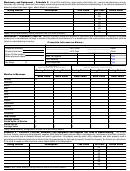

Machinery and Equipment -- Schedule 2. List at 25% machinery, repair parts, small tools, etc., used in manufacturing, mining,

laundries, dry cleaning, towel and linen supply, stone and gravel plants and radio and television broadcasting. If the value of equipment is

based on other than book value, attach detail of computation.

Taxing District

Description

True Value

Per Cent

Listed Value

$

$

25

25

25

25

25

25

25

Total

(Carry Listed Value by Taxing District to Line 2 on Front of Return)

$

$

Inventories -- Schedules 3 and 3A. Monthly inventory values are required of merchants and manufacturers. Inventory of finished

products of a manufacturer not kept or stored in the place of manufacture or in a warehouse in the county where manufactured, shall be

listed as merchandising inventory.

Complete Information Below:

Source of Values Listed

Method of Valuing Inventories Listed

Perpetual Inventory

____________________ FIFO Cost

____________________ Retail

____________________ LIFO Cost

____________________ Other

Physical Inventory

Book Adjustments

Date

Amount

DR/CR

Gross Profits method

CR

Dates physicals taken:

Book to Physical

LIFO Reserve

CR

Net Sales

$

Other Reserves

CR

Schedule 3

Schedule 3A

Manufacturing Inventories

Merchandising Inventories

Taxing District Taxing District Taxing District Taxing District Taxing District

Months in Business

Book Value

Book Value

Book Value

Book Value

Book Value

$

$

$

$

$

January

February

March

April

May

June

July

August

September

October

November

December

$

$

$

$

$

Total Values

Average Values

$

$

$

$

$

Divide by No. of Months

List at 24% of

$

$

$

$

$

Average Value

(Carry Listed Value by Taxing District to Line 3 or 4 on Front of Return)

Schedule 4 -- Furniture, Fixtures, Machinery and Equipment and Supplies Not Used in Manufacturing.

List at 25%

furniture, fixtures, machinery and equipment, supplies, small tools and repair parts not used in manufacturing, inventories of other than a manufac-

turer or merchant and all domestic animals not used in agriculture. List property used by public utility companies, and other property used in

generating and distributing electricity to others at the listing percentage for that type of property. Contact the Property Tax Division for instructions.

If the value is based on other than book value, attach details of the computation.

Taxing District

Description

True Value

Per Cent

Listed Value

$

$

25

25

25

25

25

25

25

Total (Carry Listed Value by Taxing District to Line 5 on Front of Return)

$

$

1

1 2

2