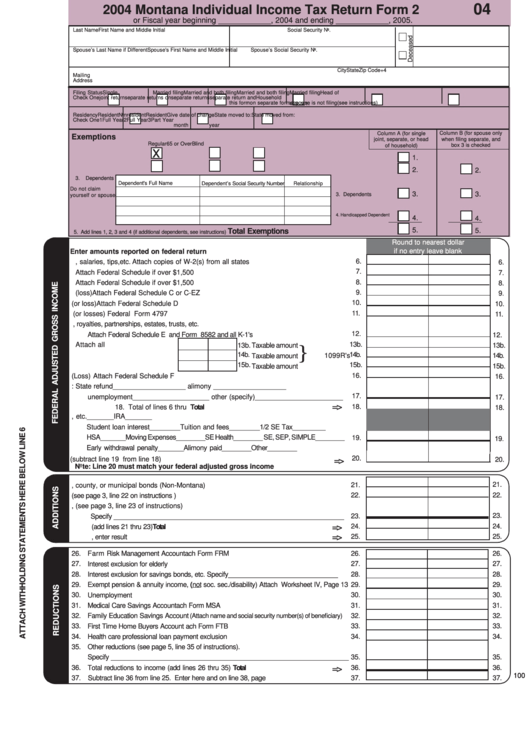

04

2004 Montana Individual Income Tax Return Form 2

or Fiscal year beginning ____________, 2004 and ending ____________, 2005.

Last Name

First Name and Middle Initial

Social Security No.

Spouse’s Last Name if Different

Spouse's First Name and Middle Initial

Spouse’s Social Security No.

City

State

Zip Code+4

Mailing

Address

Filing Status

Single

Married filing

Married and both filing

Married and both filing

Married filing

Head of

Check One

joint return

separate returns on

separate returns

separate return and

Household

this form

on separate forms

spouse is not filing

(see instructions)

1.

2.

3.

4.

5.

6.

Residency

Resident

Nonresident

Resident

Give date of change

State moved to:

State moved from:

Check One

1

Full Year

2

Full Year

3

Part Year

month

year

Column A (for single

Column B (for spouse only

Exemptions

joint, separate, or head

when filing separate, and

Regular

65 or Over

Blind

of household)

box 3 is checked

x

1.

Yourself ..............................

.......................

...............

....................Enter number checked

1.

2.

Spouse ...............................

.......................

...............

....................Enter number checked

2.

2.

3.

Dependents

Dependent's Full Name

Dependent’s Social Security Number

Relationship

Do not claim

3.

3.

3. Dependents ........

yourself or spouse

4. Handicapped Dependent

4.

4.

5.

Total Exemptions

5.

5. Add lines 1, 2, 3 and 4 (if additional dependents, see instructions)............................................................................

Round to nearest dollar

Enter amounts reported on federal return

if no entry leave blank

6.

6. Wages, salaries, tips, etc. .............................. Attach copies of W-2(s) from all states

6.

7.

7. Taxable interest income ................................ Attach Federal Schedule if over $1,500

7.

8.

8. Dividend income ........................................... Attach Federal Schedule if over $1,500

8.

9.

9. Net business income (loss) ................................. Attach Federal Schedule C or C-EZ

9.

10.

10. Capital gain (or loss) ........................................................ Attach Federal Schedule D

10.

11.

11. Supplemental gains (or losses) ......................................... Attach Federal Form 4797

11.

12. Rents, royalties, partnerships, estates, trusts, etc.

12.

Attach Federal Schedule E and Form 8582 and all K-1's .............................................

12.

}

13b.

13. Total IRA distributions

a.

Attach all

13b.

Taxable amount

13b.

14b.

14b.

14. Total pensions and annuities a.

14b.

Taxable amount

1099R's

15b.

15b.

15. Social security benefits

a.

Taxable amount

15b.

16.

16. Net farm income (Loss) .................................................... Attach Federal Schedule F

16.

17. Other income: State refund___________________ alimony ___________________

17.

unemployment____________________ other (specify)_______________________

17.

=>

18.

18. Total of lines 6 thru 17 ............................................................ Total

18.

19. Adjustments to income. Educator Expense_______Reservists, etc._______IRA_______

Student loan interest________Tuition and fees________1/2 SE Tax_________

HSA_______Moving Expenses________SE Health________ SE, SEP, SIMPLE________

19.

19.

Early withdrawal penalty_______Alimony paid________Other________

20.

20.Federal adjusted gross income (subtract line 19 from line 18) ................................

=>

20.

Note: Line 20 must match your federal adjusted gross income

21.

21.

21. Interest and dividends on state, county, or municipal bonds (Non-Montana) ..............

22.

22.

22. Federal income tax refunds/overpayment (see page 3, line 22 on instructions ) ...............

23. Other additions, (see page 3, line 23 of instructions)

23.

23.

Specify _______________________________________________________________

=>

24.

24.

24.

Total additions to income (add lines 21 thru 23) .................................... Total

=>

25.

25.

25.

Add lines 20 and 24, enter result .................................................................

26.

26.

26.

Farm Risk Management Account ...................................................... Attach Form FRM

27.

Interest exclusion for elderly ..........................................................................................

27.

27.

28.

Interest exclusion for savings bonds, etc. Specify______________________________

28.

28.

29.

Exempt pension & annuity income, (not soc. sec./disability) Attach Worksheet IV, Page 13

29.

29.

30.

Unemployment .............................................................................................................

30.

30.

31.

Medical Care Savings Account ........................................................... Attach Form MSA

31.

31.

32.

32.

32.

Family Education Savings Account

(Attach name and social security number(s) of beneficiary)

33.

First Time Home Buyers Account ....................................................... Attach Form FTB

33.

33.

34.

34.

34.

Health care professional loan payment exclusion ...........................................................

35.

Other reductions (see page 5, line 35 of instructions).

Specify _________________________________________________________________

35.

35.

36.

=>

36.

36.

Total reductions to income (add lines 26 thru 35)..................................................Total

100

37.

Subtract line 36 from line 25. Enter here and on line 38, page 2..........................................

37.

37.

1

1 2

2