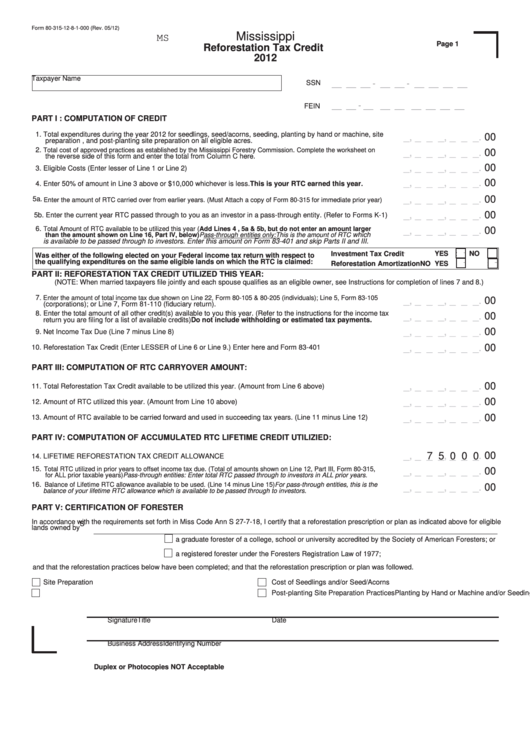

Form 80-315-12-8-1-000 (Rev. 05/12)

Mississippi

MS

Page 1

Reforestation Tax Credit

2012

Taxpayer Name

SSN

__ __ __ - __ __ - __ __ __ __

__ __ - __ __ __ __ __ __ __

FEIN

PART I : COMPUTATION OF CREDIT

1. Total expenditures during the year 2012 for seedlings, seed/acorns, seeding, planting by hand or machine, site

_, _ _ _, _ _ _.

00

preparation , and post-planting site preparation on all eligible acres.

2.

Total cost of approved practices as established by the Mississippi Forestry Commission. Complete the worksheet on

_, _ _ _, _ _ _.

00

the reverse side of this form and enter the total from Column C here.

_, _ _ _, _ _ _.

00

3. Eligible Costs (Enter lesser of Line 1 or Line 2)

_, _ _ _, _ _ _.

00

4. Enter 50% of amount in Line 3 above or $10,000 whichever is less. This is your RTC earned this year.

_, _ _ _, _ _ _.

00

5a.

Enter the amount of RTC carried over from earlier years. (Must Attach a copy of Form 80-315 for immediate prior year)

_, _ _ _, _ _ _.

00

5b. Enter the current year RTC passed through to you as an investor in a pass-through entity. (Refer to Forms K-1)

6.

Total Amount of RTC available to be utilized this year (Add Lines 4 , 5a & 5b, but do not enter an amount larger

_, _ _ _, _ _ _.

00

which

than the amount shown on Line 16, Part IV, below) Pass-through entities only: This is the amount of RTC

is available to be passed through to investors. Enter this amount on Form 83-401 and skip Parts II and III.

.

.

.

.

Investment Tax Credit

YES

NO

Was either of the following elected on your Federal income tax return with respect to

.

.

the qualifying expenditures on the same eligible lands on which the RTC is claimed:

.

.

.

.

Reforestation Amortization

YES

NO

.

.

PART II: REFORESTATION TAX CREDIT UTILIZED THIS YEAR:

(NOTE: When married taxpayers file jointly and each spouse qualifies as an eligible owner, see Instructions for completion of lines 7 and 8.)

7.

Enter the amount of total income tax due shown on Line 22, Form 80-105 & 80-205 (individuals); Line 5, Form 83-105

_, _ _ _, _ _ _.

00

(corporations); or Line 7, Form 81-110 (fiduciary return).

8. Enter the total amount of all other credit(s) available to you this year. (Refer to the instructions for the income tax

_, _ _ _, _ _ _.

00

return you are filing for a list of available credits) Do not include withholding or estimated tax payments.

_, _ _ _, _ _ _.

00

9. Net Income Tax Due (Line 7 minus Line 8)

_, _ _ _, _ _ _.

00

10. Reforestation Tax Credit (Enter LESSER of Line 6 or Line 9.) Enter here and Form 83-401

PART III: COMPUTATION OF RTC CARRYOVER AMOUNT:

_, _ _ _, _ _ _.

00

11. Total Reforestation Tax Credit available to be utilized this year. (Amount from Line 6 above)

_, _ _ _, _ _ _.

00

12. Amount of RTC utilized this year. (Amount from Line 10 above)

_, _ _ _, _ _ _.

00

13. Amount of RTC available to be carried forward and used in succeeding tax years. (Line 11 minus Line 12)

PART IV: COMPUTATION OF ACCUMULATED RTC LIFETIME CREDIT UTILIZIED:

_, _ _ _, _ _ _.

00

7 5 0 0 0

14. LIFETIME REFORESTATION TAX CREDIT ALLOWANCE

15.

Total RTC utilized in prior years to offset income tax due. (Total of amounts shown on Line 12, Part III, Form 80-315,

_, _ _ _, _ _ _.

00

for ALL prior taxable years) Pass-through entities: Enter total RTC passed through to investors in ALL prior years.

16.

Balance of Lifetime RTC allowance available to be used. (Line 14 minus Line 15) For pass-through entities, this is the

_, _ _ _, _ _ _.

00

balance of your lifetime RTC allowance which is available to be passed through to investors.

PART V: CERTIFICATION OF FORESTER

In accordance with the requirements set forth in Miss Code Ann S 27-7-18, I certify that a reforestation prescription or plan as indicated above for eligible

S

lands owned by

a graduate forester of a college, school or university accredited by the Society of American Foresters; or

a registered forester under the Foresters Registration Law of 1977;

and that the reforestation practices below have been completed; and that the reforestation prescription or plan was followed.

Site Preparation

Cost of Seedlings and/or Seed/Acorns

Planting by Hand or Machine and/or Seeding

Post-planting Site Preparation Practices

Signature

Title

Date

Business Address

Identifying Number

Duplex or Photocopies NOT Acceptable

1

1 2

2