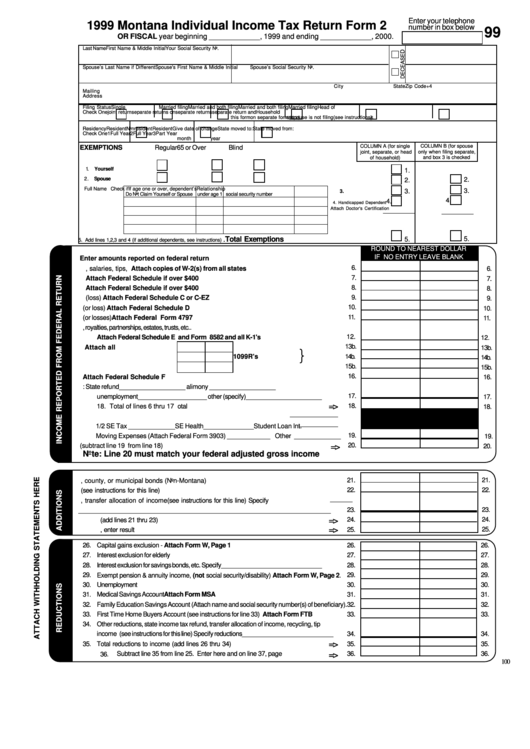

Form 2 - Montana Individual Income Tax Return - 1999

ADVERTISEMENT

Enter your telephone

1999 Montana Individual Income Tax Return Form 2

number in box below

99

OR FISCAL year beginning ____________, 1999 and ending ____________, 2000.

Last Name

First Name & Middle Initial

Your Social Security No.

Spouse’s Last Name if Different

Spouse's First Name & Middle Initial

Spouse’s Social Security No.

City

State

Zip Code+4

Mailing

Address

Filing Status

Single

Married filing

Married and both filing

Married and both filing

Married filing

Head of

Check One

joint return

separate returns on

separate returns

separate return and

Household

this form

on separate forms

spouse is not filing

(see instructions)

1

2

3

4

5

6

Residency

Resident

Nonresident

Resident

Give date of change

State moved to:

State moved from:

Check One

1

Full Year

2

Full Year

3

Part Year

month

year

COLUMN B (for spouse

COLUMN A (for single

EXEMPTIONS

Regular

65 or Over

Blind

joint, separate, or head

only when filing separate,

of household)

and box 3 is checked

1 .

Yourself .............................

.......................

...............

........................Enter number checked

1.

2.

Spouse ..............................

.......................

...............

........................Enter number checked

2.

2.

3.

Dependents Full Name

Check if

If age one or over, dependent’s Relationship

3.

3.

3. Dependents .......

Do Not Claim Yourself or Spouse under age 1 social security number

4.

4.

4. Handicapped Dependent

Attach Doctor's Certification

.Total Exemptions

5.

5.

5. Add lines 1,2,3 and 4 (if additional dependents, see instructions).................................................................................

ROUND TO NEAREST DOLLAR

IF NO ENTRY LEAVE BLANK

Enter amounts reported on federal return

6.

6. Wages, salaries, tips, etc. ............................ Attach copies of W-2(s) from all states

6.

7.

7. Taxable interest income ................................. Attach Federal Schedule if over $400

7.

8.

8. Dividend income ............................................. Attach Federal Schedule if over $400

8.

9.

9. Net business income (loss) ................................ Attach Federal Schedule C or C-EZ

9.

10.

10. Capital gain (or loss) ....................................................... Attach Federal Schedule D

10.

11.

11. Supplemental gains (or losses) ........................................ Attach Federal Form 4797

11.

12. Rents, royalties, partnerships, estates, trusts, etc..

12.

Attach Federal Schedule E and Form 8582 and all K-1's ..........................................

12.

13b.

13. Total IRA distributions

a.

13b.Taxable amount

Attach all

13b.

}

14b.Taxable amount

1099R's

14b.

14. Total pensions and annuities a.

14b.

15b.Taxable amount

15b.

15. Social Security Benefits

a.

15b.

16.

16. Net farm income ............................................................. Attach Federal Schedule F

16.

17. Other income: State refund___________________ alimony ___________________

17.

unemployment____________________ other (specify)______________________

17.

=>

18.

18. Total of lines 6 thru 17 ............................................................. Total

18.

19. Adjustments to income. Allowable IRA _____________Keogh/SEP

1/2 SE Tax _____________SE Health______________Student Loan Int.

19.

Moving Expenses (Attach Federal Form 3903) ____________ Other _____________

19.

=>

20.

20.FEDERAL ADJUSTED GROSS INCOME (subtract line 19 from line 18) ...................

20.

Note: Line 20 must match your federal adjusted gross income

21.

21.

21. Interest and dividends on state, county, or municipal bonds (Non-Montana) .............

22.

22.

22. Federal income tax refunds/overpayment (see instructions for this line) ........................

23. Other additions, transfer allocation of income (see instructions for this line) Specify

23.

_________________________________________________________________________

23.

=>

24.

24.

24.

Total additions to income (add lines 21 thru 23) .................................. TOTAL

=>

25.

25.

25.

Add lines 20 and 24, enter result ................................................................

26.

Capital gains exclusion - Attach Form W, Page 1 ..........................................................

26.

26.

27.

Interest exclusion for elderly ...........................................................................................

27.

27.

28.

Interest exclusion for savings bonds, etc. Specify______________________________

28.

28.

29.

29.

29.

Exempt pension & annuity income, (not social security/disability) Attach Form W, Page 2.

30.

Unemployment .............................................................................................................

30.

30.

31.

Medical Savings Account ................................................................... Attach Form MSA

31.

31.

32.

Family Education Savings Account

(Attach name and social security number(s) of beneficiary).

32.

32.

33.

First Time Home Buyers Account (see instructions for line 33) Attach Form FTB .......... ...

33.

33.

34.

Other reductions, state income tax refund, transfer allocation of income, recycling, tip

income (see instructions for this line) Specify reductions___________________________

34.

34.

=>

35.

Total reductions to income (add lines 26 thru 34)..................................................TOTAL

35.

35.

Subtract line 35 from line 25. Enter here and on line 37, page 2.......................

=>

36.

36.

36.

100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2