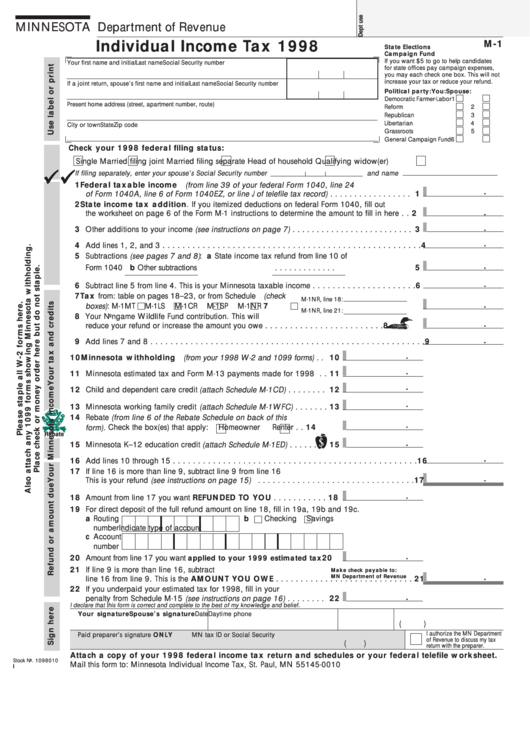

MINNESOTA Department of Revenue

Individual Income Tax 1998

M-1

State Elections

Campaign Fund

If you want $5 to go to help candidates

Your first name and initial

Last name

Social Security number

for state offices pay campaign expenses,

you may each check one box. This will not

increase your tax or reduce your refund.

If a joint return, spouse’s first name and initial

Last name

Social Security number

Political party:

You:

Spouse:

Democratic Farmer-Labor

1

Present home address (street, apartment number, route)

Reform

2

Republican

3

Libertarian

4

City or town

State

Zip code

Grassroots

5

General Campaign Fund

6

Check your 1998 federal filing status:

Single

Married filing joint

Married filing separate

Head of household

Qualifying widow(er)

If filing separately, enter your spouse’s Social Security number

and name

1 Federal taxable income (from line 39 of your federal Form 1040, line 24

.

of Form 1040A, line 6 of Form 1040EZ, or line J of telefile tax record) . . . . . . . . . . . . . . . . . 1

2 State income tax addition. If you itemized deductions on federal Form 1040, fill out

.

the worksheet on page 6 of the Form M-1 instructions to determine the amount to fill in here . . 2

.

3 Other additions to your income (see instructions on page 7) . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

4 Add lines 1, 2, and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtractions (see pages 7 and 8) : a State income tax refund from line 10 of

.

Form 1040

b Other subtractions

. . . . . . . . . . . . . 5

.

6 Subtract line 5 from line 4. This is your Minnesota taxable income . . . . . . . . . . . . . . . . . . . . . 6

7 Tax from: table on pages 18–23, or from Schedule (check

M-1NR, line 18:

.

boxes) : M-1MT

M-1LS

M-1CR

M-1SP

M-1NR

7

M-1NR, line 21:

8 Your Nongame Wildlife Fund contribution. This will

.

reduce your refund or increase the amount you owe . . . . . . . . . . . . . . . . . . . . . . . .

8

.

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

.

10 Minnesota withholding (from your 1998 W-2 and 1099 forms) . . 10

.

11 Minnesota estimated tax and Form M-13 payments made for 1998 . . 11

.

12 Child and dependent care credit (attach Schedule M-1CD) . . . . . . . . 12

.

13 Minnesota working family credit (attach Schedule M-1WFC) . . . . . . . 13

14 Rebate (from line 6 of the Rebate Schedule on back of this

.

form). Check the box(es) that apply:

Homeowner

Renter . . 14

Rebate

.

15 Minnesota K–12 education credit (attach Schedule M-1ED) . . . . . .

15

.

16 Add lines 10 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 If line 16 is more than line 9, subtract line 9 from line 16

.

This is your refund (see instructions on page 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

.

18 Amount from line 17 you want REFUNDED TO YOU . . . . . . . . . . . 18

19 For direct deposit of the full refund amount on line 18, fill in 19a, 19b and 19c.

a Routing

b

Checking

Savings

number

Indicate type of account

c Account

number

.

20 Amount from line 17 you want

applied to your 1999 estimated tax

20

21 If line 9 is more than line 16, subtract

Make check payable to:

MN Department of Revenue

.

line 16 from line 9. This is the AMOUNT YOU OWE . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 If you underpaid your estimated tax for 1998, fill in your

.

penalty from Schedule M-15 (see instructions on page 16) . . . . . . . . 22

I declare that this form is correct and complete to the best of my knowledge and belief.

Your signature

Spouse’s signature

Date

Daytime phone

(

)

I authorize the MN Department

Paid preparer’s signature ONLY

MN tax ID or Social Security no.

Date

Daytime phone

of Revenue to discuss my tax

(

)

return with the preparer.

Attach a copy of your 1998 federal income tax return and schedules or your federal telefile worksheet.

Stock No. 1098010

Mail this form to: Minnesota Individual Income Tax, St. Paul, MN 55145-0010

I I I I I

1

1 2

2