View Instructions

Reset Form

Print Form

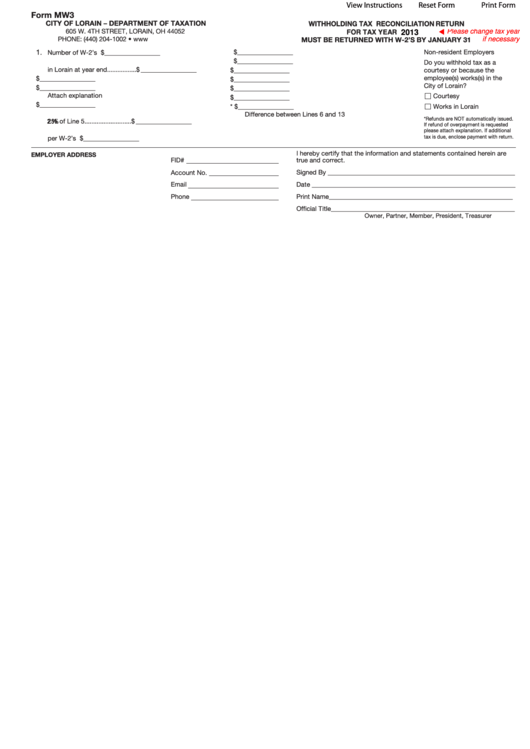

Form MW3

CITY OF LORAIN – DEPARTMENT OF TAXATION

WITHHOLDING TAX RECONCILIATION RETURN

FOR TAX YEAR

605 W. 4TH STREET, LORAIN, OH 44052

t Please change tax year

2013

MUST BE RETURNED WITH W-2’S BY JANUARY 31

PHONE: (440) 204-1002 •

if necessary

1.

8. Quarter ended March 31 .................$ _________________

Non-resident Employers

Number of W-2’s attached ..............$ _________________

9. Quarter ended June 30....................$ _________________

2. Number of employees working

Do you withhold tax as a

in Lorain at year end ........................$ _________________

10. Quarter ended September 30..........$ _________________

courtesy or because the

employee(s) works(s) in the

3. Total payroll for the year ..................$ _________________

11. Quarter ended December 31...........$ _________________

City of Lorain?

4. Less payroll not subject to tax ........$ _________________

12. Credits from prior year.....................$ _________________

Attach explanation

Courtesy

13. Total remitted for year......................$ _________________

5. Payroll subject to tax .......................$ _________________

14. Amount due or overpaid*.................$ _________________

Works in Lorain

6. Withholding tax liability at

Difference between Lines 6 and 13

*Refunds are NOT automatically issued.

2.5%

2% of Line 5....................................$ _________________

If refund of overpayment is requested

7. Total Lorain tax withheld

please attach explanation. If additional

tax is due, enclose payment with return.

per W-2’s .........................................$ _________________

EMPLOYER ADDRESS

I hereby certify that the information and statements contained herein are

FID#

true and correct.

Account No.

Signed By _________________________________________________________

Email

Date ______________________________________________________________

Phone

Print Name ________________________________________________________

Official Title ________________________________________________________

Owner, Partner, Member, President, Treasurer

1

1 2

2