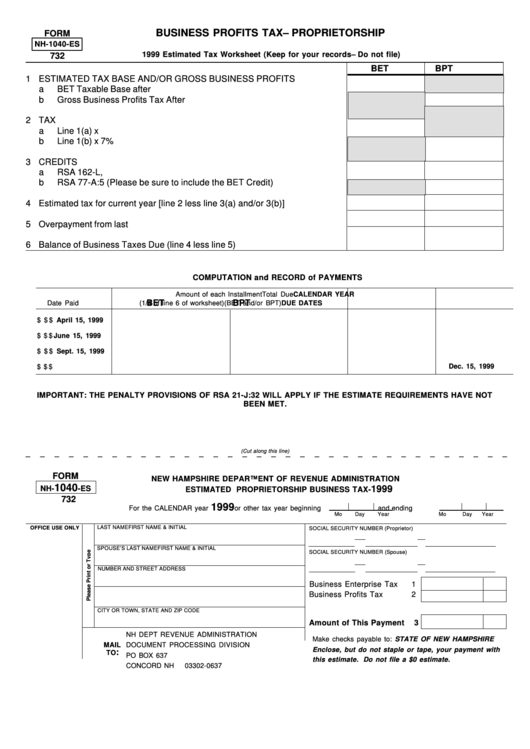

BUSINESS PROFITS TAX – PROPRIETORSHIP

FORM

NH-1040-ES

1999 Estimated Tax Worksheet (Keep for your records – Do not file)

732

BET

BPT

1 ESTIMATED TAX BASE AND/OR GROSS BUSINESS PROFITS

a

BET Taxable Base after Apportionment...................................................

b

Gross Business Profits Tax After Apportionment.....................................

2 TAX

a

Line 1(a) x .0025......................................................................................

b

Line 1(b) x 7%..........................................................................................

3 CREDITS

a

RSA 162-L, CDFA....................................................................................

b

RSA 77-A:5 (Please be sure to include the BET Credit)..........................

4 Estimated tax for current year [line 2 less line 3(a) and/or 3(b)]......................

5 Overpayment from last year.............................................................................

6 Balance of Business Taxes Due (line 4 less line 5).........................................

COMPUTATION and RECORD of PAYMENTS

Amount of each Installment

Total Due

CALENDAR YEAR

BET

BPT

Date Paid

(1/4 of line 6 of worksheet)

(BET and/or BPT)

DUE DATES

1...............................

$............................. ...................

$ .....................................................

$ ........................................

April 15, 1999

2..............................

$................. ................................

$ .....................................................

$ ........................................

June 15, 1999

3..............................

$..................................... .........

$ .....................................................

$ ........................................

Sept. 15, 1999

Dec. 15, 1999

4.............................

$................ .................................

$ .....................................................

$ ........................................

IMPORTANT: THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY IF THE ESTIMATE REQUIREMENTS HAVE NOT

BEEN MET.

(Cut along this line)

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

1040

NH-

-ES

1999

ESTIMATED PROPRIETORSHIP BUSINESS TAX-

732

1999

For the CALENDAR year

or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

LAST NAME

FIRST NAME & INITIAL

OFFICE USE ONLY

SOCIAL SECURITY NUMBER (Proprietor)

SPOUSE’S LAST NAME

FIRST NAME & INITIAL

SOCIAL SECURITY NUMBER (Spouse)

NUMBER AND STREET ADDRESS

Business Enterprise Tax

1

Business Profits Tax

2

CITY OR TOWN, STATE AND ZIP CODE

Amount of This Payment

3

NH DEPT REVENUE ADMINISTRATION

Make checks payable to: STATE OF NEW HAMPSHIRE

MAIL

DOCUMENT PROCESSING DIVISION

Enclose, but do not staple or tape, your payment with

:

TO

PO BOX 637

this estimate. Do not file a $0 estimate.

CONCORD NH

03302-0637

1

1 2

2