Form Rct-112 - Gross Receipts Tax Report Electric, Hydro-Electric And Water Power Companies -Commonwealth Of Pennsylvania Department Of Revenue

ADVERTISEMENT

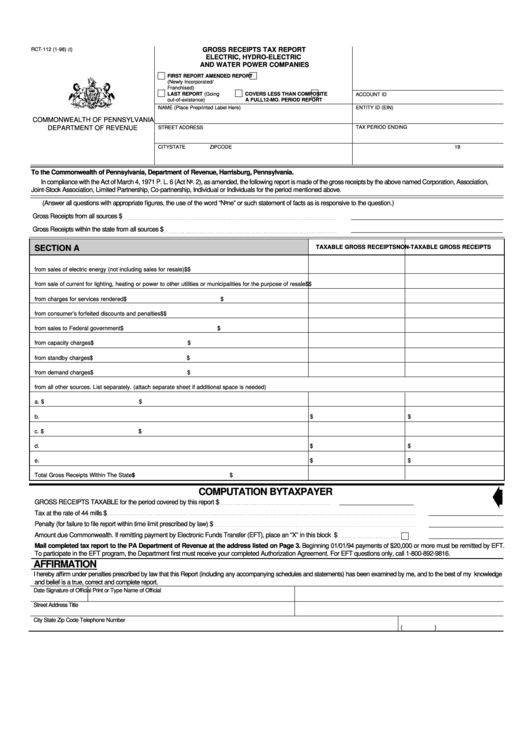

GROSS RECEIPTS TAX REPORT

RCT-112 (1-98)

(I

)

ELECTRIC, HYDRO-ELECTRIC

AND WATER POWER COMPANIES

FIRST REPORT

AMENDED REPORT

(Newly Incorporated/

Franchised)

LAST REPORT (Going

COVERS LESS THAN

COMPOSITE

ACCOUNT ID

out-of-existence)

A FULL 12-MO. PERIOD

REPORT

NAME

(Place Preprinted Label Here)

ENTITY ID (EIN)

COMMONWEALTH OF PENNSYLVANIA

DEPARTMENT OF REVENUE

TAX PERIOD ENDING

STREET ADDRESS

CITY

STATE

ZIP CODE

19

To the Commonwealth of Pennsylvania, Department of Revenue, Harrisburg, Pennsylvania.

In compliance with the Act of March 4, 1971 P. L. 6 (Act No. 2), as amended, the following report is made of the gross receipts by the above named Corporation, Association,

Joint-Stock Association, Limited Partnership, Co-partnership, Individual or Individuals for the period mentioned above.

(Answer all questions with appropriate figures, the use of the word “None” or such statement of facts as is responsive to the question.)

Gross Receipts from all sources

$

Gross Receipts within the state from all sources

$

TAXABLE GROSS RECEIPTS

NON-TAXABLE GROSS RECEIPTS

SECTION A

from sales of electric energy (not including sales for resale)

$

$

from sale of current for lighting, heating or power to other utilities or municipalities for the purpose of resale $

$

from charges for services rendered

$

$

from consumer’s forfeited discounts and penalties

$

$

from sales to Federal government

$

$

from capacity charges

$

$

from standby charges

$

$

from demand charges

$

$

from all other sources. List separately. (attach separate sheet if additional space is needed)

a.

$

$

b.

$

$

c.

$

$

d.

$

$

e.

$

$

Total Gross Receipts Within The State

$

$

COMPUTATION BY TAXPAYER

GROSS RECEIPTS TAXABLE for the period covered by this report

$

Tax at the rate of 44 mills

$

Penalty (for failure to file report within time limit prescribed by law)

$

Amount due Commonwealth. If remitting payment by Electronic Funds Transfer (EFT), place an “X” in this block

$

Mail completed tax report to the PA Department of Revenue at the address listed on Page 3. Beginning 01/01/94 payments of $20,000 or more must be remitted by EFT.

To participate in the EFT program, the Department first must receive your completed Authorization Agreement. For EFT questions only, call 1-800-892-9816.

AFFIRMATION

I hereby affirm under penalties prescribed by law that this Report (including any accompanying schedules and statements) has been examined by me, and to the best of my knowledge

and belief is a true, correct and complete report.

Date

Signature of Official

Print or Type Name of Official

Street Address

Title

City

State

Zip Code

Telephone Number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4