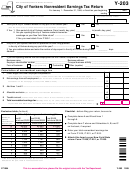

Form Nyc-203 - City Of New York Nonresident Earnings Tax Return - 1999 Page 2

ADVERTISEMENT

NYC-203 (1999) (back)

Schedule A —

Allocation of wage and salary income to the city of New York - Do not use this schedule for income

based on the volume of business transacted. See the instructions on page 4 if:

• you had more than one job, or

• you had a job for only part of the year, or

• you were a full-year New York State resident, or

• you changed your New York State residence.

10

Total days

....................................................................................................... 10

(see instructions on page 4)

Nonworking

11 Saturdays and Sundays

..........................................

11

(not worked)

days

12 Holidays

................................................................... 12

(not worked)

included

13 Sick leave .................................................................................... 13

in line 10:

14 Vacation .......................................................................................

14

15 Other nonworking days ............................................................... 15

16

Total nonworking days

.......................................................................................

16

(add lines 11 through 15)

17

Total days worked in year at this job

............................................................ 17

(subtract line 16 from line 10)

(attach schedule or explanation)

18

Total days included in line 17 worked outside the city of New York

.........

18

19

Enter number of days worked at home included in line 18 amount ................................ 19

20

Days worked in the city of New York

............................................................ 20

(subtract line 18 from line 17)

21

Enter number of days from line 17 above ...............................................................................................

21

22

Divide line 20 by line 21; carry the result to four decimal places ..................................................

22

23

Gross wages and other employee compensation to be allocated ...............................

23

24

Multiply line 22 by line 23; this is your city of New York allocated wage and

salary income. Include this amount on line 1 ............................................................

24

Schedule B —

List all places, both in and out of the city of New York, where you carry on business

(Use only if your net

earnings from self-employment are from a business carried on both in and out of the city of New York.)

(1) Street address

(2) City and state

(3) Description

(see instructions)

Schedule C —

Allocation of net earnings from self-employment to the city of New York

(Use only if your business is carried on both in and out of the city of New York. If the net earnings are from a

partnership, the factors must be the partnership amounts.)

See the instructions on page 4 if:

• you were a full-year New York State resident, or

• you changed your New York State residence.

You may use the business allocation percentage determined by the formula on Form IT-204-NYC, City of New York

Nonresident Partner Allocation. If you use the percentage from Form IT-204-NYC, skip lines 25 through 31 and enter

the allocation percentage on line 32 below.

(1) Totals - in and out

(2) City of New York

(3)

Items used as factors

of the city of New York

amount

Percent

Property percentage

(see instructions):

column (2)

25

Real property owned ...................................................

25

is of

26

Real property rented from others .................................

26

column (1)

27

Tangible personal property owned ............................... 27

28

Property percentage

28

%

(add lines 25, 26, and 27; see instructions) ..

29

Payroll percentage

29

%

(see instructions) .....................................

30

Gross income percentage

30

%

(see instructions) ........................

31

Total of percentages

31

%

(add lines 28, 29, and 30, column (3)) ..............................................................................................

32

Business allocation percentage

32

%

(divide total percentages on line 31 by three or by actual number of percentages if less than three) .......

33

Net earnings from self-employment to be allocated

33

(see instructions) ........................................................................

34

Allocated net earnings from self-employment

34

(multiply line 33 by line 32; enter the result here and on line 5) ...........

282999

NYC-203 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2