Form Rpd-41374 - Annual Report Of Non-Resident Remittees Holding An Agreement To Pay Tax On Oil And Gas Proceeds - 2013 Page 2

ADVERTISEMENT

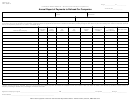

RPD-41374 (2013)

New Mexico Taxation and Revenue Department

*134090200*

Rev. 5/3/2013

2013 Annual Report of Non-Resident

Remittees Holding an Agreement to Pay

Tax on Oil and Gas Proceeds

- Supplemental Page -

Remitter’s FEIN or SSN

Remitter’s name

Check one:

FEIN

Page _______ of _______

SSN

Remittee’s name,

Column 2

Column 3

Column 4

street address,

Remittee’s SSN/FEIN

Remittee’s oil and

Tax withheld and

city, state, ZIP code

gas proceeds

paid by the remitter

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

If more space is needed, print the Supplemental page directly from

2.

Line 2. Total withholding this page.

the website and attach the additional supplemental pages to the

first page of this report. Reproducing from a photocopy reduces the

readability of the bar code on scanning equipment.

OGP-D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2