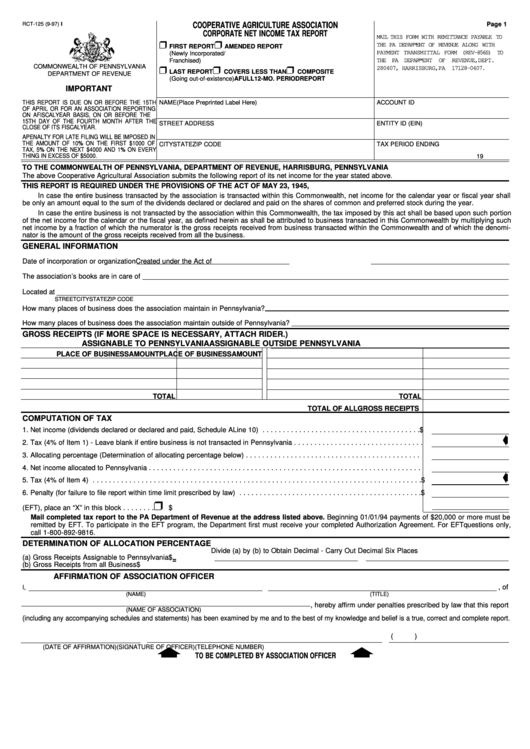

RCT-125 (9-97) I

COOPERATIVE AGRICULTURE ASSOCIATION

Page 1

CORPORATE NET INCOME TAX REPORT

MAIL THIS FORM WITH REMITTANCE PAYABLE TO

THE PA DEPARTMENT OF REVENUE ALONG WITH

FIRST REPORT

AMENDED REPORT

PAYMENT TRANSMITTAL FORM (REV-856S) TO

(Newly Incorporated/

Franchised)

THE PA DEPARTMENT OF REVENUE, DEPT .

COMMONWEALTH OF PENNSYLVANIA

280407, HARRISBURG,PA 17128-0407.

LAST REPORT

COVERS LESS THAN

COMPOSITE

DEPARTMENT OF REVENUE

(Going out-of-existence)

A FULL 12-MO. PERIOD

REPORT

IMPORTANT

THIS REPORT IS DUE ON OR BEFORE THE 15TH

NAME

(Place Preprinted Label Here)

ACCOUNT ID

OF APRIL OR FOR AN ASSOCIATION REPORTING

ON A FISCAL YEAR BASIS, ON OR BEFORE THE

15TH DAY OF THE FOURTH MONTH AFTER THE

STREET ADDRESS

ENTITY ID (EIN)

CLOSE OF ITS FISCAL YEAR.

A PENALTY FOR LATE FILING WILL BE IMPOSED IN

THE AMOUNT OF 10% ON THE FIRST $1000 OF

TAX PERIOD ENDING

CITY

STATE

ZIP CODE

TAX, 5% ON THE NEXT $4000 AND 1% ON EVERY

THING IN EXCESS OF $5000.

19

TO THE COMMONWEALTH OF PENNSYLVANIA, DEPARTMENT OF REVENUE, HARRISBURG, PENNSYLVANIA

The above Cooperative Agricultural Association submits the following report of its net income for the year stated above.

THIS REPORT IS REQUIRED UNDER THE PROVISIONS OF THE ACT OF MAY 23, 1945, P.L. 893.

In case the entire business transacted by the association is transacted within this Commonwealth, net income for the calendar year or fiscal year shall

be only an amount equal to the sum of the dividends declared or declared and paid on the shares of common and preferred stock during the year.

In case the entire business is not transacted by the association within this Commonwealth, the tax imposed by this act shall be based upon such portion

of the net income for the calendar or the fiscal year, as defined herein as shall be attributed to business transacted in this Commonwealth by multiplying such

net income by a fraction of which the numerator is the gross receipts received from business transacted within the Commonwealth and of which the denomi-

nator is the amount of the gross receipts received from all the business.

GENERAL INFORMATION

Date of incorporation or organization

Created under the Act of

The association’s books are in care of

Located at

STREET

CITY

STATE

ZIP CODE

How many places of business does the association maintain in Pennsylvania?

How many places of business does the association maintain outside of Pennsylvania?

GROSS RECEIPTS (IF MORE SPACE IS NECESSARY, ATTACH RIDER.)

ASSIGNABLE TO PENNSYLVANIA

ASSIGNABLE OUTSIDE PENNSYLVANIA

PLACE OF BUSINESS

AMOUNT

PLACE OF BUSINESS

AMOUNT

TOTAL

TOTAL

TOTAL OF ALL GROSS RECEIPTS

COMPUTATION OF TAX

1. Net income (dividends declared or declared and paid, Schedule A Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. Tax (4% of Item 1) - Leave blank if entire business is not transacted in Pennsylvania . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Allocating percentage (Determination of allocating percentage below) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Net income allocated to Pennsylvania . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Tax (4% of Item 4)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

6. Penalty (for failure to file report within time limit prescribed by law) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

7. Amount due Commonwealth. If remitting payment by Electronic Funds Transfer (EFT), place an “X” in this block . . . . . . . .

$

Mail completed tax report to the PA Department of Revenue at the address listed above. Beginning 01/01/94 payments of $20,000 or more must be

remitted by EFT. To participate in the EFT program, the Department first must receive your completed Authorization Agreement. For EFT questions only,

call 1-800-892-9816.

DETERMINATION OF ALLOCATION PERCENTAGE

Divide (a) by (b) to Obtain Decimal - Carry Out Decimal Six Places

(a) Gross Receipts Assignable to Pennsylvania

$

=

(b) Gross Receipts from all Business

$

AFFIRMATION OF ASSOCIATION OFFICER

, of

I,

(NAME)

(TITLE)

, hereby affirm under penalties prescribed by law that this report

(NAME OF ASSOCIATION)

(including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is a true, correct and complete report.

(

)

(DATE OF AFFIRMATION)

(SIGNATURE OF OFFICER)

(TELEPHONE NUMBER)

TO BE COMPLETED BY ASSOCIATION OFFICER

1

1 2

2 3

3 4

4