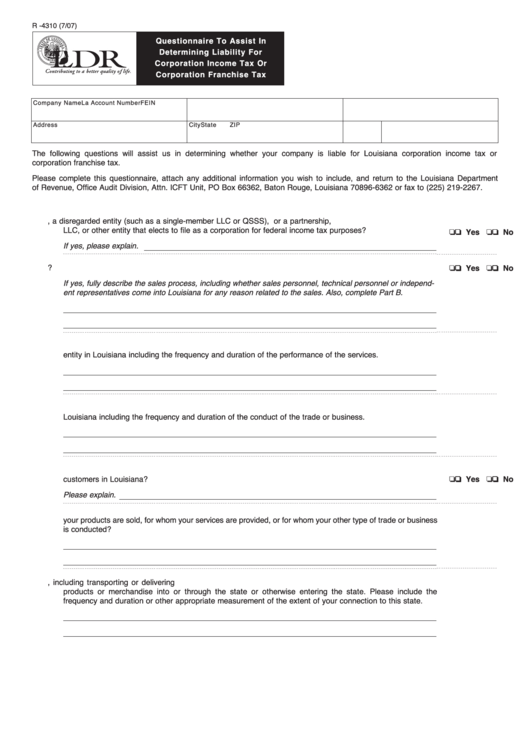

R -4310 (7/07)

Questionnaire To Assist In

Determining Liability For

Corporation Income Tax Or

Corporation Franchise Tax

Company Name

La Account Number

FEIN

Address

City

State

ZIP

The following questions will assist us in determining whether your company is liable for Louisiana corporation income tax or

corporation franchise tax.

Please complete this questionnaire, attach any additional information you wish to include, and return to the Louisiana Department

of Revenue, Office Audit Division, Attn. ICFT Unit, PO Box 66362, Baton Rouge, Louisiana 70896-6362 or fax to (225) 219-2267.

A. Nexus Questionnaire

1.

Is this entity a corporation, a disregarded entity (such as a single-member LLC or QSSS), or a partnership,

❏ ❏ Yes ❏ ❏ No

LLC, or other entity that elects to file as a corporation for federal income tax purposes?

If yes, please explain .

❏ ❏ Yes ❏ ❏ No

2.

Does this company sell tangible personal property into Louisiana?

If yes, fully describe the sales process, including whether sales personnel, technical personnel or independ-

ent representatives come into Louisiana for any reason related to the sales. Also, complete Part B.

3.

Fully describe any types of services that are performed by this company in Louisiana or for or on behalf of an

entity in Louisiana including the frequency and duration of the performance of the services.

4.

Fully describe any other trade or business that is conducted in Louisiana or for or on behalf of an entity in

Louisiana including the frequency and duration of the conduct of the trade or business.

5.

Does this company license any type of intangible right to any entity that uses the right in Louisiana or that has

❏ ❏ Yes ❏ ❏ No

customers in Louisiana?

Please explain.

6.

What is the approximate number of Louisiana customers and the type or class of customers to whom

your products are sold, for whom your services are provided, or for whom your other type of trade or business

is conducted?

7.

Please describe any other connection this company has to Louisiana, including transporting or delivering

products or merchandise into or through the state or otherwise entering the state. Please include the

frequency and duration or other appropriate measurement of the extent of your connection to this state.

1

1 2

2