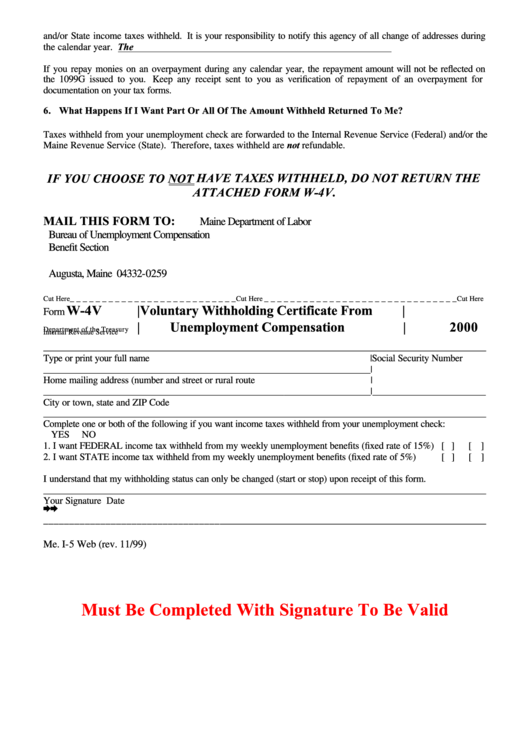

Form W-4v - Voluntary Withholding Certificate From Unemployment Compensation - Maine Department Of Treasury - 2000

ADVERTISEMENT

and/or State income taxes withheld. It is your responsibility to notify this agency of all change of addresses during

the calendar year. The U.S. Postal Service will not forward Department of Labor mail.

If you repay monies on an overpayment during any calendar year, the repayment amount will not be reflected on

the 1099G issued to you. Keep any receipt sent to you as verification of repayment of an overpayment for

documentation on your tax forms.

6. What Happens If I Want Part Or All Of The Amount Withheld Returned To Me?

Taxes withheld from your unemployment check are forwarded to the Internal Revenue Service (Federal) and/or the

Maine Revenue Service (State). Therefore, taxes withheld are not refundable.

IF YOU CHOOSE TO NOT HAVE TAXES WITHHELD, DO NOT RETURN THE

ATTACHED FORM W-4V.

MAIL THIS FORM TO:

Maine Department of Labor

Bureau of Unemployment Compensation

Benefit Section

P.O. Box 259

Augusta, Maine 04332-0259

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Cut Here

Cut Here

Cut Here

W-4V

|Voluntary Withholding Certificate From

|

Form

|

Unemployment Compensation

|

2000

Department of the Treasury

Internal Revenue Service

____________________________________________________________________________________________

Type or print your full name

|Social Security Number

____________________________________________________________________|

Home mailing address (number and street or rural route

|

____________________________________________________________________|_______________________

City or town, state and ZIP Code

____________________________________________________________________________________________

Complete one or both of the following if you want income taxes withheld from your unemployment check:

YES

NO

1. I want FEDERAL income tax withheld from my weekly unemployment benefits (fixed rate of 15%) [ ]

[ ]

2. I want STATE income tax withheld from my weekly unemployment benefits (fixed rate of 5%)

[ ]

[ ]

I understand that my withholding status can only be changed (start or stop) upon receipt of this form.

____________________________________________________________________________________________

Your Signature

Date

è

è

____________________________________________________________________________________________

Me. I-5 Web (rev. 11/99)

Must Be Completed With Signature To Be Valid

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1