Instructions For Form Ia8453ol

ADVERTISEMENT

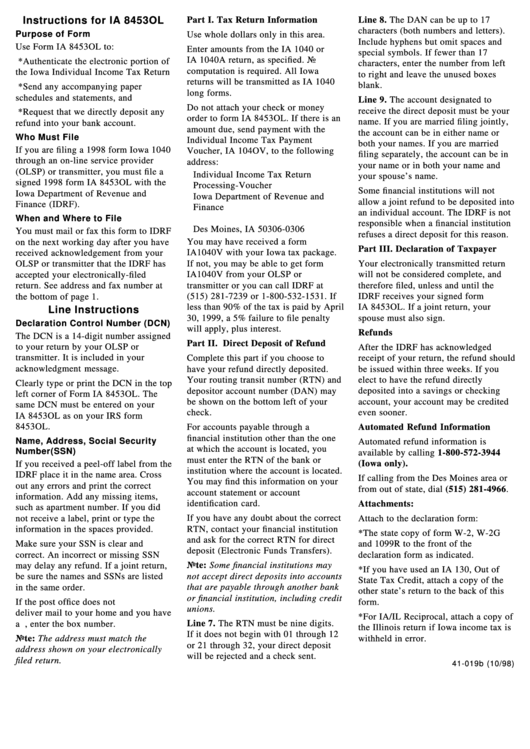

Instructions for IA 8453OL

Part I. Tax Return Information

Line 8. The DAN can be up to 17

characters (both numbers and letters).

Purpose of Form

Use whole dollars only in this area.

Include hyphens but omit spaces and

Use Form IA 8453OL to:

Enter amounts from the IA 1040 or

special symbols. If fewer than 17

IA 1040A return, as specified. No

*Authenticate the electronic portion of

characters, enter the number from left

computation is required. All Iowa

the Iowa Individual Income Tax Return

to right and leave the unused boxes

returns will be transmitted as IA 1040

blank.

*Send any accompanying paper

long forms.

schedules and statements, and

Line 9. The account designated to

Do not attach your check or money

receive the direct deposit must be your

*Request that we directly deposit any

order to form IA 8453OL. If there is an

name. If you are married filing jointly,

refund into your bank account.

amount due, send payment with the

the account can be in either name or

Who Must File

Individual Income Tax Payment

both your names. If you are married

If you are filing a 1998 form Iowa 1040

Voucher, IA 104OV, to the following

filing separately, the account can be in

through an on-line service provider

address:

your name or in both your name and

(OLSP) or transmitter, you must file a

Individual Income Tax Return

your spouse’s name.

signed 1998 form IA 8453OL with the

Processing-Voucher

Some financial institutions will not

Iowa Department of Revenue and

Iowa Department of Revenue and

allow a joint refund to be deposited into

Finance (IDRF).

Finance

an individual account. The IDRF is not

P.O. Box 10306

When and Where to File

responsible when a financial institution

Des Moines, IA 50306-0306

You must mail or fax this form to IDRF

refuses a direct deposit for this reason.

You may have received a form

on the next working day after you have

Part III. Declaration of Taxpayer

received acknowledgement from your

IA1040V with your Iowa tax package.

If not, you may be able to get form

Your electronically transmitted return

OLSP or transmitter that the IDRF has

will not be considered complete, and

accepted your electronically-filed

IA1040V from your OLSP or

transmitter or you can call IDRF at

therefore filed, unless and until the

return. See address and fax number at

(515) 281-7239 or 1-800-532-1531. If

IDRF receives your signed form

the bottom of page 1.

less than 90% of the tax is paid by April

IA 8453OL. If a joint return, your

Line Instructions

30, 1999, a 5% failure to file penalty

spouse must also sign.

Declaration Control Number (DCN)

will apply, plus interest.

Refunds

The DCN is a 14-digit number assigned

Part II. Direct Deposit of Refund

to your return by your OLSP or

After the IDRF has acknowledged

transmitter. It is included in your

Complete this part if you choose to

receipt of your return, the refund should

acknowledgment message.

have your refund directly deposited.

be issued within three weeks. If you

Your routing transit number (RTN) and

elect to have the refund directly

Clearly type or print the DCN in the top

depositor account number (DAN) may

deposited into a savings or checking

left corner of Form IA 8453OL. The

be shown on the bottom left of your

account, your account may be credited

same DCN must be entered on your

check.

even sooner.

IA 8453OL as on your IRS form

8453OL.

For accounts payable through a

Automated Refund Information

financial institution other than the one

Name, Address, Social Security

Automated refund information is

at which the account is located, you

Number (SSN)

available by calling 1-800-572-3944

must enter the RTN of the bank or

(Iowa only).

If you received a peel-off label from the

institution where the account is located.

IDRF place it in the name area. Cross

If calling from the Des Moines area or

You may find this information on your

out any errors and print the correct

from out of state, dial (515) 281-4966.

account statement or account

information. Add any missing items,

identification card.

Attachments:

such as apartment number. If you did

If you have any doubt about the correct

not receive a label, print or type the

Attach to the declaration form:

information in the spaces provided.

RTN, contact your financial institution

*The state copy of form W-2, W-2G

and ask for the correct RTN for direct

Make sure your SSN is clear and

and 1099R to the front of the

deposit (Electronic Funds Transfers).

correct. An incorrect or missing SSN

declaration form as indicated.

may delay any refund. If a joint return,

Note: Some financial institutions may

*If you have used an IA 130, Out of

not accept direct deposits into accounts

be sure the names and SSNs are listed

State Tax Credit, attach a copy of the

that are payable through another bank

in the same order.

other state’s return to the back of this

or financial institution, including credit

P.O. Box. If the post office does not

form.

unions.

deliver mail to your home and you have

*For IA/IL Reciprocal, attach a copy of

Line 7. The RTN must be nine digits.

a P.O. box, enter the box number.

the Illinois return if Iowa income tax is

If it does not begin with 01 through 12

Note: The address must match the

withheld in error.

or 21 through 32, your direct deposit

address shown on your electronically

will be rejected and a check sent.

filed return.

41-019b (10/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1