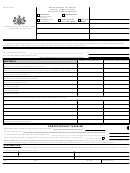

Form Rct-112 - Gross Receipts Tax Report Electric, Hydro-Electric And Water Power Companies -Commonwealth Of Pennsylvania Department Of Revenue Page 3

ADVERTISEMENT

DUE DATE

This report is due on or before March 15, for the 12 months ended December 31 immediately preceding. A penalty for late filing will be imposed in

the amount of 10% on the first $1000 of tax, 5% on the next $4000 and 1% on everything in excess of $5000.

MAILING INSTRUCTIONS

Mail this form with remittance payable to the PA Department of Revenue along with payment transmittal form REV-856S to:

PA Department of Revenue

Dept. 280407

Harrisburg, PA 17128-0407

GENERAL DEFINITIONS

The terms “electric light company”, “waterpower company” and hydro-electric company” as used in section 1101 (b) of the Tax Reform Code of 1971,

shall be deemed to include electric distribution companies and electric generation suppliers.

Sales of electric energy- Retail sales of electric generation, transmission, distribution or supply of electric energy, dispatching services, customer

services, competitive transition charges intangible transition charges and universal service and energy conservation charges and such other retail

sales in this Commonwealth the receipts of which, if bundled, would have been deemed to be sales of electric energy prior to the effective date of

this chapter shall be deemed sales of electric energy for purposes of section 1101 of the Tax Reform Code of 1971. The phrases “doing business in

this Commonwealth” and “engages in electric light and power business, waterpower business and hydro-electric business in this Commonwealth” as

such terms are used in section 1101(b) of the Tax Reform Code of 1971 and in this chapter, shall be construed to include the direct and indirect

engaging in, transacting or conducting of activity in this commonwealth for the purpose of establishing or maintaining a market for the sales of

electric energy and include obtaining a license or certification from the commission to supply electric energy. Retail sales of generation shall be

deemed to occur at the meter of the retail customer.

GENERAL INSTRUCTIONS

SECTION A-

List all gross receipts within the state into taxable and nontaxable categories. Submit an explanation of all nontaxable

gross receipts.

SECTION B-

If you are a electric distributor, list the names of suppliers and gross receipts collected on behalf of and remitted to each supplier.

Provide the corresponding kilowatt hours of service distributed on behalf of each supplier.

If you are a supplier, list the names of the electric distribution company that provided distribution services to customers in PA and the kilowatt hours

distributed.

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4