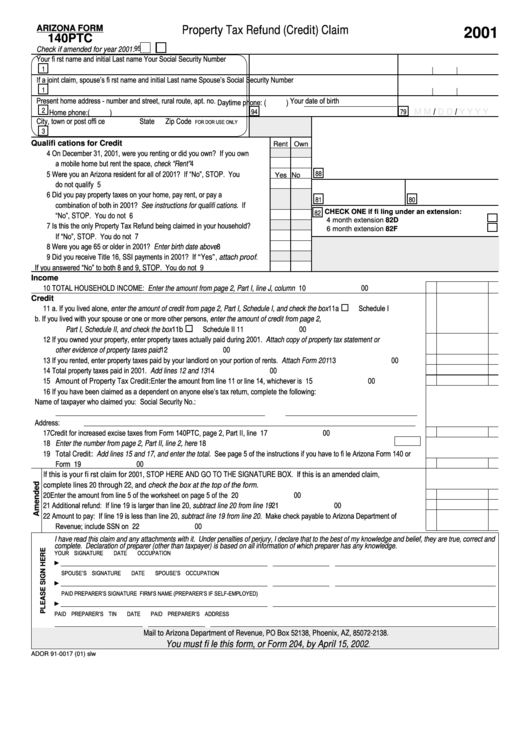

Arizona Form 140ptc - Property Tax Refund (Credit) Claim - 2001

ADVERTISEMENT

Property Tax Refund (Credit) Claim

ARIZONA FORM

2001

140PTC

95

Check if amended for year 2001:

Your fi rst name and initial

Last name

Your Social Security Number

1

If a joint claim, spouse’s fi rst name and initial

Last name

Spouse’s Social Security Number

1

Present home address - number and street, rural route, apt. no.

Your date of birth

Daytime phone: (

)

2

/

/

94

79

Home phone: (

)

M M

D D

Y Y Y Y

City, town or post offi ce

State

Zip Code

FOR DOR USE ONLY

3

Qualifi cations for Credit

Rent Own

4 On December 31, 2001, were you renting or did you own? If you own

a mobile home but rent the space, check “Rent” ...................................

4

5 Were you an Arizona resident for all of 2001? If “No”, STOP. You

88

Yes

No

do not qualify .........................................................................................

5

6 Did you pay property taxes on your home, pay rent, or pay a

81

80

combination of both in 2001? See instructions for qualifi cations. If

82

CHECK ONE if fi ling under an extension:

“No”, STOP. You do not qualify.............................................................

6

4 month extension

82D

7 Is this the only Property Tax Refund being claimed in your household?

6 month extension

82F

If “No”, STOP. You do not qualify..........................................................

7

8 Were you age 65 or older in 2001? Enter birth date above ..................

8

9 Did you receive Title 16, SSI payments in 2001? If “Yes”, attach proof.

If you answered “No” to both 8 and 9, STOP. You do not qualify..........

9

Income

10 TOTAL HOUSEHOLD INCOME: Enter the amount from page 2, Part I, line J, column 4 .................................................................. 10

00

Credit

!

11 a. If you lived alone, enter the amount of credit from page 2, Part I, Schedule I, and check the box ..........

11a

Schedule I

b. If you lived with your spouse or one or more other persons, enter the amount of credit from page 2,

!

Part I, Schedule II, and check the box .....................................................................................................

11b

Schedule II

11

00

12 If you owned your property, enter property taxes actually paid during 2001. Attach copy of property tax statement or

other evidence of property taxes paid.................................................................................................................................................. 12

00

13 If you rented, enter property taxes paid by your landlord on your portion of rents. Attach Form 201................................................. 13

00

14 Total property taxes paid in 2001. Add lines 12 and 13 ...................................................................................................................... 14

00

15 Amount of Property Tax Credit: Enter the amount from line 11 or line 14, whichever is less ......................................................... 15

00

16 If you have been claimed as a dependent on anyone else’s tax return, complete the following:

Name of taxpayer who claimed you:

Social Security No.:

Address:

17 Credit for increased excise taxes from Form 140PTC, page 2, Part II, line 6...................................................................................... 17

00

18 Enter the number from page 2, Part II, line 2, here ...................................................................................................... 18

19 Total Credit: Add lines 15 and 17, and enter the total. See page 5 of the instructions if you have to fi le Arizona Form 140 or

Form 140A ........................................................................................................................................................................................... 19

00

If this is your fi rst claim for 2001, STOP HERE AND GO TO THE SIGNATURE BOX. If this is an amended claim,

complete lines 20 through 22, and check the box at the top of the form.

20 Enter the amount from line 5 of the worksheet on page 5 of the instructions...................................................................................... 20

00

21 Additional refund: If line 19 is larger than line 20, subtract line 20 from line 19.................................................................................. 21

00

22 Amount to pay: If line 19 is less than line 20, subtract line 19 from line 20. Make check payable to Arizona Department of

Revenue; include SSN on payment..................................................................................................................................................... 22

00

I have read this claim and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true, correct and

complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

YOUR SIGNATURE

DATE

OCCUPATION

►

SPOUSE’S SIGNATURE

DATE

SPOUSE’S OCCUPATION

►

PAID PREPARER’S SIGNATURE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

►

PAID PREPARER’S TIN

DATE

PAID PREPARER’S ADDRESS

Mail to Arizona Department of Revenue, PO Box 52138, Phoenix, AZ, 85072-2138.

You must fi le this form, or Form 204, by April 15, 2002

.

ADOR 91-0017 (01) slw

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2