Form Dr 0025 - Colorado Statement Of Sales Taxes Paid On Loaner Motor Vehicles

ADVERTISEMENT

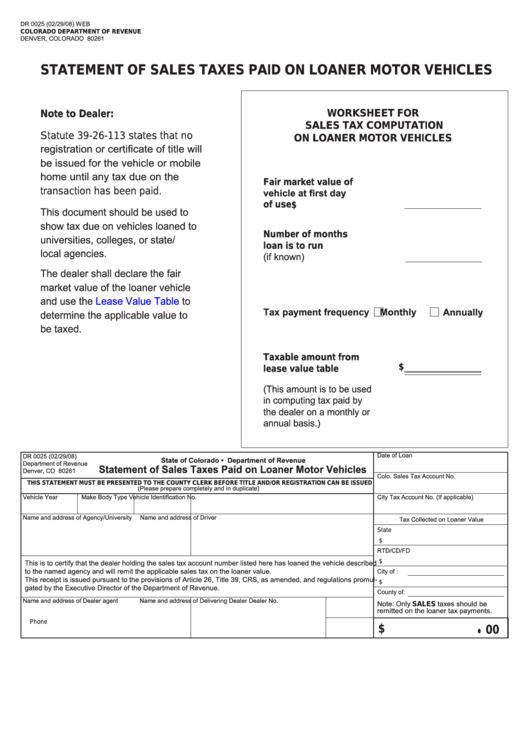

DR 0025 (02/29/08) WEB

coloRado dePaRtment of ReVenUe

DEnVER, COLORaDO 80261

Statement of SaleS taxeS Paid on loaneR motoR VehicleS

WoRKSheet foR

note to dealer:

SaleS tax comPUtation

Statute 39-26-113 states that no

on loaneR motoR VehicleS

registration or certificate of title will

be issued for the vehicle or mobile

home until any tax due on the

fair market value of

transaction has been paid.

vehicle at first day

of use

$

This document should be used to

show tax due on vehicles loaned to

number of months

universities, colleges, or state/

loan is to run

local agencies.

(if known)

The dealer shall declare the fair

market value of the loaner vehicle

and use the

Lease Value Table

to

Tax payment frequency

Monthly

Annually

determine the applicable value to

be taxed.

taxable amount from

$

lease value table

(This amount is to be used

in computing tax paid by

the dealer on a monthly or

annual basis.)

Date of Loan

DR 0025 (02/29/08)

State of Colorado • Department of Revenue

Department of Revenue

Statement of Sales Taxes Paid on Loaner Motor Vehicles

Denver, CO 80261

Colo. Sales Tax account no.

thiS Statement mUSt Be PReSented to the coUntY cleRK BefoRe title and/oR ReGiStRation can Be iSSUed

(Please prepare completely and in duplicate)

Vehicle Year

Make

Body Type

Vehicle Identification no.

City Tax account no. (If applicable)

name and address of agency/University

name and address of Driver

Tax Collected on Loaner Value

State

$

RTD/CD/FD

$

This is to certify that the dealer holding the sales tax account number listed here has loaned the vehicle described

to the named agency and will remit the applicable sales tax on the loaner value.

City of :

This receipt is issued pursuant to the provisions of article 26, Title 39, CRS, as amended, and regulations promul-

$

gated by the Executive Director of the Department of Revenue.

County of:

name and address of Dealer agent

name and address of Delivering Dealer

Dealer no.

note: Only SaleS taxes should be

remitted on the loaner tax payments.

Phone

$

00

•

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1