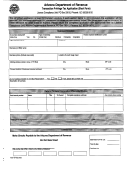

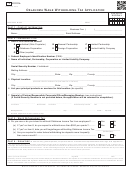

UNEMPLOYMENT TAX ADDENDUM

UC-001 A (3/03) - (Page 3)

I.

IF YOU ACQUIRED ALL OR PART OF AN EXISTING ARIZONA BUSINESS, PLEASE COMPLETE THIS SECTION

Date Acquired:

Acquired:

All

Part

Acquired by:

Purchase

Lease

Other

Explain Other:

II.

PREVIOUS OWNERS INFORMATION

Name(s) of Previous Owners:

Business Name of Previous Owners:

Current Street Address of Previous Owners:

City, State, ZIP

Current Telephone Number of Previous Owners:

Unemployment Number of Previous Owners:

III. VOLUNTARY ELECTION OF UNEMPLOYMENT TAX COVERAGE

The undersigned, on behalf of the employing unit, voluntarily elects beginning January 1 of the current calendar year or the date employment

started if later, and continuing for not less than two full calendar years to:

A. Become an employer subject to Title 23, Chapter 4, Arizona Revised Statutes, to the same extent as all other employers and extend

unemployment tax coverage to my employees although not mandatory.

B. Extend coverage to all employees performing services excluded from coverage as shown in Section VIII, on Page 2.

AGENCY USE ONLY

SIGNATURE/TITLE

DATE

APPROVED/DATE

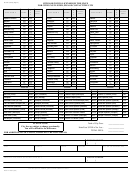

ADDITIONAL INSTRUCTIONS FOR UNEMPLOYMENT TAX ADDENDUM

WHAT IS A SUCCESSOR EMPLOYER?

ACQUISITION OF A PART OF AN EXISTING ARIZONA

BUSINESS

When you acquire all or part of a business, which was required

to pay unemployment taxes in Arizona, you are a “successor” for

If you acquire a PART of a business and continue to operate it, you

unemployment tax purposes. As a successor, you are immediately

are not automatically assigned the tax rate and experience rating

liable for unemployment taxes regardless of the amount of wages

account of the former owner. To apply for a portion of the account

you pay or the number of workers you employ.

and its corresponding tax rate, you must fi le an “Application &

Agreement for Severable Portion Experience Rating Transfer”

As a successor, you may also take into account wages paid by

(UC-247) within 180 days of acquiring the business. The former

the former owner in determining the amount of wages on which

owner must agree and provide payroll information for the portions

you must pay taxes during the year in which you acquired the

of the business acquired and retained. Your account may then

business. For example, if the former owner has paid wages in

be charged for a portion of the unemployment benefi ts paid to

excess of $7,000 to a worker you continue to employ, you will not

the former owners’ employees. The application form is available

have to pay taxes on any additional wages you pay this worker in

online at or you may call (602) 248-9101

the year you acquire the business.

to obtain an application.

ACQUISITION OF ALL OF AN EXISTING ARIZONA

VOLUNTARY ELECTION OF UNEMPLOYMENT TAX

BUSINESS

COVERAGE

When you acquire an entire business and continue its operation,

Complete and sign this portion of the application ONLY if you

you are assigned the tax rate and experience rating account

wish to provide unemployment coverage to your employees,

of the former owner. The experience rating account includes

and you believe you are not REQUIRED to provide coverage.

the record of wages and taxes previously paid. Therefore, any

Refer to the “Employers Handbook” (available online at

unemployment benefi ts awarded based on wages paid by the

or “Guide to Arizona Employment Tax

former owner may be charged to your account. Additionally,

Requirements.”

you may be liable for taxes unpaid by the former owner. When

acquiring a business, consider whether any unemployment taxes

remain unpaid by the seller.

ADOR 74-4002 (3/03)

1

1 2

2 3

3 4

4