Form Mdes-1499a - Questionnaire To Determine The State To Which Wages Are Properly Reported

ADVERTISEMENT

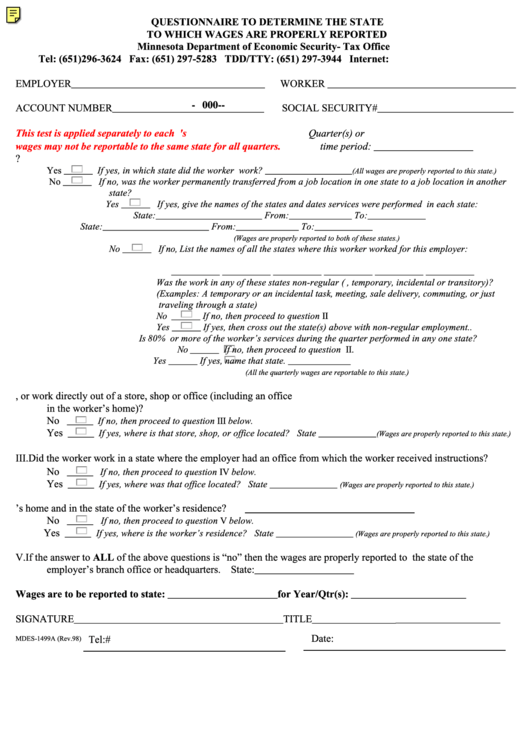

QUESTIONNAIRE TO DETERMINE THE STATE

TO WHICH WAGES ARE PROPERLY REPORTED

Minnesota Department of Economic Security - Tax Office

Tel: (651)296-3624 Fax: (651) 297-5283 TDD/TTY: (651) 297-3944 Internet:

EMPLOYER_____________________________________

WORKER ____________________________________

- 000

-

-

ACCOUNT NUMBER_____________________________

SOCIAL SECURITY#__________________________

This test is applied separately to each quarter. The worker's

Quarter(s) or

wages may not be reportable to the same state for all quarters.

time period: ___________________

I.

Did the worker work for the employer only in one state?

Yes ______ If yes, in which state did the worker work? __________________

(All wages are properly reported to this state.)

No ______ If no, was the worker permanently transferred from a job location in one state to a job location in another

state?

Yes ______ If yes, give the names of the states and dates services were performed in each state:

State:______________________ From:_____________ To:____________

State:______________________ From:_____________ To:____________

(Wages are properly reported to both of these states.)

No ______ If no, List the names of all the states where this worker worked for this employer:

__________ __________ __________ __________ __________ __________

Was the work in any of these states non-regular (i.e., temporary, incidental or transitory)?

(Examples: A temporary or an incidental task, meeting, sale delivery, commuting, or just

traveling through a state)

No ______ If no, then proceed to question II

Yes ______ If yes, then cross out the state(s) above with non-regular employment..

Is 80% or more of the worker’ s services during the quarter performed in any one state?

No ______ If no, then proceed to question II.

Yes ______ If yes, name that state. _____________

(All the quarterly wages are reportable to this state.)

II.

Did the worker routinely report in person to, or work directly out of a store, shop or office (including an office

in the worker’ s home)?

If no, then proceed to question III below.

No _____

If yes, where is that store, shop, or office located? State ____________

Yes _____

(Wages are properly reported to this state.)

III.

Did the worker work in a state where the employer had an office from which the worker received instructions?

If no, then proceed to question IV below.

No _____

If yes, where was that office located? State ______________

Yes _____

(Wages are properly reported to this state.)

IV.

Did the worker work out of the worker’ s home and in the state of the worker’ s residence ?

If no, then proceed to question V below.

No _____

If yes, where is the worker’ s residence? State ________________

Yes _____

(Wages are properly reported to this state.)

If the answer to ALL of the above questions is “no” then the wages are properly reported to the state of the

V.

employer’ s branch office or headquarters. State:___________________

Wages are to be reported to state: _____________________for Year/Qtr(s): ______________________

SIGNATURE________________________________________ TITLE________________

________________________

Date:

Tel:#

MDES-1499A (Rev.98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1