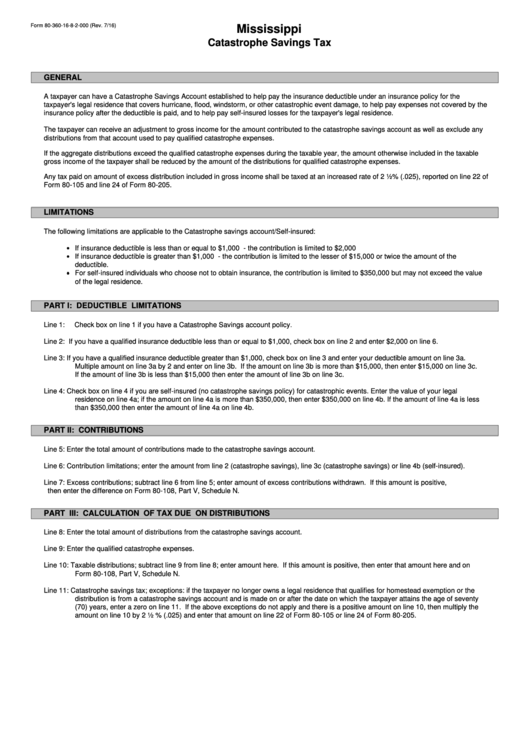

Form 80-360-16-8-2-000 - Catastrophe Saving Tax

ADVERTISEMENT

Form 80-360-16-8-2-000 (Rev. 7/16)

Mississippi

Catastrophe Savings Tax

GENERAL

A taxpayer can have a Catastrophe Savings Account established to help pay the insurance deductible under an insurance policy for the

taxpayer's legal residence that covers hurricane, flood, windstorm, or other catastrophic event damage, to help pay expenses not covered by the

insurance policy after the deductible is paid, and to help pay self-insured losses for the taxpayer's legal residence.

The taxpayer can receive an adjustment to gross income for the amount contributed to the catastrophe savings account as well as exclude any

distributions from that account used to pay qualified catastrophe expenses.

If the aggregate distributions exceed the qualified catastrophe expenses during the taxable year, the amount otherwise included in the taxable

gross income of the taxpayer shall be reduced by the amount of the distributions for qualified catastrophe expenses.

Any tax paid on amount of excess distribution included in gross income shall be taxed at an increased rate of 2 ½% (.025), reported on line 22 of

Form 80-105 and line 24 of Form 80-205.

LIMITATIONS

The following limitations are applicable to the Catastrophe savings account/Self-insured:

If insurance deductible is less than or equal to $1,000 - the contribution is limited to $2,000

If insurance deductible is greater than $1,000 - the contribution is limited to the lesser of $15,000 or twice the amount of the

deductible.

For self-insured individuals who choose not to obtain insurance, the contribution is limited to $350,000 but may not exceed the value

of the legal residence.

PART I: DEDUCTIBLE LIMITATIONS

Line 1:

Check box on line 1 if you have a Catastrophe Savings account policy.

Line 2:

If you have a qualified insurance deductible less than or equal to $1,000, check box on line 2 and enter $2,000 on line 6.

Line 3:

If you have a qualified insurance deductible greater than $1,000, check box on line 3 and enter your deductible amount on line 3a.

Multiple amount on line 3a by 2 and enter on line 3b. If the amount on line 3b is more than $15,000, then enter $15,000 on line 3c.

If the amount of line 3b is less than $15,000 then enter the amount of line 3b on line 3c.

Line 4:

Check box on line 4 if you are self-insured (no catastrophe savings policy) for catastrophic events. Enter the value of your legal

residence on line 4a; if the amount on line 4a is more than $350,000, then enter $350,000 on line 4b. If the amount of line 4a is less

than $350,000 then enter the amount of line 4a on line 4b.

PART II: CONTRIBUTIONS

Line 5:

Enter the total amount of contributions made to the catastrophe savings account.

Line 6:

Contribution limitations; enter the amount from line 2 (catastrophe savings), line 3c (catastrophe savings) or line 4b (self-insured).

Line 7:

Excess contributions; subtract line 6 from line 5; enter amount of excess contributions withdrawn. If this amount is positive,

then enter the difference on Form 80-108, Part V, Schedule N.

PART III: CALCULATION OF TAX DUE ON DISTRIBUTIONS

Line 8:

Enter the total amount of distributions from the catastrophe savings account.

Line 9:

Enter the qualified catastrophe expenses.

Line 10: Taxable distributions; subtract line 9 from line 8; enter amount here. If this amount is positive, then enter that amount here and on

Form 80-108, Part V, Schedule N.

Line 11: Catastrophe savings tax; exceptions: if the taxpayer no longer owns a legal residence that qualifies for homestead exemption or the

distribution is from a catastrophe savings account and is made on or after the date on which the taxpayer attains the age of seventy

(70) years, enter a zero on line 11. If the above exceptions do not apply and there is a positive amount on line 10, then multiply the

amount on line 10 by 2 ½ % (.025) and enter that amount on line 22 of Form 80-105 or line 24 of Form 80-205.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1