. 2015)

Or fiscal year beginning _____________________, 2015, and ending __________________ , 20

SSN OR FEIN

ATTACH THIS SCHEDULE TO FORM F-1, N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP

Name

Hawaii Tax Identification Number

W ___ ___ ___ ___ ___ ___ ___ ___ - ___ ___

CAUTION:

The deadline to claim the credit, including amended claims, is 12 months after the close of your taxable year. An

extension of time for filing a return does not extend the time for claiming the credit. The taxpayer shall treat the amount of the credit

allowable and claimed as a taxable income item for the taxable year in which it is properly recognized under the method of accounting

used to compute taxable income. Alternatively, the basis of eligible property for depreciation purposes for State income taxes shall be

reduced by the amount of the credit allowable and claimed. No credit may be claimed for property for which the Motion Picture,

Digital Media, and Film Production Income Tax Credit is claimed.

PART I COMPUTATION OF TAX CREDIT

(a) Description of Property — Attach a

(b) Date property was

(c) Cost of qualifying

separate sheet if more space is needed

placed in service

property

1.

Hawaii purchases

2a. Purchases from out-of-state sellers

2b. Was 4% Use Tax paid on these purchases?

Yes

No

Some

3.

Total qualifying cost of eligible property. Add amounts in column (c), lines 1 and 2. (Estates, trusts,

and cooperatives, see Instructions) .........................................................................................................................

3

4.

Tax credit percentage. . ............................................................................................................................................

4

4%

5.

Multiply line 3 by line 4 and enter result here ..........................................................................................................

5

6.

Amount of sales or use taxes paid to another state or jurisdiction for which a credit was claimed under

section 238-3(i), Hawaii Revised Statutes. (see Instructions) ..................................................................................

6

7.

Capital Goods Excise Tax Credit — Line 5 minus line 6. Enter difference (> zero) rounded to the nearest dollar for

individual taxpayers and enter on Form F-1, Schedule I, line 1 or Schedule CR, line 16 ........................................

7

Yes

No

A.

Was a deduction taken under Internal Revenue Code Section 179 (regarding an election

to expense certain depreciable business assets) on any property listed on lines 1 or 2a?

B.

Was any property listed on lines 1 or 2a acquired from a related company or person?

C.

Is any property listed on lines 1 or 2a subject to the limitation on capital goods excise tax

credit and the depreciation deduction under Internal Revenue Code Section 280F?

D.

Is any property listed on lines 1 or 2a an integral part of a building or structure?

E.

Does any of the property listed on lines 1 or 2a have a useful life of less than 3 years?

If you answered “Yes” to any question above, please attach an explanation as to how the

qualifying basis was determined and identify the property involved on lines 1 or 2a, Part

I using the applicable letter(s) for the description above.

FORM N-312

1

1 2

2