Instructions For Form Ct-43 - New York State Tax Department - 1998

ADVERTISEMENT

CT-43 (1998) (back)

Instructions

General Information

beginning in 1986 through periods beginning in 1989, and

periods beginning in or after 1994, these taxpayers may elect,

Do not file Form CT-43 if you are claiming a refund on

in lieu of carryover, to treat the unused portion of special

Form CT-43.1.

additional mortgage recording tax credit as an overpayment of

Reporting Period

tax to be credited or refunded on Form CT-43.1. See

If you are a calendar year filer, check the box in the upper right

TSB-M-94(4)C for additional information.

corner on the front of this form.

New York S corporations taxable under Article 9-A will not be

If you are a fiscal year filer, complete the beginning and ending

allowed to carry forward special additional mortgage recording

tax period boxes in the upper right corner on the front of the

tax credit due and paid in any tax year beginning before 1994.

form.

For periods beginning in and after 1994, this credit may be

If you file one of the following franchise tax returns, you may

applied against the franchise tax, carried over, or treated as an

claim, as a credit against your franchise tax, certain special

overpayment of tax as discussed above.

additional mortgage recording tax you paid.

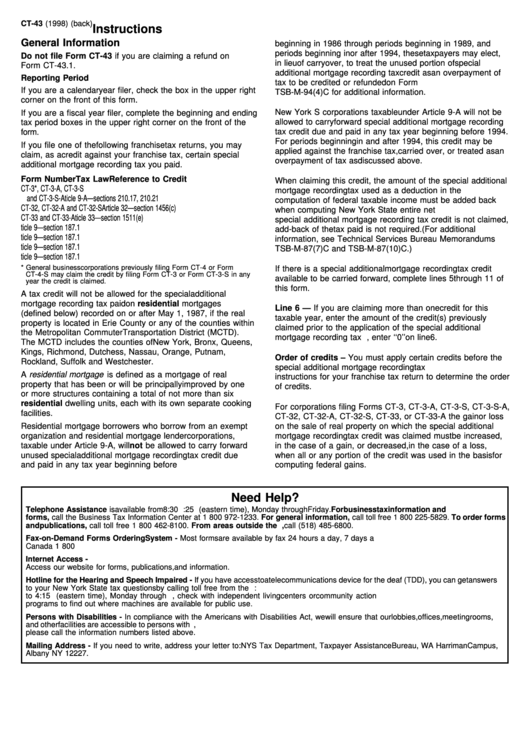

Form Number

Tax Law

Reference to Credit

When claiming this credit, the amount of the special additional

CT-3*, CT-3-A, CT-3-S

mortgage recording tax used as a deduction in the

and CT-3-S-A . . . . . . . . . . . Article 9-A

— sections 210.17, 210.21

computation of federal taxable income must be added back

CT-32, CT-32-A and CT-32-S

Article 32

— section 1456(c)

when computing New York State entire net income. When the

CT-33 and CT-33-A . . . . . . . . Article 33

— section 1511(e)

special additional mortgage recording tax credit is not claimed,

CT-183 . . . . . . . . . . . . . . . . . . Article 9

— section 187.1

add-back of the tax paid is not required. (For additional

CT-184 . . . . . . . . . . . . . . . . . . Article 9

— section 187.1

information, see Technical Services Bureau Memorandums

CT-185 . . . . . . . . . . . . . . . . . . Article 9

— section 187.1

TSB-M-87(7)C and TSB-M-87(10)C.)

CT-186 . . . . . . . . . . . . . . . . . . Article 9

— section 187.1

* General business corporations previously filing Form CT-4 or Form

If there is a special additional mortgage recording tax credit

CT-4-S may claim the credit by filing Form CT-3 or Form CT-3-S in any

available to be carried forward, complete lines 5 through 11 of

year the credit is claimed.

this form.

A tax credit will not be allowed for the special additional

mortgage recording tax paid on residential mortgages

Line 6 — If you are claiming more than one credit for this

(defined below) recorded on or after May 1, 1987, if the real

taxable year, enter the amount of the credit(s) previously

property is located in Erie County or any of the counties within

claimed prior to the application of the special additional

the Metropolitan Commuter Transportation District (MCTD).

mortgage recording tax credit. Otherwise, enter ‘‘0’’ on line 6.

The MCTD includes the counties of New York, Bronx, Queens,

Kings, Richmond, Dutchess, Nassau, Orange, Putnam,

Order of credits – You must apply certain credits before the

Rockland, Suffolk and Westchester.

special additional mortgage recording tax credit. Refer to the

A residential mortgage is defined as a mortgage of real

instructions for your franchise tax return to determine the order

property that has been or will be principally improved by one

of credits.

or more structures containing a total of not more than six

residential dwelling units, each with its own separate cooking

For corporations filing Forms CT-3, CT-3-A, CT-3-S, CT-3-S-A,

facilities.

CT-32, CT-32-A, CT-32-S, CT-33, or CT-33-A the gain or loss

Residential mortgage borrowers who borrow from an exempt

on the sale of real property on which the special additional

organization and residential mortgage lender corporations,

mortgage recording tax credit was claimed must be increased,

taxable under Article 9-A, will not be allowed to carry forward

in the case of a gain, or decreased, in the case of a loss,

unused special additional mortgage recording tax credit due

when all or any portion of the credit was used in the basis for

and paid in any tax year beginning before 1986. For periods

computing federal gains.

Need Help?

Telephone Assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time), Monday through Friday. For business tax information and

forms, call the Business Tax Information Center at 1 800 972-1233. For general information, call toll free 1 800 225-5829. To order forms

and publications, call toll free 1 800 462-8100. From areas outside the U.S. and outside Canada, call (518) 485-6800.

Fax-on-Demand Forms Ordering System - Most forms are available by fax 24 hours a day, 7 days a week. Call toll free from the U.S. and

Canada 1 800 748-3676. You must use a Touch Tone phone to order by fax. A fax code is used to identify each form.

Internet Access -

Access our website for forms, publications, and information.

Hotline for the Hearing and Speech Impaired - If you have access to a telecommunications device for the deaf (TDD), you can get answers

to your New York State tax questions by calling toll free from the U.S. and Canada 1 800 634-2110. Assistance is available from 8:30 a.m.

to 4:15 p.m. (eastern time), Monday through Friday. If you do not own a TDD, check with independent living centers or community action

programs to find out where machines are available for public use.

Persons with Disabilities - In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms,

and other facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities,

please call the information numbers listed above.

Mailing Address - If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus,

Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1