74A100 (12-02)

Page 3

SECTION II. OTHER THAN LIFE INSURANCE TAX (Kentucky Revised Statutes 136.340, 136.350, 136.370 and 136.390)

A.

Gross amount of premiums received (Include policy and membership fees. Do not include premiums for

federally insured crop and federally insured flood insurance (direct written premium and write-your-own

policies only).) .......................................................................................................................................................................

B.

Other amounts received for insurance or incidental services related to insurance ....................................................................

C.

Gross amount received from reinsurance assumed on Kentucky risks from unauthorized companies .....................................

(Attach itemized account of all reinsurance assumed on Kentucky risks.)

D.

Total lines A, B and C ............................................................................................................................................................

E.

1.

Returned premiums

(Exclude amounts applicable to workers’ compensation.) ....................................................

2.

Dividends paid or credited by mutual companies to policyholders

(Exclude amounts applicable to workers’ compensation.) ....................................................

3.

Workers’ compensation insurance premiums included on line D .........................................

F.

Total lines E-1, E-2, and E-3 ..................................................................................................................................................

G.

Total taxable premiums (subtract line F from line D) .............................................................................................................

H.

Other than life insurance tax liability (2% of line G) ..............................................................................................................

I.

Life and Health Guaranty Fund Assessment credit .................................................................................................................

J.

Net other than life insurance tax liability (subtract line I from line H; if line I exceeds line H, enter zero) ..............................

First Installment

Second Installment

K.

1.

Other than life insurance tax paid by declaration ............................

2.

Adjustments (attach adjustments) ........................................................................................

L.

Total lines K-1 and K-2 ..........................................................................................................................................................

M.

Other than life insurance tax due (subtract line L from line J and enter here and on line B, page 1) ........................................

$

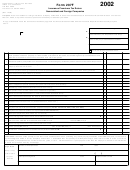

SECTION III. FIRE INSURANCE TAX (Kentucky Revised Statutes 136.350, 136.360, 136.370 and 136.390)

Enter Amounts

Enter Amount

A. Complete the following schedule:

Enter Gross

Refunded on

Allocated to Fire

Subtract

Percentage

Policies not Taken

(Multiply amount

Amount Received

or Cancelled and

Column 2 from

Allocated

in Column 3

Regardless of

Dividends Paid

by percentage

Column 1

to Fire

Line of Business

Designation

or Credited to

in Column 4)

Policyholders

(3)

(4)

(1)

(2)

(5)

1.

Fire ......................................................................

100

2.

Inland marine .........................................................

15

3.

Aircraft physical damage .......................................

20

4.

Auto physical damage:

a.

Comprehensive ..............................................

37.5

b.

Fire and theft ..................................................

74.8

c.

Fire, theft and miscellaneous ..........................

67.8

5.

Comprehensive dwelling ........................................

33.3

6.

Home owners’ policies A, B, C and tenants ............

33.3

7.

Manufacturers’ output policy .................................

33.3

8.

Multiple peril .........................................................

50

9.

Other (specify) .......................................................

B.

Amount allocated to fire (add lines 1 through 9) ...............................................................................................................................

C.

Adjustments (negative amounts and other documented adjustments) ................................................................................................

D.

Total lines B and C ...........................................................................................................................................................................

E.

Fire insurance tax (multiply line D by .0075 and enter here and on line C, page 1) ...........................................................................

$

1

1 2

2 3

3 4

4