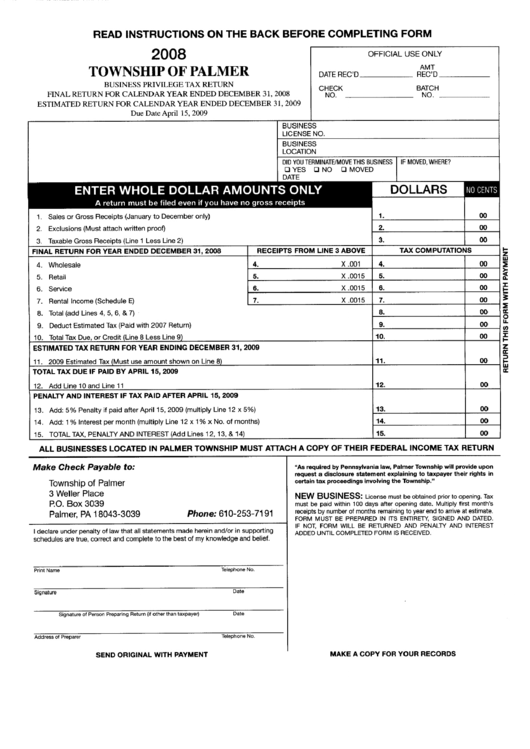

Business Privilege Tax Return Form 2008

ADVERTISEMENT

READ

INSTRUCTIONS ON

THE

BACK BEFORE COMPLETING FORM

2008

TOWNSHIP OF PALMER

OFFICIAL USE ONLY

AMT

DATE

REC

D

REC D

BUSINESS PRIVILEGE TAX RETURN

FINAL

RETURN

FOR CALENDAR YEAR ENDED DECEMBER 31 2008

ESTIMATED RETURN FOR CALENDAR YEAR ENDED DECEMBER 31 2009

Due

Date

April

15 2009

CHECK

BATCH

NO

NO

BUSINESS

LICENSE NO

BUSINESS

LOCATION

DID YOU TERMINATEMOVE THIS BUSINESS

IF MOVED WHERE

DYES

0 NO

0 MOVED

DATE

ENTER WHOLE DOLLAR AMOUNTS ONLY

A return

must

be filed

even

if you have

no

gross

receipts

DOLLARS

00

00

00

TAX

COMPUTATIONS

I

z

W

00

E

00

ll

00

J

I

00

j

E

00

a

0

00

II

Q

00

J

I

Z

a

00

I

W

a

00

00

00

00

1

Sales

or

Gross

Receipts January

to December

only

2

Exclusions Must attach written

proof

3

Taxable Gross

Receipts

Line 1 Less Line 2

FINAL RETURN FOR YEAR ENDED DECEMBER 31

2008

4

Wholesale

1

2

3

RECEIPTS

FROM

LINE 3 ABOVE

4

X 001

4

X 0015

5

X 0015

6

X 0015

7

8

9

10

11

12

13

14

15

5

Retail

5

6

Service

6

7

Rental Income

Schedule E

7

8

Total add Lines 4 5 6

7

9

Deduct

Estimated

Tax

Paid

with 2007 Return

10

Total Tax Due

or

Credit

Line 8 Less Line 9

ESTIMATED

TAX RETURN FOR YEAR

ENDING

DECEMBER 31 2009

11

2009 Estimated Tax

Must

use

amount shown

on

Line 8

TOTAL TAX DUE IF PAID BY APRIL 15 2009

12

Add Line 10 and Line 11

PENALTY AND

INTEREST

IF TAX PAID AFTER APRIL 15 2009

13

Add 5

Penalty

if

paid

after

April

15 2009

multiply

Line 12

x

5

14

Add 1

Interest per month

multiply

Line 12

x

1

x

No

of months

15

TOTAL TAX

PENALTY

AND

INTEREST

Add Lines 12 13

14

ALL

BUSINESSES

LOCATED IN PALMER TOWNSHIP

MUST

ATTACH A

COPY

OF THEIR FEDERAL INCOME TAX RETURN

Make Check

Payable

to

Township

of Palmer

3 Weller Place

P O Box 3039

Palmer PA 18043 3039

As

required by Pennsylvania

law Palmer

Township

will

provide

upon

request

a

disclosure

statement

explaining

to

taxpayer their

rights

in

certain

tax

proceedings involving

the

Township

Phone 610 253 7191

NEW BUSINESS

License

must

be obtained

prior

to

opening

Tax

must

be

paid

within 100

days

after

opening

date

Multiply

first month

s

receipts by

number of months

remaining

to year end

to

arrive

at

estimate

FORM MUST BE PREPARED IN ITS ENTIRETY SIGNED AND DATED

IF NOT

FORM WILL BE RETURNED AND PENALTY AND INTEREST

ADDED UNTIL COMPLETED FORM IS RECEIVED

I declare under

penalty

of law that all statements made herein and

or

in

supporting

schedules

are

true correct and

complete

to the best of my

knowledge

and belief

Print Name

Telephone

No

Signature

Date

Signature

of Person

Preparing

Return

if

other than

taxpayer

Date

Address of

Preparer

Telephone

No

SEND

ORIGINAL WITH PAYMENT

MAKE A

COpy

FOR YOUR

RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1