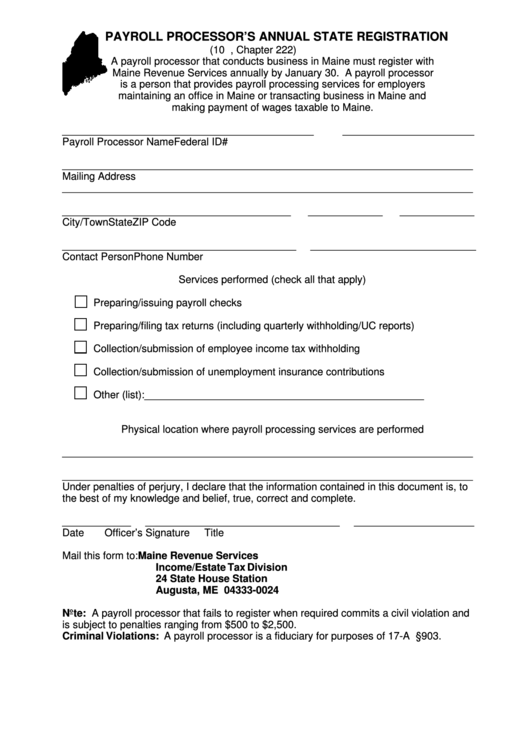

PAYROLL PROCESSOR’S ANNUAL STATE REGISTRATION

(10 M.R.S.A., Chapter 222)

A payroll processor that conducts business in Maine must register with

Maine Revenue Services annually by January 30. A payroll processor

is a person that provides payroll processing services for employers

maintaining an office in Maine or transacting business in Maine and

making payment of wages taxable to Maine.

____________________________________________

_______________________

Payroll Processor Name

Federal ID#

________________________________________________________________________

Mailing Address

________________________________________________________________________

________________________________________

_____________

_____________

City/Town

State

ZIP Code

_________________________________________

_____________________________

Contact Person

Phone Number

Services performed (check all that apply)

Preparing/issuing payroll checks

Preparing/filing tax returns (including quarterly withholding/UC reports)

Collection/submission of employee income tax withholding

Collection/submission of unemployment insurance contributions

Other (list): _________________________________________________

Physical location where payroll processing services are performed

________________________________________________________________________

________________________________________________________________________

Under penalties of perjury, I declare that the information contained in this document is, to

the best of my knowledge and belief, true, correct and complete.

____________

__________________________________

_____________________

Date

Officer’s Signature

Title

Mail this form to:

Maine Revenue Services

Income/Estate Tax Division

24 State House Station

Augusta, ME 04333-0024

Note: A payroll processor that fails to register when required commits a civil violation and

is subject to penalties ranging from $500 to $2,500.

Criminal Violations: A payroll processor is a fiduciary for purposes of 17-A M.R.S.A.§903.

1

1