Special Return Sales Tax Holiday For Specific School Supplies - St. Clair County Sales Tax Department

ADVERTISEMENT

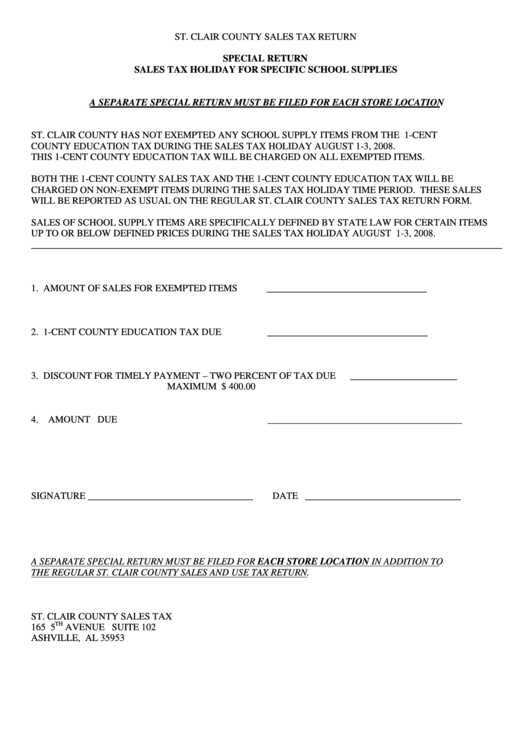

ST. CLAIR COUNTY SALES TAX RETURN

SPECIAL RETURN

SALES TAX HOLIDAY FOR SPECIFIC SCHOOL SUPPLIES

A SEPARATE SPECIAL RETURN MUST BE FILED FOR EACH STORE LOCATION

ST. CLAIR COUNTY HAS NOT EXEMPTED ANY SCHOOL SUPPLY ITEMS FROM THE 1-CENT

COUNTY EDUCATION TAX DURING THE SALES TAX HOLIDAY AUGUST 1-3, 2008.

THIS 1-CENT COUNTY EDUCATION TAX WILL BE CHARGED ON ALL EXEMPTED ITEMS.

BOTH THE 1-CENT COUNTY SALES TAX AND THE 1-CENT COUNTY EDUCATION TAX WILL BE

CHARGED ON NON-EXEMPT ITEMS DURING THE SALES TAX HOLIDAY TIME PERIOD. THESE SALES

WILL BE REPORTED AS USUAL ON THE REGULAR ST. CLAIR COUNTY SALES TAX RETURN FORM.

SALES OF SCHOOL SUPPLY ITEMS ARE SPECIFICALLY DEFINED BY STATE LAW FOR CERTAIN ITEMS

UP TO OR BELOW DEFINED PRICES DURING THE SALES TAX HOLIDAY AUGUST 1-3, 2008.

_________________________________________________________________________________________________

1. AMOUNT OF SALES FOR EXEMPTED ITEMS

_________________________________

2. 1-CENT COUNTY EDUCATION TAX DUE

_________________________________

3. DISCOUNT FOR TIMELY PAYMENT – TWO PERCENT OF TAX DUE

______________________

MAXIMUM $ 400.00

4. AMOUNT DUE

________________________________________

SIGNATURE __________________________________

DATE ________________________________

A SEPARATE SPECIAL RETURN MUST BE FILED FOR EACH STORE LOCATION IN ADDITION TO

THE REGULAR ST. CLAIR COUNTY SALES AND USE TAX RETURN.

ST. CLAIR COUNTY SALES TAX

TH

165 5

AVENUE SUITE 102

ASHVILLE, AL 35953

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4