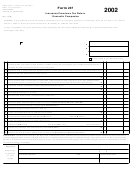

74A100 (12-02)

Page 4

SECTION IV. RETALIATORY TAXES AND FEES ON INSURERS (Kentucky Revised Statutes 304.3-270 and 304.4-010)

A.

Aggregate of all taxes and fees on Kentucky basis

1.

a.

1.7% premiums tax (from line F, Section I, page 2) or

2% premiums tax (from line H, Section II, page 3) ................

b.

Fire premiums tax (from line E, Section III, page 3) ..............

c.

Taxes paid to Kentucky municipalities ...................................

d.

Other (specify) ___________________________________

e.

Taxes on Kentucky basis (add lines a through d) ............................................................

2.

a.

Filing fee, annual statement (see instructions) ........................

100.00

b.

Certificate of authority fee (see instructions) ..........................

100.00

c.

Other (specify) ___________________________________

d.

Total fees on Kentucky basis (add lines a through c) ......................................................

3.

Taxes and fees on Kentucky basis (add lines 1e and 2d) .....................................................................................................

B.

Aggregate of all taxes and fees adjusted to home state basis ___________________________________________________

Name of Home State

1.

a.

Total Kentucky taxable premiums (exclude workers’ compensation) ..............................

b.

Deductions to total Kentucky taxable premiums according to

home state basis (itemize):

(1) _____________________________________________

(2) _____________________________________________

(3) _____________________________________________

(4) _____________________________________________

(5) _____________________________________________

(6) Total deductions .......................................................................................................

c.

Subtract line b(6) from line a .........................................................................................

d.

Multiple line c by home state premium tax rate ( __________ % ).

If multiple rates are applicable in home state, attach computation ...................................

2.

a.

Fees and other taxes charged insurer in home state (itemize):

(1) _____________________________________________

(2) _____________________________________________

(3) _____________________________________________

(4) _____________________________________________

(5) _____________________________________________

b.

Total fees and other taxes (add lines 1 through 5) ...........................................................

3.

Taxes and fees adjusted to home state basis (sum of lines 1d and 2b) ..................................................................................

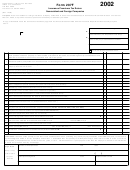

C.

Computation of amount due—retaliatory provision

1.

Amount from line B-3 .........................................................................................................................................................

2.

Amount from line A-3 .........................................................................................................................................................

3.

If line C-1 is greater than line C-2, enter excess. This is your retaliatory taxes and fees liability ..........................................

First Installment

Second Installment

4.

Retaliatory taxes and fees paid by declaration ........................................................................

5.

Adjustments (attach adjustments) ........................................................................................................................................

6.

Total lines C-4 and C-5 .......................................................................................................................................................

7.

Retaliatory taxes and fees due (subtract line C-6 from line C-3) .......................................................................................... $

8.

Kentucky Investment Fund Act Credit ................................................................................................................................

9.

Net Retaliatory taxes and fees due (subtract line C8 from line C7 and enter here and on line D, page 1) .............................

IF THERE IS A NEGATIVE TAX LIABILITY REPORTED IN

THE SUMMARY OF NET TAX DUE (PAGE 1), CHECK THE APPROPRIATE BOX

o

Apply to 2003 estimated insurance premiums tax (attach installment(s)) (Form 74A110).

First Installment (due June 2) ........................................................................................................................................................ $

Second Installment (due October 1) .............................................................................................................................................. $

o

Refund

..................................................................................................................................................................................... $

1

1 2

2 3

3 4

4