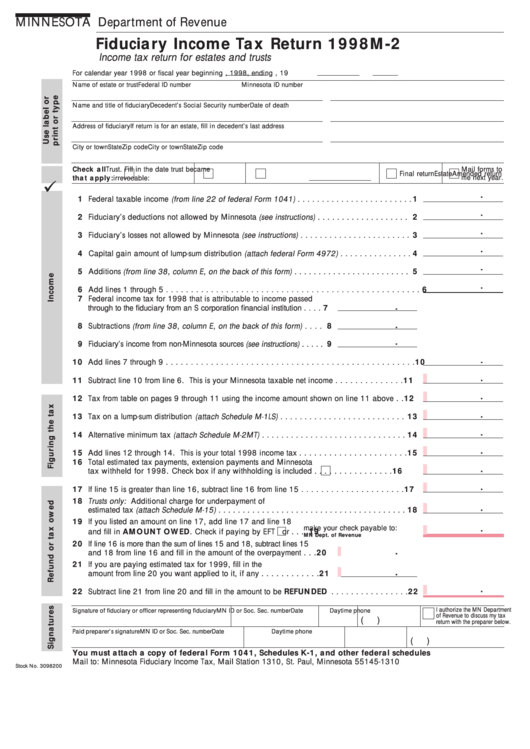

MINNESOTA Department of Revenue

Fiduciary Income Tax Return 1998

M-2

Income tax return for estates and trusts

For calendar year 1998 or fiscal year beginning

, 1998, ending

, 19

Name of estate or trust

Federal ID number

Minnesota ID number

Name and title of fiduciary

Decedent’s Social Security number

Date of death

Address of fiduciary

If return is for an estate, fill in decedent’s last address

City or town

State

Zip code

City or town

State

Zip code

Check all

Trust. Fill in the date trust became

Mail forms to

Amended return

Estate

Final return

me next year.

that apply:

irrevocable:

.

1 Federal taxable income (from line 22 of federal Form 1041) . . . . . . . . . . . . . . . . . . . . . . . . 1

.

2 Fiduciary’s deductions not allowed by Minnesota (see instructions) . . . . . . . . . . . . . . . . . . . 2

.

3 Fiduciary’s losses not allowed by Minnesota (see instructions) . . . . . . . . . . . . . . . . . . . . . . . 3

.

4 Capital gain amount of lump-sum distribution (attach federal Form 4972) . . . . . . . . . . . . . . . 4

.

5 Additions (from line 38, column E, on the back of this form) . . . . . . . . . . . . . . . . . . . . . . . . 5

.

6 Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Federal income tax for 1998 that is attributable to income passed

.

through to the fiduciary from an S corporation financial institution . . . . 7

.

8 Subtractions (from line 38, column E, on the back of this form) . . . . 8

.

9 Fiduciary’s income from non-Minnesota sources (see instructions) . . . . . 9

.

10 Add lines 7 through 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

11 Subtract line 10 from line 6. This is your Minnesota taxable net income . . . . . . . . . . . . . . 11

.

12 Tax from table on pages 9 through 11 using the income amount shown on line 11 above . . 12

.

13 Tax on a lump-sum distribution (attach Schedule M-1LS) . . . . . . . . . . . . . . . . . . . . . . . . . . 13

.

14 Alternative minimum tax (attach Schedule M-2MT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

.

15 Add lines 12 through 14. This is your total 1998 income tax . . . . . . . . . . . . . . . . . . . . . . 15

16 Total estimated tax payments, extension payments and Minnesota

.

tax withheld for 1998. Check box if any withholding is included

. . . . . . . . . . . . . . . . 16

.

17 If line 15 is greater than line 16, subtract line 16 from line 15 . . . . . . . . . . . . . . . . . . . . . 17

18 Trusts only: Additional charge for underpayment of

.

estimated tax (attach Schedule M-15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 If you listed an amount on line 17, add line 17 and line 18

make your check payable to:

.

and fill in AMOUNT OWED. Check if paying by EFT

or

. . . . 19

MN Dept. of Revenue

20 If line 16 is more than the sum of lines 15 and 18, subtract lines 15

.

and 18 from line 16 and fill in the amount of the overpayment . . . 20

21 If you are paying estimated tax for 1999, fill in the

.

amount from line 20 you want applied to it, if any . . . . . . . . . . . . 21

.

22 Subtract line 21 from line 20 and fill in the amount to be REFUNDED . . . . . . . . . . . . . . . . 22

I authorize the MN Department

Signature of fiduciary or officer representing fiduciary

MN ID or Soc. Sec. number

Date

Daytime phone

of Revenue to discuss my tax

(

)

return with the preparer below.

Paid preparer’s signature

MN ID or Soc. Sec. number

Date

Daytime phone

(

)

You must attach a copy of federal Form 1041, Schedules K-1, and other federal schedules

Mail to: Minnesota Fiduciary Income Tax, Mail Station 1310, St. Paul, Minnesota 55145-1310

Stock No. 3098200

1

1 2

2