Individual Refund Form - Ohio Department Of Taxation

ADVERTISEMENT

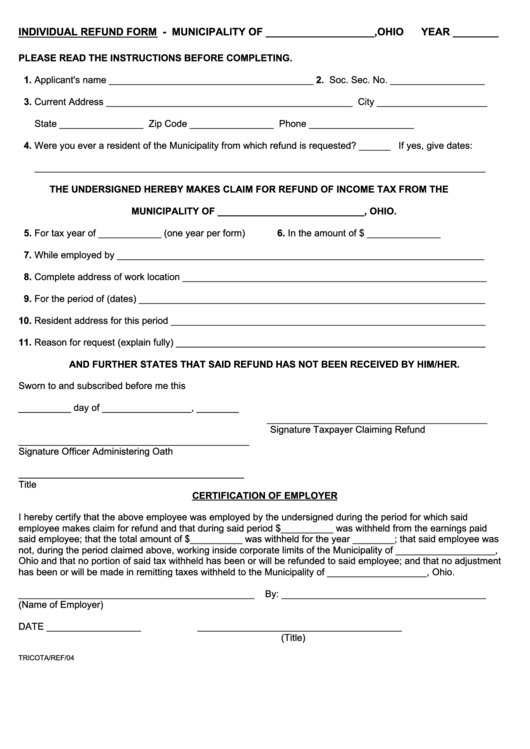

INDIVIDUAL REFUND FORM - MUNICIPALITY OF ___________________,OHIO

YEAR ________

PLEASE READ THE INSTRUCTIONS BEFORE COMPLETING.

1. Applicant's name _______________________________________ 2. Soc. Sec. No. __________________

3. Current Address _______________________________________________ City _____________________

State ________________ Zip Code ________________ Phone ____________________

4. Were you ever a resident of the Municipality from which refund is requested? ______ If yes, give dates:

______________________________________________________________________________________

THE UNDERSIGNED HEREBY MAKES CLAIM FOR REFUND OF INCOME TAX FROM THE

MUNICIPALITY OF ____________________________, OHIO.

5. For tax year of ____________ (one year per form)

6. In the amount of $ ______________

7. While employed by ______________________________________________________________________

8. Complete address of work location __________________________________________________________

9. For the period of (dates) __________________________________________________________________

10. Resident address for this period ____________________________________________________________

11. Reason for request (explain fully) ___________________________________________________________

AND FURTHER STATES THAT SAID REFUND HAS NOT BEEN RECEIVED BY HIM/HER.

Sworn to and subscribed before me this

__________ day of _________________, ________

__________________________________________

Signature Taxpayer Claiming Refund

____________________________________________

Signature Officer Administering Oath

___________________________________________

Title

CERTIFICATION OF EMPLOYER

I hereby certify that the above employee was employed by the undersigned during the period for which said

employee makes claim for refund and that during said period $__________ was withheld from the earnings paid

said employee; that the total amount of $__________ was withheld for the year ________; that said employee was

not, during the period claimed above, working inside corporate limits of the Municipality of ___________________,

Ohio and that no portion of said tax withheld has been or will be refunded to said employee; and that no adjustment

has been or will be made in remitting taxes withheld to the Municipality of ___________________, Ohio.

_____________________________________________

By: _______________________________________

(Name of Employer)

DATE __________________

_______________________________________

(Title)

TRICOTA/REF/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1