Form Wtex - Non-Residence Of City Of Pittsburgh Stop Withholding Wage Tax- 2009

ADVERTISEMENT

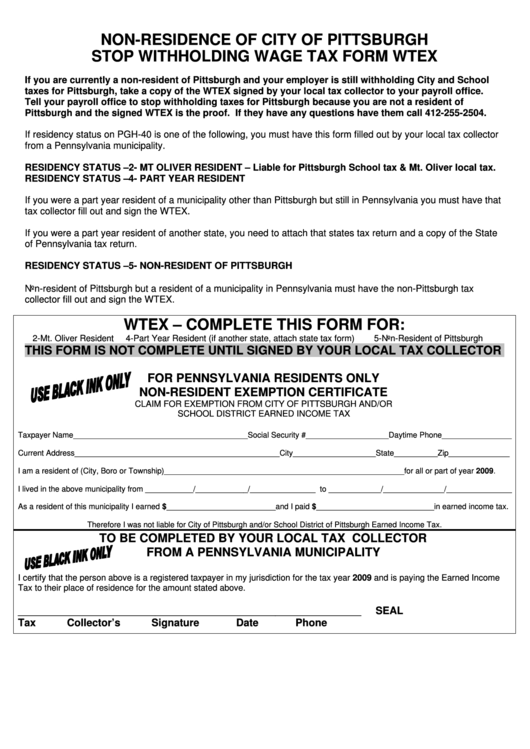

NON-RESIDENCE OF CITY OF PITTSBURGH

STOP WITHHOLDING WAGE TAX FORM WTEX

If you are currently a non-resident of Pittsburgh and your employer is still withholding City and School

taxes for Pittsburgh, take a copy of the WTEX signed by your local tax collector to your payroll office.

Tell your payroll office to stop withholding taxes for Pittsburgh because you are not a resident of

Pittsburgh and the signed WTEX is the proof. If they have any questions have them call 412-255-2504.

If residency status on PGH-40 is one of the following, you must have this form filled out by your local tax collector

from a Pennsylvania municipality.

RESIDENCY STATUS –2- MT OLIVER RESIDENT – Liable for Pittsburgh School tax & Mt. Oliver local tax.

RESIDENCY STATUS –4- PART YEAR RESIDENT

If you were a part year resident of a municipality other than Pittsburgh but still in Pennsylvania you must have that

tax collector fill out and sign the WTEX.

If you were a part year resident of another state, you need to attach that states tax return and a copy of the State

of Pennsylvania tax return.

RESIDENCY STATUS –5- NON-RESIDENT OF PITTSBURGH

Non-resident of Pittsburgh but a resident of a municipality in Pennsylvania must have the non-Pittsburgh tax

collector fill out and sign the WTEX.

WTEX – COMPLETE THIS FORM FOR:

2-Mt. Oliver Resident

4-Part Year Resident (if another state, attach state tax form)

5-Non-Resident of Pittsburgh

THIS FORM IS NOT COMPLETE UNTIL SIGNED BY YOUR LOCAL TAX COLLECTOR

FOR PENNSYLVANIA RESIDENTS ONLY

NON-RESIDENT EXEMPTION CERTIFICATE

CLAIM FOR EXEMPTION FROM CITY OF PITTSBURGH AND/OR

SCHOOL DISTRICT EARNED INCOME TAX

Taxpayer Name________________________________________Social Security #___________________Daytime Phone________________

Current Address_______________________________________________City___________________State__________Zip______________

I am a resident of (City, Boro or Township)_______________________________________________________for all or part of year 2009.

I lived in the above municipality from ___________/____________/_______________ to ____________/______________/_______________

As a resident of this municipality I earned $_________________________and I paid $___________________________in earned income tax.

Therefore I was not liable for City of Pittsburgh and/or School District of Pittsburgh Earned Income Tax.

TO BE COMPLETED BY YOUR LOCAL TAX COLLECTOR

FROM A PENNSYLVANIA MUNICIPALITY

I certify that the person above is a registered taxpayer in my jurisdiction for the tax year 2009 and is paying the Earned Income

Tax to their place of residence for the amount stated above.

____________________________________________________________

SEAL

Tax Collector’s Signature

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1