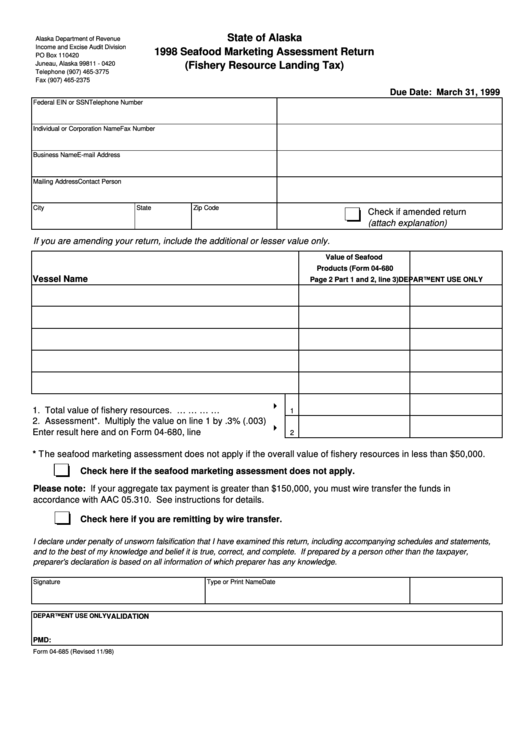

State of Alaska

Alaska Department of Revenue

Income and Excise Audit Division

1998 Seafood Marketing Assessment Return

PO Box 110420

Juneau, Alaska 99811 - 0420

(Fishery Resource Landing Tax)

Telephone (907) 465-3775

Fax (907) 465-2375

Due Date: March 31, 1999

Federal EIN or SSN

Telephone Number

Individual or Corporation Name

Fax Number

Business Name

E-mail Address

Mailing Address

Contact Person

City

State

Zip Code

Check if amended return

(attach explanation)

If you are amending your return, include the additional or lesser value only.

Value of Seafood

Products (Form 04-680

Vessel Name

Page 2 Part 1 and 2, line 3)

DEPARTMENT USE ONLY

4

1. Total value of fishery resources. ..........................................................…...........................…..................................................

1

2. Assessment*. Multiply the value on line 1 by .3% (.003)

4

Enter result here and on Form 04-680, line 4....................................................................

2

* The seafood marketing assessment does not apply if the overall value of fishery resources in less than $50,000.

Check here if the seafood marketing assessment does not apply.

Please note: If your aggregate tax payment is greater than $150,000, you must wire transfer the funds in

accordance with AAC 05.310. See instructions for details.

Check here if you are remitting by wire transfer.

I declare under penalty of unsworn falsification that I have examined this return, including accompanying schedules and statements,

and to the best of my knowledge and belief it is true, correct, and complete. If prepared by a person other than the taxpayer,

preparer's declaration is based on all information of which preparer has any knowledge.

Signature

Type or Print Name

Date

DEPARTMENT USE ONLY

VALIDATION

PMD:

Form 04-685 (Revised 11/98)

1

1