Biotechnology Tax Credit Application For General Corporation Tax And Unincorporated Business Tax - Nyc Department Of Finance Page 2

ADVERTISEMENT

Biotechnology Credit Application for General Corporation Tax and Unincorporated Business Tax

Page 2

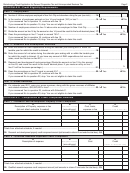

SCHEDULE B - Credit Eligibility Requirements

PART 1 - Employment

14. Number of full-time employees employed in New York City and elsewhere during the year (see instr.) .........14. ________________________

15. Is the number of employees entered on line 14 one hundred (100) or less? ...............................15.

Yes

No

K

K

If you answered Yes to question 15, continue with line 16.

If you answered No to question 15, stop. You are not eligible to claim this credit.

16. Number of employees entered on line 14 above who are employed in New York City ................16. ________________________

%

17. Divide the amount on line 16 by the amount on line 14 (round the result to the fourth decimal place) .17. ________________________

18. Does the percentage on line 17 equal or exceed 75%? ...............................................................18.

Yes

No

K

K

If you answered Yes to question 18, continue with line 19.

If you answered No to question 18, stop. You are not eligible to claim this credit.

PART 2 - Research and Development Activities

19. Enter the amount of R&D expenditures during the calendar year ending with or within the

taxable year for which the credit is claimed ..................................................................................19. ________________________

20. Enter the amount of net sales during the calendar year ending with or within the taxable year

for which the credit is claimed. (If you have any amount of R&D expenditures but zero net

sales, mark the Yes box on line 22.) .................................................................................................20. ________________________

21. Research and development funds percentage (Divide the amount on line 19 by the amount

%

on line 20, and round the result to the fourth decimal place. If you made an entry on line 7,

line 21 will be the same percentage.)............................................................................................21. ________________________

22. Does the percentage on line 21 equal or exceed 6%? .................................................................22.

Yes

No

K

K

If you answered Yes to question 22, continue with line 23.

If you answered No to question 22, stop. You are not eligible to claim this credit.

PART 3 - Gross Revenues

23. For calendar year 2011, were your gross revenues, along with the gross revenues of affiliates

and related members, $20,000,000 or less? .................................................................................23.

Yes

No

K

K

If you answered Yes to question 23, continue with Schedule C.

If you answered No to question 23, stop. You are not eligible to claim this credit.

SCHEDULE C - Computation of Credit Component Amounts

PART 1 - Research and Development Property Credit Component

A

B

C

D

Description of Property, expense or fee

Cost, basis,

Credit

Date placed in service

(list and attach schedule if needed)

(mm-dd-yyyy)

expense or fee

(column C x rate of 18% (.18))

Totals from attached schedule, if needed ............................................................

24. Research and development property credit component amount (add amounts in column D and enter the total here) ..24.

PART 2 - Qualified Research expenses Credit Component

A

B

C

D

Description of expense

Cost

Credit

Date paid or incurred

(mm-dd-yyyy)

(column C x rate of 9% (.09))

Totals from attached schedule, if needed ............................................................

25. Qualified research expenses credit component amount (add amounts in column D and enter the total here) ...25.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3