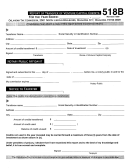

Certification Form For Issuance Of Prep Tax Credit Certificate - Philadelphia Re-Entry Employment Program ("Prep") Tax Credit Page 3

ADVERTISEMENT

CITY OF PHILADELPHIA – DEPARTMENT OF REVENUE

PHILADELPHIA RE-ENTRY EMPLOYMENT PROGRAM (“PREP”) TAX CREDIT

Instructions for Requesting and Claiming the PREP Tax Credit

•

To be eligible to receive the tax credit, a business must first execute a PREP Tax

Agreement with the Revenue Department.

•

After a business has executed a PREP Tax Credit Agreement, it may make an

application to The Mayor’s Office of Re-Integration Services for Ex-Offenders

(“R.I.S.E.”) on a form required by R.I.S.E. for each employee it wishes to have

certified as a “Qualifying Employee”.

•

After a business has received certification from R.I.S.E. for each Qualifying

Employee, it may make a request to the Revenue Department for the issuance of the

PREP Tax Credit and to claim the tax credit.

•

For the methodology to calculate the PREP Tax Credit, reference Section 19-

2604(9)(b) of The Philadelphia Code - “Calculation of Tax Credits”; The (amended)

Ordinance can be accessed at

•

For issuance of the tax credit certificate, and to claim the tax credit, the business

must

submit the following documents to the Revenue Department:

1. Signed and completed Certification Form for Issuance of PREP Tax Credit;

2. Copy of the certification issued by R.I.S.E. for each Qualifying Employee

and Qualifying Exempt Organization;

3. List of each Qualifying Full-Time and Part-Time Employee for which the

tax credit was calculated – including name, SSN, hire and termination dates,

tax credit amount;

4. List of each Qualifying Exempt Organization to which a contribution was

made – including the name and SSN of each Qualifying Full-Time and Part-

Time Employee hired by the Organization, tax credit amount,

Organization’s EIN, contribution amount, date of the contribution, a copy of

both sides of the cancelled contribution check.

•

Upon review and verification of the tax credit calculations, you will be notified and a

tax credit certificate will be issued accordingly by the Department. The tax credit

and applicable BPT Return have to be manually processed. To claim the tax credit,

you must submit the original copy of Business Privilege Tax Return, for which the

credit is being claimed, directly to Technical Staff in order to have the tax credit

processed. OTHERWISE, the tax credit will not get processed.

•

Failure to submit any of the required documents or documentation

NOTE:

will result in delays in the issuance and processing of the PREP Tax Credit.

Mail completed certification form and all other required documents to:

City of Philadelphia – Department of Revenue

Municipal Services Building – Room 630

1401 John F. Kennedy Boulevard

Philadelphia, PA 19102

3 of 3

Rev. 9.2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3