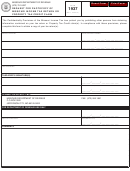

Section 4 - Property Tax Credit

You must answer all 5 questions.

Yes

No

1.

Will you be age 65 or older before December 31, 1998?

or

Are you a widow or widower (not remaried)?

If you are a widow or widower, enter your spouse's date of death:_________. If filing for the first

time as a widow or widower, you must attach a copy of the Death Certificate of your deceased spouse.

Yes

No

2.

Was your household income (from section 2, line I) less than $21,644?

Yes

No

3.

Will you furnish your own financial support for 1998 (you cannot be claimed as a dependent on

someone's tax return)?

Yes

No

4.

Will you live in Utah for the entire year of 1998?

An applicant must be domiciled in Utah for the entire calendar to be eligible.

Yes

No

5.

Have all prior years' property tax obligations been paid?

If your name is not listed as the property owner of the Property Tax Billins Notice, attach legal documentation of

ownership. Only property tax on claimant's primary residence is eligible for property tax credit.

Is your home located on property

that exceeds one acre

?

Yes

No

If yes, total number of acres

Do you rent out a portion of your home?

Yes

No

If yes, what percent is rented

Do you use a portion of your home for business?

Yes

No

If yes, what percent is used

You must have owned your home on January 1, 1998 to qualify.

If you qualify for property tax credit, you may also qualify for low income credit, on the reverse side.

Section 5 - Certification and Signature

Read certification, sign and date.

Under penalties of perjury, I declare to the best of my knowledge and understanding, this information is true, correct and complete.

Signature of claimant

Date

Signature of spouse

Date

(Spouse must sign if home is owned in joint tenancy)

X

X

Preparer's name and address or organization (if not claimant)

Preparer's telephone number

Property Tax Credit Schedule

For County Use Only

(estimated)

Tax amount

1997 Household

Property

Income

Tax Credit

Blind and/or veteran

Under

$7,358

$577

$7,359

$9,812

$504

Indigent abatement

$9,813

$12,264

$432

$12,265

$14,717

$324

Circuit breaker

$14,718

$17,171

$252

$17,172

$19,479

$144

$19,480

$21,644

$71

Net tax due

County government approval

Date approved

40CYB.FRM Rev. 4/98

1

1 2

2