Biotechnology Tax Credit Application For General Corporation Tax And Unincorporated Business Tax - Nyc Department Of Finance Page 3

ADVERTISEMENT

Biotechnology Credit Application for General Corporation Tax and Unincorporated Business Tax

Page 3

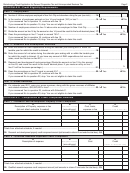

SCHEDULE C - Computation of Credit Component Amounts - Continued

PART 3 - Qualified High-Technology Training Expenditures Credit Component

A

B

C

D

E

F

Employee

Social

Description of qualified

Date paid

Amount

Credit (enter the

name

Security

high-technology

or incurred

of expense

lesser of Column E

number

training expense

mm-dd-yyyy

or $4,000)

Totals from attached schedule, if needed ................................................................................................................

26. Qualified high technology training expenditures credit component amount

....26.

(add amounts in column F and enter the total here)

SCHEDULE D - Credit Limitations

PART 1 - Dollar Amount

27. Total credit component amounts ................................................................................................................27. ________________________

$250,000 00

28. Credit limitation ..............................................................................................................................28. ________________________

29. Available credit after limitation (enter the lesser of line 27 or line 28; see instructions).................29. ________________________

PART 2 - Percentage Limitation

30. Enter the number of full-time employees located in the City of New York during the

base year (see instructions) ..........................................................................................................30. ________________________

31. Enter the number of full-time employees located in the City of New York in the calendar

year ending with or within the taxable year. ..................................................................................31. ________________________

%

32. Divide the number entered in line 31 by the number entered in line 30 and enter the percentage .....32. ________________________

33. Is the number of full-time employees entered on line 32, 105% or greater? ................................33.

Yes

No

K

K

34. If you answered Yes on line 33, enter the amount on line 29 .......................................................34. ________________________

35. Is the company receiving space and support services by an academic incubator facility? .........35.

Yes

No

K

K

36. If you answered No on both lines 33 and 35, enter 50% of the amount on line 29......................36. ________________________

If you answered No on line 33 and Yes on line 35, enter zero. The company is not entitled to a credit.

CERTIFICATION

I hereby certify that this application, including any accompanying documentation, is, to the best of my knowledge and belief, true, correct and complete.

_________________________________________________

___________________________________________________

SIGNATURE

PRINTED NAME

____________________________________________

_____________________________

__________________________

TITLE

TELEPHONE NUMBER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3