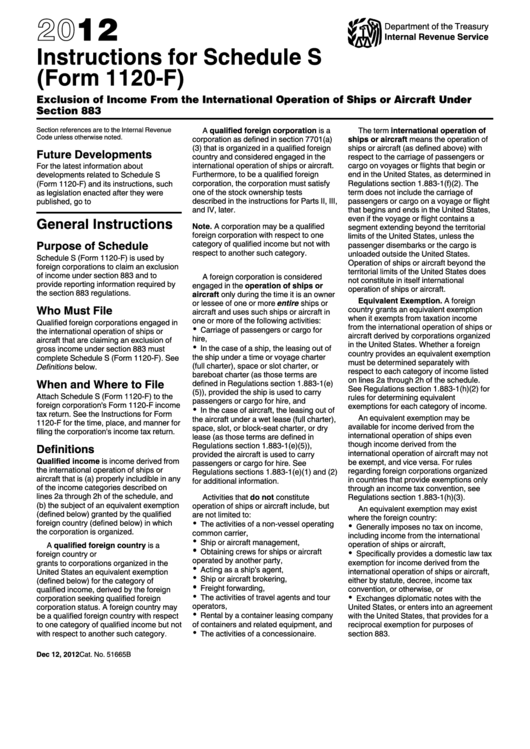

Instructions For Schedule S (Form 1120-F) - 2012

ADVERTISEMENT

2012

Department of the Treasury

Internal Revenue Service

Instructions for Schedule S

(Form 1120-F)

Exclusion of Income From the International Operation of Ships or Aircraft Under

Section 883

A qualified foreign corporation is a

The term international operation of

Section references are to the Internal Revenue

Code unless otherwise noted.

corporation as defined in section 7701(a)

ships or aircraft means the operation of

(3) that is organized in a qualified foreign

ships or aircraft (as defined above) with

Future Developments

country and considered engaged in the

respect to the carriage of passengers or

international operation of ships or aircraft.

cargo on voyages or flights that begin or

For the latest information about

Furthermore, to be a qualified foreign

end in the United States, as determined in

developments related to Schedule S

corporation, the corporation must satisfy

Regulations section 1.883-1(f)(2). The

(Form 1120-F) and its instructions, such

one of the stock ownership tests

term does not include the carriage of

as legislation enacted after they were

described in the instructions for Parts II, III,

passengers or cargo on a voyage or flight

published, go to

and IV, later.

that begins and ends in the United States,

even if the voyage or flight contains a

General Instructions

Note. A corporation may be a qualified

segment extending beyond the territorial

foreign corporation with respect to one

limits of the United States, unless the

Purpose of Schedule

category of qualified income but not with

passenger disembarks or the cargo is

respect to another such category.

unloaded outside the United States.

Schedule S (Form 1120-F) is used by

Operation of ships or aircraft beyond the

foreign corporations to claim an exclusion

territorial limits of the United States does

of income under section 883 and to

A foreign corporation is considered

not constitute in itself international

provide reporting information required by

engaged in the operation of ships or

operation of ships or aircraft.

the section 883 regulations.

aircraft only during the time it is an owner

Equivalent Exemption. A foreign

or lessee of one or more entire ships or

Who Must File

country grants an equivalent exemption

aircraft and uses such ships or aircraft in

when it exempts from taxation income

one or more of the following activities:

Qualified foreign corporations engaged in

from the international operation of ships or

Carriage of passengers or cargo for

the international operation of ships or

aircraft derived by corporations organized

hire,

aircraft that are claiming an exclusion of

in the United States. Whether a foreign

In the case of a ship, the leasing out of

gross income under section 883 must

country provides an equivalent exemption

the ship under a time or voyage charter

complete Schedule S (Form 1120-F). See

must be determined separately with

(full charter), space or slot charter, or

Definitions below.

respect to each category of income listed

bareboat charter (as those terms are

on lines 2a through 2h of the schedule.

When and Where to File

defined in Regulations section 1.883-1(e)

See Regulations section 1.883-1(h)(2) for

(5)), provided the ship is used to carry

Attach Schedule S (Form 1120-F) to the

rules for determining equivalent

passengers or cargo for hire, and

foreign corporation's Form 1120-F income

exemptions for each category of income.

In the case of aircraft, the leasing out of

tax return. See the Instructions for Form

An equivalent exemption may be

the aircraft under a wet lease (full charter),

1120-F for the time, place, and manner for

available for income derived from the

space, slot, or block-seat charter, or dry

filing the corporation's income tax return.

international operation of ships even

lease (as those terms are defined in

though income derived from the

Regulations section 1.883-1(e)(5)),

Definitions

international operation of aircraft may not

provided the aircraft is used to carry

Qualified income is income derived from

be exempt, and vice versa. For rules

passengers or cargo for hire. See

the international operation of ships or

regarding foreign corporations organized

Regulations sections 1.883-1(e)(1) and (2)

aircraft that is (a) properly includible in any

in countries that provide exemptions only

for additional information.

of the income categories described on

through an income tax convention, see

lines 2a through 2h of the schedule, and

Activities that do not constitute

Regulations section 1.883-1(h)(3).

(b) the subject of an equivalent exemption

operation of ships or aircraft include, but

An equivalent exemption may exist

(defined below) granted by the qualified

are not limited to:

where the foreign country:

foreign country (defined below) in which

The activities of a non-vessel operating

Generally imposes no tax on income,

the corporation is organized.

common carrier,

including income from the international

Ship or aircraft management,

operation of ships or aircraft,

A qualified foreign country is a

Obtaining crews for ships or aircraft

Specifically provides a domestic law tax

foreign country or U.S. possession that

operated by another party,

exemption for income derived from the

grants to corporations organized in the

Acting as a ship's agent,

international operation of ships or aircraft,

United States an equivalent exemption

Ship or aircraft brokering,

either by statute, decree, income tax

(defined below) for the category of

Freight forwarding,

qualified income, derived by the foreign

convention, or otherwise, or

The activities of travel agents and tour

corporation seeking qualified foreign

Exchanges diplomatic notes with the

operators,

corporation status. A foreign country may

United States, or enters into an agreement

Rental by a container leasing company

be a qualified foreign country with respect

with the United States, that provides for a

of containers and related equipment, and

to one category of qualified income but not

reciprocal exemption for purposes of

with respect to another such category.

The activities of a concessionaire.

section 883.

Dec 12, 2012

Cat. No. 51665B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4